In the rapidly evolving world of cryptocurrencies, one question often stands out: “How do crypto exchanges make money?” This question is not only intriguing but also crucial for both investors and users of these platforms. Understanding the revenue models of crypto exchanges can provide valuable insights into the crypto market’s inner workings and future trends.

Table of Contents

Background Information

The concept of cryptocurrency exchanges was born out of the need for a platform where digital currencies could be traded. These exchanges have been in existence since the early days of Bitcoin, the first and most popular cryptocurrency. Bitcoin was introduced in 2009, and by 2010, the first trading platforms began to appear. These platforms, known as Bitcoin exchanges, allowed users to trade Bitcoin for traditional currencies.

As more cryptocurrencies were developed and entered the market, these platforms expanded their offerings and became known as cryptocurrency exchanges. Today, there are thousands of digital currencies available for trading on these exchanges.

Cryptocurrency exchanges play a pivotal role in the digital currency ecosystem. They act as intermediaries between buyers and sellers, much like traditional stock exchanges. However, instead of trading stocks, users trade digital currencies. These exchanges provide the infrastructure necessary for the trading of cryptocurrencies, including the systems for placing orders, matching trades, and managing accounts.

There are several popular crypto exchanges in operation today, each with its unique features and offerings.

Understanding Cryptocurrency Exchanges

Cryptocurrency exchanges are digital platforms that facilitate the buying, selling, and trading of cryptocurrencies. They serve as the gateway for individuals and institutions to participate in the cryptocurrency market. Understanding their operation and the different types of exchanges is crucial for anyone involved in the crypto space.

What is a Cryptocurrency Exchange?

At its core, a cryptocurrency exchange is a platform that allows customers to trade cryptocurrencies for other assets, such as conventional fiat money or different digital currencies. They operate similarly to traditional stock exchanges, where buyers and sellers are matched based on their respective bid and ask prices. However, instead of trading equities, users trade digital currencies.

Types of Cryptocurrency Exchanges

There are three main types of cryptocurrency exchanges: centralized exchanges (CEXs), decentralized exchanges (DEXs), and hybrid exchanges.

- Centralized Exchanges (CEXs): These are the most common type of crypto exchanges. They are run by a company that owns and operates the platform. Users deposit their funds directly with the exchange, and the exchange takes custody of these funds. The exchange’s servers are centrally located, and all transactions are routed through this central point. Examples of centralized exchanges include Binance, Coinbase, and Kraken.

- Decentralized Exchanges (DEXs): These platforms operate without a central authority. Instead, trades occur directly between users (peer-to-peer) through an automated process. This setup enhances privacy and prevents a single point of failure but can be less intuitive for beginners. Examples of decentralized exchanges include Uniswap and SushiSwap.

- Hybrid Exchanges: As the name suggests, hybrid exchanges aim to combine the best features of both centralized and decentralized exchanges. They offer the financial security of decentralized exchanges, with the speed and functionality of centralized platforms. An example of a hybrid exchange is DeversiFi.

Each type of exchange has its advantages and disadvantages, and the choice between them depends on the user’s specific needs and risk tolerance. Centralized exchanges are often more user-friendly and provide higher liquidity, while decentralized exchanges offer more privacy and control over one’s funds.

How Do Cryptocurrency Exchanges Work?

Regardless of the type, the basic working principle of a cryptocurrency exchange involves the matching of buy and sell orders in the exchange’s order book. Users place orders to buy or sell a cryptocurrency at a specific price. The exchange matches these orders to facilitate trades.

When a user wants to withdraw their funds, they submit a withdrawal request. On a centralized exchange, the exchange will process this request. On a decentralized exchange, the funds are typically moved directly between users’ wallets, without the need for the exchange to process the withdrawal.

Revenue Models of Cryptocurrency Exchanges

Cryptocurrency exchanges employ various revenue models to generate income. While the specifics can vary from one platform to another, the following are some common methods:

Trading Fees

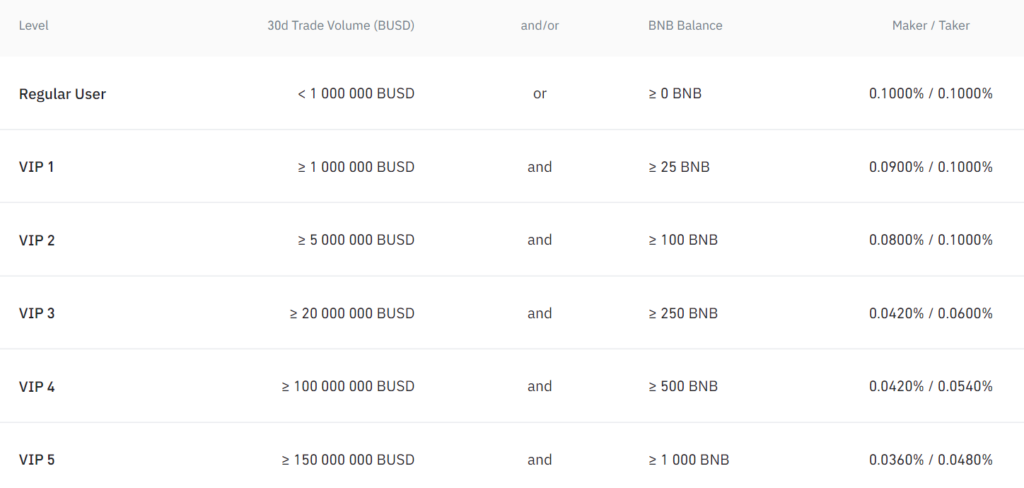

This is the primary revenue source for most exchanges. They charge a fee for each transaction made on their platform. The fee is usually a small percentage of the transaction value and is charged from both the buyer and the seller. For instance, Binance, one of the world’s largest exchanges, charges a maximum trading fee of 0.1%.

Withdrawal Fees

Most exchanges charge fees for withdrawing funds from the platform. These fees can vary based on the type of cryptocurrency and the amount involved.

Listing Fees

Exchanges often charge a fee to cryptocurrency projects that want to list their tokens on the platform. This fee can vary greatly, depending on the exchange and the specific project.

Margin Trading Fees

Another significant revenue model for cryptocurrency exchanges is lending to margin traders. Margin trading is a practice where traders borrow funds to trade larger amounts of a cryptocurrency. This practice can amplify profits, but it also comes with increased risk, including the potential to lose more than your initial investment.

Cryptocurrency exchanges that offer margin trading services essentially act as the lender. Traders borrow from the exchange, often paying interest on the borrowed funds. The interest rate can be fixed or variable, depending on the platform’s policies and market conditions.

Liquidations

Crypto exchanges can significantly profit from liquidations. When the market is volatile, and prices fluctuate rapidly, traders who use leverage (borrowed funds) may find their positions liquidated if the market moves against them. The exchange then liquidates these positions at market price. This process can be profitable for exchanges, as they charge fees for each liquidation and may also benefit from the spread (difference) between the liquidation price and the market price. Additionally, during periods of high volatility, the frequency of liquidations can increase, potentially leading to higher profits for the exchanges. This aspect of revenue generation, while advantageous for exchanges, can pose high risks for leveraged traders.

Loyalty Tokens

Some exchanges issue their own tokens, which serve multiple purposes. Users can earn these tokens through trading activities, participation in the exchange’s programs, or direct purchase. These tokens often come with benefits such as discounted trading fees, voting rights in the exchange’s decision-making processes, or access to premium services. The exchange benefits from the initial sale of these tokens and potentially from transaction fees if the tokens are traded on their platform.

Initial Exchange Offerings (IEO) Fees

An Initial Exchange Offering (IEO) is a token sale hosted on a cryptocurrency exchange’s platform. Projects that want to conduct an IEO on an exchange’s platform often have to pay a fee, which can be a significant revenue source for the exchange. The exchange may also receive a percentage of the tokens sold during the IEO.

Market Making

Some exchanges engage in market making activities to increase liquidity on their platform. Market makers are firms or individuals that provide both buy and sell quotes for a financial instrument, filling the order book and making it easier for traders to execute their trades. Exchanges that act as market makers earn from the spread between the buying and selling prices.

Advertising

Cryptocurrency exchanges have a large user base, which makes them attractive platforms for advertising. Exchanges can earn revenue by selling advertising space on their platform. This could be in the form of banner ads, sponsored listings, or even partnerships with other companies. Additionally, many exchanges are now exploring the potential of crypto affiliate programs as a new revenue stream.

Staking

Some exchanges allow users to stake their cryptocurrencies directly through the platform. The exchange takes a cut of the staking rewards.

Other Services

Many exchanges offer additional services, such as futures trading, options trading, and more. They generate revenue from these services through various means, including fees and spreads.

Here’s a brief overview of the revenue models of the specific exchanges you mentioned:

- BingX: BingX offers spot, derivatives, copy, and grid trading services. They likely generate revenue through derivatives trading fees, although the exact fee structure is not explicitly stated on the website.

- MEXC: The MEXC website does not provide specific details about their revenue model. However, like most exchanges, they likely generate revenue through trading fees.

- CoinEx: CoinEx generates revenue through trading fees and listing fees.

- Binance: Binance generates revenue primarily through trading fees. They charge a maximum fee of 0.1% per trade. They also offer various other services, including futures trading and margin trading, which provide additional revenue.

Calculating the Profit

| Exchange | Trading Type | Fee (%) | Trading Volume (24h) |

|---|---|---|---|

| MEXC | Spot | 0.0 | $427,154,041 |

| MEXC | Futures (Maker) | 0.0 | $2,710,019,216 |

| MEXC | Futures (Taker) | 0.01 | $2,710,019,216 |

| CoinEx | Spot | 0.2 | $13,565,707 |

| CoinEx | Futures (Maker) | 0.2 | $159,905,063 |

| CoinEx | Futures (Taker) | 0.16 | $159,905,063 |

| Binance | Spot | 0.1 | $5,215,781,483 |

| Binance | Futures (Maker) | 0.1 | $25,276,365,034 |

| Binance | Futures (Taker) | 0.1 | $25,276,365,034 |

To calculate the profit for each exchange, we need to multiply the trading volume by the respective fees. However, for MEXC, the spot trading is currently under a promo with 0.0% fees, so it won’t generate any profit from spot trading. The same applies to the futures maker fee.

Here’s the calculation:

MEXC

Spot Trading Profit: $427,154,041 * 0.0% = $0

Futures Trading Profit (Taker): $2,710,019,216 * 0.01% = $271,001.92

Total Profit for MEXC: $0 (Spot) + $271,001.92 (Futures) = $271,001.92 per day

CoinEx

Spot Trading Profit: $13,565,707 * 0.2% = $27,131.41

Futures Trading Profit (Maker): $159,905,063 * 0.2% = $319,810.13

Futures Trading Profit (Taker): $159,905,063 * 0.16% = $255,848.10

Total Profit for CoinEx: $27,131.41 (Spot) + $319,810.13 (Futures Maker) + $255,848.10 (Futures Taker) = $602,789.64 per day

Binance

Spot Trading Profit: $5,215,781,483 * 0.1% = $5,215,781.48

Futures Trading Profit (Maker): $25,276,365,034 * 0.1% = $25,276,365.03

Futures Trading Profit (Taker): $25,276,365,034 * 0.1% = $25,276,365.03

Total Profit for Binance: $5,215,781.48 (Spot) + $25,276,365.03 (Futures Maker) + $25,276,365.03 (Futures Taker) = $55,768,511.54 per day

Please note that these calculations are oversimplified and actual profits may be lower after considering operational costs, promotional activities, and other factors. Also, these figures are based on a single day’s trading volume, and actual profits can vary significantly from day to day.

The Impact of Revenue Models on Users

The revenue models of cryptocurrency exchanges have a direct impact on users in several ways. Understanding these impacts can help users make informed decisions about which platforms to use for their trading activities.

- Transaction Costs: The most immediate impact of an exchange’s revenue model on its users is the cost of transactions. Exchanges that rely heavily on trading fees for revenue may charge higher fees, increasing the cost of trading on these platforms. High trading fees can eat into the profits of traders, especially those who trade frequently or in large volumes.

- Access to Services: The types of services an exchange offers can also be influenced by its revenue model. For instance, exchanges that earn revenue from staking or lending services may offer these features to their users. These services can provide additional ways for users to earn from their crypto holdings.

- User Experience: The revenue model can also impact the user experience. For example, exchanges that earn significant revenue from premium services may offer a higher quality of customer service, more advanced trading features, or a more user-friendly platform to their premium users.

- Security and Trust: Exchanges that have a transparent and sustainable revenue model are likely to be more trustworthy. They are less likely to resort to unethical practices to earn revenue, which can enhance user trust and security.

- Choice of Exchange: Ultimately, the revenue model can influence a user’s choice of exchange. Users may prefer exchanges with lower fees, more services, or a better user experience, depending on their trading needs and preferences.

Future Trends in Crypto Exchange Revenue Models

As the cryptocurrency market continues to evolve, so too will the revenue models of cryptocurrency exchanges. Here are some potential future trends:

- Fee Reductions or Eliminations: As competition among exchanges increases, some platforms may reduce or even eliminate certain fees to attract users. We’ve already seen this trend in traditional stock trading with the advent of commission-free trading platforms, and it’s possible that the crypto market could follow suit.

- More Premium Services: Exchanges may begin to offer more premium services to differentiate themselves from competitors and generate additional revenue. These could include advanced trading tools, personalized customer service, increased withdrawal limits, and more.

- Revenue Sharing: Some exchanges may adopt revenue-sharing models, where users are given a portion of the exchange’s earnings. This could take the form of dividends paid out in the exchange’s native token or discounts on trading fees.

- Decentralized Finance (DeFi) Services: As DeFi continues to grow, exchanges may begin to offer more DeFi-related services, such as yield farming or liquidity mining. These services could provide additional revenue streams for exchanges.

- Tokenization: More exchanges may launch their own tokens, following the lead of platforms like Binance (BNB) and Uniswap (UNI). These tokens can serve multiple purposes, from granting holders discounts on fees to giving them voting rights in the exchange’s governance.

- Staking and Lending Services: With the rise of Proof-of-Stake (PoS) cryptocurrencies and interest in passive income opportunities, more exchanges may begin to offer staking and lending services. These services allow users to earn interest on their crypto holdings, and the exchanges take a cut of the interest as revenue.

- Regulatory Compliance Services: As the regulatory landscape for cryptocurrencies becomes more complex, exchanges may begin to offer services to help users comply with regulations. This could include tax reporting services or tools to track the source of funds.

These trends reflect the dynamic nature of the cryptocurrency market. As the market continues to mature, exchanges will likely continue to innovate and adapt their revenue models to stay competitive and meet the changing needs of their users.

Conclusion

The world of cryptocurrency exchanges is as diverse and dynamic as the cryptocurrencies they trade. Understanding how these platforms generate revenue is crucial for both traders and investors alike. It provides insights into the cost of trading, the services offered, and the sustainability of the exchange itself.

From trading fees to listing fees, and from staking rewards to revenue from premium services, exchanges have devised a multitude of ways to generate income. As the crypto market continues to evolve, these models are likely to adapt and innovate, offering new opportunities and challenges for traders and exchanges.

The future of crypto exchange revenue models is likely to be influenced by several factors, including regulatory developments, technological advancements, market competition, and user demand. As we’ve seen, some exchanges are already exploring new revenue streams such as DeFi services, tokenization, and revenue sharing.

However, as with all aspects of the crypto world, due diligence is crucial. Traders and investors should always take the time to understand the fee structure and revenue model of any exchange they choose to use. This understanding can help to avoid unexpected costs, make the most of the services offered, and ultimately, contribute to successful trading or investing in the exciting world of cryptocurrencies.

In conclusion, the question of “how do crypto exchanges make money” opens the door to a deeper understanding of the crypto market’s inner workings. It’s a testament to the innovative and dynamic nature of this industry, and a topic that will continue to evolve as the market grows and matures.

FAQs

How do cryptocurrency exchanges make money?

Cryptocurrency exchanges primarily make money through trading fees, which are charged on each transaction made on the platform. Other revenue streams can include deposit and withdrawal fees, listing fees, margin trading fees, staking rewards, revenue from premium services, and more.

What are trading fees on cryptocurrency exchanges?

Trading fees are charges applied by exchanges for each transaction made on their platform. These fees are usually a small percentage of the transaction value and are charged from both the buyer and the seller.