In the volatile world of cryptocurrencies, understanding market trends is crucial. One such trend, often overlooked but incredibly significant, is the phenomenon of capitulation. Capitulation in crypto can be a game-changer, marking the end of a bear market and the beginning of a new bull cycle. But what exactly is capitulation, and how can we identify it?

Table of Contents

Understanding Capitulation

Capitulation is a term used in the investment world to describe a point in time when investors are rapidly selling off their holdings, typically out of fear that prices will drop further. This mass selling often results in a sharp and significant drop in asset prices. Let’s delve deeper into understanding capitulation

Definition and Characteristics of Capitulation

Capitulation is derived from the military term that refers to surrender. In the financial world, it refers to the point when investors give up any previous gains in any security or market by selling their positions. This typically occurs when there are significant losses and pessimism in the market, causing investors to ‘surrender’ to the downward pressure and sell off their holdings to avoid further losses. Capitulation is often characterized by high trading volumes and sharp price declines.

Psychology Behind Capitulation

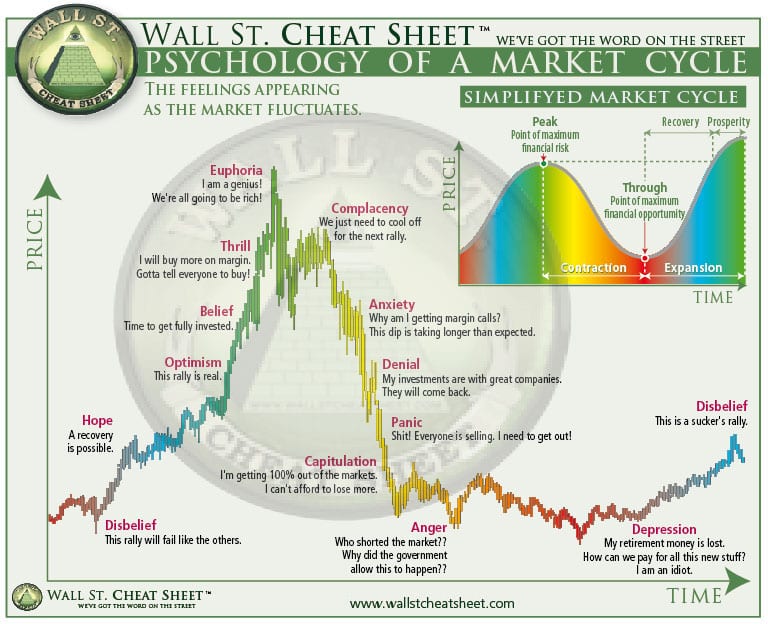

The psychology behind capitulation is largely driven by fear and panic. As prices continue to fall, fear takes over, and investors sell their holdings to avoid further losses. This fear is often fueled by negative news and a pessimistic market sentiment. The decision to sell is often emotional rather than rational, which can exacerbate the sell-off and lead to lower prices.

Capitulation and Market Bottoms

While capitulation can be a stressful and difficult time for investors, it’s often seen as a sign that a market bottom is near. This is because, after a period of intense selling, there are fewer sellers left in the market, which can set the stage for a price reversal. However, it’s important to note that identifying a market bottom is challenging, and prices may continue to fall even after a capitulation event.

Capitulation in Crypto Markets

Capitulation in the world of cryptocurrencies carries the same fundamental principles as in traditional markets, but with some unique characteristics due to the nature of the crypto market. Here’s a deeper look into capitulation in crypto markets:

Capitulation in the Context of Crypto

In the crypto market, capitulation refers to a stage where investors give up on any potential gains due to a significant downturn in prices. This usually happens after a prolonged bear market, where prices have been falling for some time. The fear of further losses drives investors to sell their crypto assets, often at a loss. This mass selling leads to a sharp drop in prices, marking a period of capitulation.

Volatility and Capitulation

The crypto market is known for its high volatility, with prices capable of making large swings in very short periods. This volatility can exacerbate the effects of capitulation, leading to even sharper price drops compared to traditional markets.

Impact of Capitulation on Crypto Markets

Capitulation can have a significant impact on the crypto market. The mass selling can lead to sharp price drops, but it also clears out investors who were holding onto their assets in the hope of a price recovery. This can pave the way for new investors to enter the market, potentially starting a new upward trend.

Understanding capitulation in the context of crypto markets can be a valuable tool for investors. However, due to the high volatility and unpredictability of the crypto market, it’s important to approach capitulation with caution and make informed decisions based on thorough analysis.

Signs of Capitulation in Crypto

Capitulation in the crypto market, like in traditional markets, is characterized by a sharp and dramatic sell-off. This is typically driven by fear and panic among investors who decide to cut their losses and sell their holdings to avoid further potential losses. Here are some key signs of capitulation in the crypto market:

Sharp Price Drops

One of the most obvious signs of capitulation is a rapid and significant decrease in price. This is due to a large number of investors selling off their holdings, which drives the price down. During periods of capitulation, it’s common to see double-digit percentage drops in a single day.

High Trading Volume

Another sign of capitulation is a sudden increase in trading volume. This is because capitulation involves a large number of investors selling their holdings. When you see a sharp price drop accompanied by a spike in trading volume, it’s often a sign that capitulation is taking place.

Negative News Cycle

Capitulation is often accompanied by a negative news cycle. This could be news about the crypto market in general or negative news about a specific cryptocurrency. The news can fuel fear and panic among investors, leading to a sell-off.

Extreme Fear Index Readings

There are tools available, such as the Crypto Fear & Greed Index, that measure the general sentiment in the cryptocurrency market. When the index shows a reading of extreme fear, it can often precede capitulation. This is because extreme fear can drive investors to sell off their holdings to avoid further losses.

Social Media Sentiment

In the crypto market, social media platforms can often provide early signs of capitulation. A sudden increase in negative comments or posts about a particular cryptocurrency or the market in general can indicate that investors are starting to panic.

Market Momentum

Market momentum can also provide signs of capitulation. When the momentum shifts from positive (uptrend) to negative (downtrend) rapidly and significantly, it can be a sign that investors are capitulating.

Remember, while these signs can indicate capitulation, they are not foolproof. The crypto market is highly volatile and can be influenced by a wide range of factors. Therefore, it’s important to use these signs as part of a broader investment strategy and not rely on them solely to make investment decisions.

How to Respond to Capitulation

Capitulation can be a stressful time for investors, especially those who are new to the crypto market. However, it’s important to remember that capitulation is a natural part of market cycles. Here are some strategies on how to respond to capitulation:

- Stay Calm and Avoid Panic Selling: One of the most important things to do during a capitulation is to stay calm. Panic selling often leads to selling at the bottom and missing the subsequent recovery. It’s important to remember that markets are cyclical and that after every downturn, there is usually an upturn.

- Assess Your Investment Strategy: Capitulation is a good time to assess your investment strategy. If you’re feeling extreme fear and panic, it might be a sign that you’re overexposed or invested in assets you don’t fully understand. Use this time to reassess your risk tolerance and investment strategy.

- Consider Buying Opportunities: For some investors, capitulation can present unique buying opportunities. When everyone else is selling, it might be a good time to buy. However, this strategy requires a good understanding of the market and should be approached with caution.

- Implement Risk Management Techniques: During periods of capitulation, it’s crucial to have risk management techniques in place. This could include setting stop losses to limit potential losses, diversifying your portfolio to spread risk, and only investing money you can afford to lose.

- Seek Professional Advice: If you’re unsure about how to respond to capitulation, it might be a good idea to seek professional advice. A financial advisor or a seasoned investor can provide valuable insights and advice.

- Educate Yourself: Use this time to educate yourself more about the crypto market and investment strategies. Understanding the market better can help you make more informed decisions in the future.

Real-life Examples of Capitulation in Crypto

Bitcoin Capitulation in 2018

A notable example of capitulation in the crypto market occurred during the 2018 Bitcoin crash. After reaching an all-time high in December 2017, Bitcoin’s price fell throughout 2018, with a significant sell-off occurring in November, marking a period of capitulation. This was followed by a period of relative stability before the price started to rise again in 2019.

Bitcoin Capitulation in 2022

One of the most notable instances of capitulation in the crypto market occurred during the Bitcoin downturn in 2022. After a bear market and signs of recovery in the first quarter of the year, Bitcoin’s price stagnated from mid-March onwards, leading to doubts and downside targets that stretched towards $20,000. This period marked a state of capitulation, where the spot price was lower than the long-term holder’s cost basis, leading to significant spending due to financial pressure and capitulation. This information is according to analytics firm Glassnode‘s weekly newsletter, “The Week On-Chain.”

Transition Phase Post-Capitulation

After the period of capitulation at the end of 2022, Bitcoin’s long-term holders began a “transition” towards a state of “equilibrium” before full “euphoria” — the next Bitcoin price cycle top — hits. This transition phase is when the market is trading slightly above the long-term holders’ cost basis, and occasional light spending is part of day-to-day trade. As of May 30, the long-term holder cost basis was around $20,800.

Speculative Activity in 2023

In 2023, Glassnode noted an increase in speculative activity, making the short-term holder’s cost basis — at around $26,000 — an increasingly important level. This speculative activity among short-term holders, which corresponds to more speculative investors, is already on the radar.

These examples highlight the cyclical nature of the crypto market and the role capitulation plays in these cycles. It’s important to note that while capitulation often signals a market bottom, predicting the exact bottom is challenging, and prices may continue to fall even after a capitulation event.

Capitulation and Market Cycles

Understanding market cycles is crucial to interpreting capitulation and its potential effects on your investments. Market cycles refer to the periodic and somewhat predictable patterns in markets where prices rise and fall over time. These cycles are typically characterized by four phases: accumulation, markup, distribution, and markdown.

- Accumulation Phase: This is the phase where informed investors start to buy or accumulate assets when prices are low, often after a bear market. The market sentiment is generally negative, and most investors are pessimistic.

- Markup Phase: As more investors start to notice the asset’s potential, demand increases, leading to an increase in price. This phase is characterized by a bullish trend and ends when the asset becomes overpriced.

- Distribution Phase: In this phase, informed investors start to sell their holdings to other investors. The market sentiment is generally positive, and most investors are optimistic. However, the increase in supply and decrease in demand start to put downward pressure on prices.

- Markdown Phase: This is the phase where the asset’s price decreases significantly. It’s characterized by a bearish trend and often ends in capitulation, where investors sell their holdings to avoid further losses.

Capitulation and Its Role in Market Cycles

Capitulation typically occurs during the markdown phase of a market cycle, signaling the end of a bear market. It’s characterized by a rapid and significant decrease in prices due to panic selling. This mass sell-off often leads to an oversold condition, setting the stage for the market to bottom out.

Once capitulation occurs, the cycle can start anew with the accumulation phase. This is when savvy investors, who understand that the market is cyclical, start buying assets at lower prices. They understand that capitulation often signals the end of a bear market and the beginning of a new bull market.

Understanding capitulation and its role in market cycles can help investors make more informed decisions. It can provide insights into when to buy or sell assets and how to manage risk. However, predicting exact market bottoms or tops is extremely difficult, even for experienced investors. Therefore, it’s important to use capitulation as one of many tools in your investment strategy.

Conclusion

Capitulation, while often viewed negatively due to its association with significant market downturns and investor panic, is a crucial aspect of the financial market cycles, including the crypto market. It represents the extreme point of pessimism in a bear market, often marking the end of a downward trend and the beginning of a new upward cycle.

Understanding capitulation, its signs, and its implications can equip investors with the knowledge to navigate these challenging periods more effectively. Recognizing the signs of capitulation, such as sharp price drops, high trading volumes, and extreme fear, can help investors identify potential market bottoms.

Responding to capitulation requires a balanced approach. While it’s essential to protect your investments, capitulation can also present unique buying opportunities. Strategies such as staying calm, avoiding panic selling, reassessing your investment strategy, implementing risk management techniques, and seeking professional advice can be beneficial during these times.

In the context of crypto markets, capitulation can be particularly intense due to the market’s high volatility. However, as seen in historical examples, capitulation often paves the way for new market cycles and potential opportunities.

Ultimately, understanding capitulation and its role in market cycles can help investors make more informed decisions, manage their risk effectively, and potentially seize new investment opportunities. However, it’s important to remember that investing in cryptocurrencies involves risk, and decisions should always be based on careful analysis and consideration of individual risk tolerance.

FAQs

What is capitulation in crypto?

Capitulation in crypto refers to a point in a bear market where investors give up any previous gains, selling their positions to avoid further losses.

What are the signs of capitulation in crypto?

Signs of capitulation include sharp price drops, high trading volume, a negative news cycle, and extreme fear index readings.

How should I respond to capitulation in crypto?

Responding to capitulation requires a balanced approach, including implementing risk management techniques and maintaining emotional control.