Ever since we delved into the world of Bitcoin mining, the curiosity and enthusiasm among our readers have skyrocketed. Today, we’re going one step further, guiding you through the exciting process of how to mine Bitcoin at home. It’s a journey that promises not just the thrill of participation in the crypto universe but also the potential for profit.

Table of Contents

Understanding Bitcoin Mining

What is Bitcoin Mining?

Bitcoin mining is a fundamental process in the world of cryptocurrency. It’s not just about creating new Bitcoins; mining is the engine that powers the entire Bitcoin network. It involves miners using powerful computers to solve complex mathematical puzzles. These puzzles are necessary to confirm and record transactions on the blockchain, which is Bitcoin’s decentralized ledger. Every time a miner successfully solves a puzzle, they help to maintain the network’s security and, in return, are rewarded with newly minted Bitcoins.

How Does Bitcoin Mining Work?

Mining is essentially a race to solve a cryptographic puzzle, and the first miner to solve it gets to add a new block of transactions to the blockchain. This process is called ‘proof of work’, and it’s designed to be challenging and resource-intensive. This difficulty ensures the stability and security of the network. When a miner adds a block to the blockchain, they are rewarded with a certain number of Bitcoins. This reward halves approximately every four years in an event known as ‘Bitcoin halving’. This system not only incentivizes miners but also controls the rate at which new Bitcoins are generated, simulating a form of digital scarcity similar to precious metals.

Basic Requirements for Mining Bitcoin at Home

Mining Bitcoin at home has evolved significantly, and it’s important to understand the requirements and constraints involved, especially with the current predominance of ASIC miners.

ASICs: The Primary Tool for Bitcoin Mining

Today, Bitcoin is effectively mined using Application-Specific Integrated Circuits (ASICs). These are specialized devices built specifically for the purpose of mining cryptocurrencies. Unlike general-purpose CPUs and GPUs, ASICs are designed to perform the hash calculations required by the blockchain at high speeds and with greater efficiency. However, this efficiency comes with a caveat: ASICs are expensive, and their performance degrades as the network’s difficulty level increases.

Noise and Heat Considerations

ASIC miners are not only costly but also loud and generate significant heat. This makes it impractical to operate them in a standard living space. If you’re considering setting up an ASIC miner at home, you will likely need a dedicated space like a garage or a specially prepared room. This space should have adequate ventilation or cooling systems to manage the heat, and some form of soundproofing if noise is a concern.

Alternatives: CPU and GPU Mining

While ASICs dominate Bitcoin mining, it’s still technically possible to mine with CPUs and GPUs. However, due to the lower efficiency and processing power, mining Bitcoin directly with these devices is no longer viable. For those with CPU or GPU setups, one alternative is to mine other, less resource-intensive cryptocurrencies and then use converting services like NiceHash to exchange these for Bitcoin. This method allows miners to utilize existing hardware without competing directly with the high processing power of ASICs.

Electricity and Internet Considerations

Electricity Costs and Requirements

Bitcoin mining consumes a significant amount of electricity. Therefore, it’s crucial to calculate the cost-effectiveness of your setup. High electricity costs can quickly erode mining profits. That’s why solar crypto mining at home becomes more and more popular. Additionally, the electrical infrastructure of your home should be capable of handling the increased load, especially if operating multiple ASICs.

Stable Internet Connection

A stable and reliable internet connection is vital for Bitcoin mining. The mining process requires constant communication with the Bitcoin network and other miners. Any disruptions in connectivity can lead to lost mining potential and reduced earnings.

Setting Up Your Home Mining Rig

Setting up a Bitcoin mining rig at home involves a series of steps to ensure everything is configured correctly for optimal performance.

Step-by-step Chart to Guide you Through

| Step | Description | Details |

|---|---|---|

| 1. Selecting the Right ASIC Miner | Choose an ASIC miner that fits your budget and electricity constraints. Popular models include the Bitmain Antminer series. | Consider factors like hash rate, power consumption, and price. |

| 2. Choosing the Location | Find a suitable place in your home, like a garage or a dedicated room, with adequate space, ventilation, and power supply. | Ensure the area is well-ventilated and can handle the noise and heat generated by the ASIC. |

| 3. Preparing the Space | Prepare the selected location by setting up ventilation, cooling systems, and soundproofing if necessary. | Install fans, air conditioning, or an exhaust system to manage heat. Soundproofing materials can help with noise control. |

| 4. Electrical Setup | Ensure your electrical system can handle the load. You might need to upgrade your power supply or install new outlets. | Consult with an electrician to ensure your home’s electrical system is safe and capable of handling the additional load. |

| 5. Unboxing and Assembling | Carefully unbox the ASIC miner and assemble any parts as per the manufacturer’s instructions. | Handle the equipment with care. Follow the manufacturer’s guide for any assembly required. |

| 6. Powering Up the Miner | Connect your ASIC miner to the power supply and switch it on. | Double-check all connections before powering up. Ensure that your power supply is adequate for your miner’s requirements. |

| 7. Connecting to the Network | Connect the ASIC miner to your home network via Ethernet. | Use a reliable and fast Ethernet connection for stability. |

| 8. Monitoring and Maintenance | Regularly check your mining rig for any issues and perform routine maintenance. | This includes cleaning dust from the miner, checking connections, and ensuring the cooling system is functioning properly. |

Additional Tips

Safety First

Always prioritize safety when dealing with electrical equipment. If you’re unsure about the electrical setup, consult a professional.

Noise Management

Noise is an issue at home, so consider soundproofing solutions or placing the mining rig in an isolated area.

Heat Management

Effective heat management is crucial. Regularly monitor the temperature of your mining space and adjust cooling as necessary.

Regular Maintenance

ASIC miners can accumulate dust and require periodic cleaning to maintain efficiency and longevity.

Stay Informed

Keep up to date with the latest trends and updates in mining technology and software, even though this guide focuses on hardware setup.

By following these steps, you can set up a home mining rig that is efficient, safe, and optimized for Bitcoin mining. Remember, while the initial setup might require some effort and investment, having a well-prepared mining rig can enhance your mining experience and potential profitability.

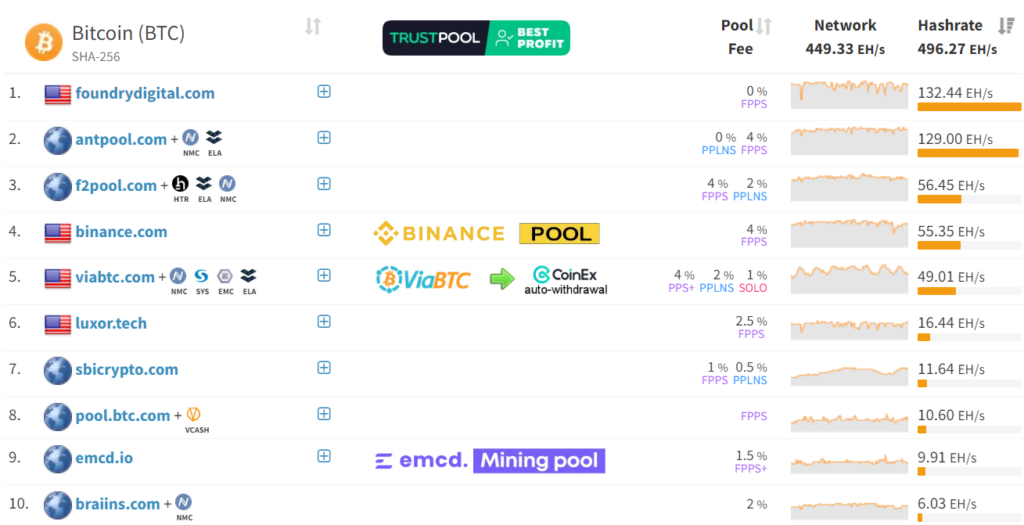

Joining a Mining Pool vs. Solo Mining

The decision between joining a mining pool and solo mining is crucial for anyone venturing into Bitcoin mining. Each approach has its own set of pros and cons, and the choice largely depends on your resources and objectives. For further insights into pool mining, refer to our detailed article on PPLNS vs Solo mining.

Comparison Chart

| Factor | Solo Mining | Mining Pool |

|---|---|---|

| Chance of Earning Rewards | Low (depends on individual mining power) | High (collective mining power increases chance of finding blocks) |

| Payout Size | Large (full block reward and transaction fees) | Smaller, split among pool members |

| Consistency of Earnings | Highly inconsistent and unpredictable | More consistent and frequent, though smaller amounts |

| Control and Transparency | Complete control over the mining process and rewards | Limited control; reliant on pool’s terms and transparency |

| Technical Expertise | Requires more technical knowledge and management | Easier to start with, as pools manage the technical aspects |

| Costs | All costs borne individually, higher risks | Shared costs, reduced risks |

Recent Cases of Solo Miners Finding Blocks

While solo mining is generally less profitable due to the enormous hashing power of mining pools, there have been cases where individual miners have successfully mined entire blocks. For instance, a solo miner might unexpectedly solve a block and receive the full reward of 6.25 BTC, not to mention the transaction fees. These instances, however, are rare and akin to winning a lottery due to the astronomical odds against solo miners.

A solo #Bitcoin miner with ~1PH of hash rate won a block reward worth 6.25 $BTC (over $160,000).

— Bitcoin Magazine (@BitcoinMagazine) August 19, 2023

A miner this small would only solve a solo block once every 7 years on average at this difficulty 🤯 pic.twitter.com/v6haUepVp2

The probability of a solo miner finding a block is directly related to their share of the total network hash rate. With the Bitcoin network’s hash rate often measured in exahashes per second (EH/s), an individual miner’s chances are slim without significant investment in hardware.

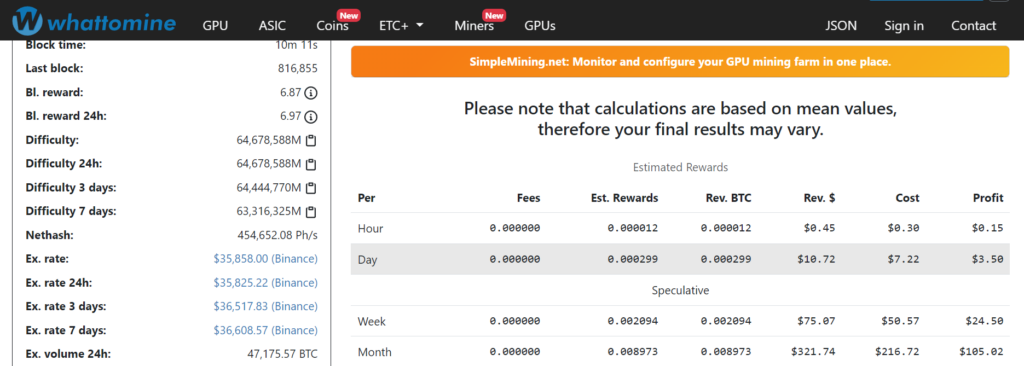

Calculating Profitability and Risks

In Bitcoin mining, understanding the balance between profitability and associated risks is crucial. With the right tools and knowledge, miners can make informed decisions that maximize their potential earnings while minimizing risks. It’s also important to note that Bitcoin mining rigs, designed for the SHA-256 algorithm, can mine other cryptocurrencies based on the same algorithm, which at times can be more profitable than mining Bitcoin itself.

Profitability Tools

A variety of tools are available to help calculate the potential profitability of your mining operation. These tools consider factors such as hardware efficiency, electricity cost, current Bitcoin price, and network difficulty. Here’s a detailed chart of some popular tools:

| Tool Name | Features | Note |

|---|---|---|

| CryptoCompare | Offers a detailed breakdown of potential profits and costs, including electricity, hardware, and other expenses. | Widely used for its user-friendly interface and comprehensive calculations. |

| WhatToMine | Allows miners to compare profitability across different cryptocurrencies, useful for those with SHA-256 rigs considering other coins. | Highly beneficial for miners looking to maximize earnings by switching between cryptocurrencies. |

| NiceHash Calculator | Provides profitability estimates specifically for users of the NiceHash platform, taking into account the current rates for buying and selling hashing power. | Ideal for miners using or considering the NiceHash platform for mining or trading hash power. |

| CoinWarz | Offers a Bitcoin mining calculator that includes parameters like hardware costs, power consumption, and Bitcoin’s price. | Popular for its detailed and up-to-date profitability reports. |

Understanding the Risks

Volatility

The price of Bitcoin and other cryptocurrencies is highly volatile. This volatility affects mining profitability as the rewards are valued in Bitcoin. A sudden drop in the price can significantly reduce the value of the mined Bitcoins.

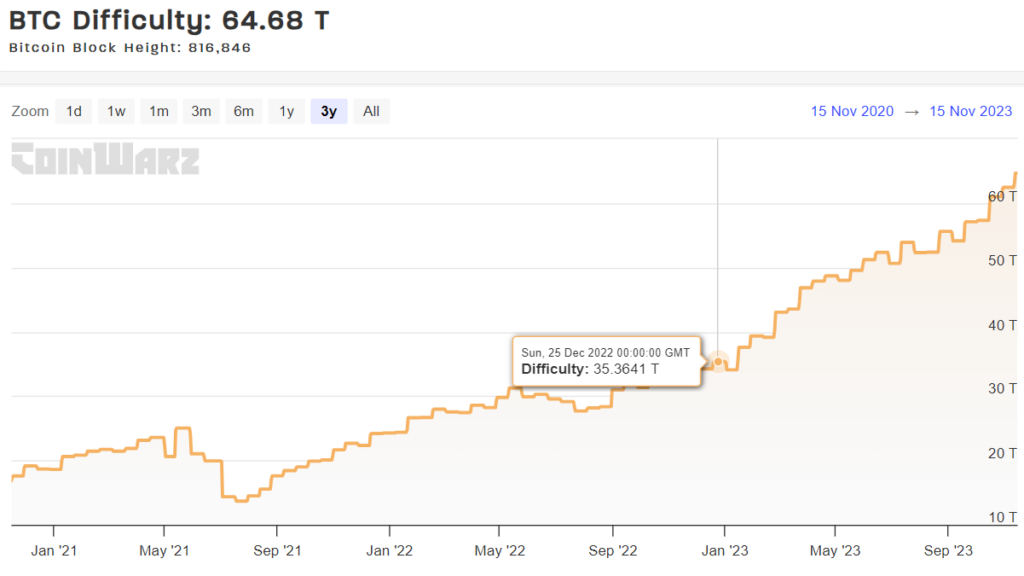

Increasing Difficulty

The Bitcoin network adjusts the difficulty of mining approximately every two weeks. This means that as more miners join the network, the harder it becomes to mine Bitcoin, which can affect profitability.

Hardware Obsolescence

Mining technology advances rapidly. Today’s state-of-the-art hardware can become obsolete within a few years, requiring continuous investment to stay competitive.

Electricity Costs

Electricity is a major operational cost in Bitcoin mining. High electricity costs can quickly erode profits, especially during times when the price of Bitcoin is low.

Regulatory Risks

Changes in regulations can have significant impacts on the profitability of mining. Bans, restrictions, or heavy taxation in your region can pose risks to your mining operation.

Alternative Coin Mining

SHA-256 miners have the flexibility to mine other cryptocurrencies. At times, these alternative coins might offer better profitability than Bitcoin. However, this requires staying informed about market trends and being ready to switch your mining operations to different coins as market conditions change.

Where to Sell Home Mined Bitcoin?

When deciding where to sell the Bitcoin you’ve mined at home, it’s important to consider various factors such as exchange fees, the need for KYC (Know Your Customer) verification, and the availability of peer-to-peer (P2P) trading options. Here’s a detailed comparison chart of some popular exchanges:

| Exchange | Spot Fees | KYC Requirement for Withdrawal | P2P Trading |

|---|---|---|---|

| MEXC | 0% | No (up to 30 BTC per day) | Yes (with KYC) |

| CoinEx | 0.2% | No (up to 10K USDT per day) | No |

| Kraken | 0.2% | Yes | Yes |

| Gemini | 0.3% | Yes | Yes |

| Crypto.com | 0.075% | Yes | Yes |

| Bybit | 0.1% | Yes | Yes (with KYC) |

| KuCoin | 0.06% | Yes | Yes |

For home miners, MEXC Exchange emerges as a highly attractive option for selling Bitcoin. The primary reasons include:

- No Spot Fees: MEXC offers 0% fees for spot trading, which means you can sell your Bitcoin without incurring additional costs.

- Flexible KYC Policy: The exchange allows for a significant daily withdrawal limit (up to 30 BTC) without the need for KYC verification. This feature is particularly beneficial for miners who prefer privacy and ease of transactions.

- P2P Trading Option: MEXC also provides a P2P trading platform, albeit with KYC requirements, offering another avenue for selling Bitcoin.

Given these benefits, MEXC stands out as a favorable choice for home miners looking to sell their Bitcoin in a cost-effective, convenient, and flexible manner.

Legal and Tax Implications

Legal Implications

United States

In the USA, states are adopting various approaches towards cryptocurrency and Bitcoin mining. Here are some key legal implications:

- Arkansas: The Arkansas Data Centers Act of 2023 seeks to protect miners from discrimination, ensuring that local governments cannot impose requirements on crypto miners different from those applicable to data centers. It also prevents the Arkansas Public Service Commission from establishing discriminatory rates for crypto mining customers.

- Montana: Montana passed a bill similar to Arkansas’s, which allows industrial and at-home miners to conduct their business free from government interference, recognizing the positive economic value of crypto mining.

- Missouri and Mississippi: Proposed laws in these states look to offer protection for crypto miners, similar to the bills in Arkansas and Montana, aiming to prevent discrimination against digital asset mining businesses.

- Texas: Texas Senate Bill 1751 sets limits on bitcoin miners’ participation in demand response programs and prohibits tax abatements on certain bitcoin mining properties. This bill could impact ancillary services, where bitcoin miners sell the right to curtail their load to balance the grid.

- Oregon: An Oregon bill proposed to require facilities with high energy use, including crypto mining, to reduce greenhouse gas emissions. However, it faced opposition and didn’t pass.

Canada

In Canada, the legal and tax landscape for Bitcoin mining varies:

- General Legality: Crypto mining is legal in Canada with no specific federal or provincial laws governing it. The main challenge is getting approval from utility companies, especially for large-scale operations. Smaller, home-based mining operations usually do not require approval.

- Alberta: Known for its deregulated electricity and natural gas supply, Alberta is a popular destination for crypto mining. Mining operations here need approval from the Alberta Utilities Commission unless they meet certain exemptions.

- Quebec: Hydro-Quebec is limiting the power provided to miners, making the province less ideal for large operations.

Tax Implications

USA

In the United States, cryptocurrency mining rewards are taxed as income upon receipt. Miners must report their income on tax returns, and the income is taxed based on the fair market value of the coins on the day they are received. If mining rewards are sold or traded, they incur capital gains or losses. Not reporting mining rewards to the IRS is considered tax evasion, a serious crime. In 2023, there was a proposal for a 30% excise tax on cryptocurrency mining businesses, but its status is still uncertain.

Canada

In Canada, if you are operating a mining business, rewards are taxed as business income, and any sale or trade of these rewards is taxed as capital gains. For hobbyist miners running a few miners at home, mining operation is taxed only when rewards are sold or traded, also as capital gains tax. In 2022, proposals were introduced regarding tax credits and GST/HST related to mining, stating that mining payment received as a fee or reward is not considered a “supply” and thus, miners are not required to collect and remit GST/HST.

Trends of Bitcoin Mining at Home

The landscape of Bitcoin mining at home is continually evolving, with new trends emerging as technology advances and miners seek more efficient and sustainable ways to operate. Some of the most notable trends include the integration of renewable energy sources like solar panels and the innovative use of ASIC miners for dual purposes like heating homes or swimming pools.

Solar-Powered Mining

One of the most significant trends in home Bitcoin mining is the use of solar energy. With the high electricity costs associated with mining, solar panels offer a way to significantly reduce operational expenses. Solar-powered mining rigs can operate off-grid, making them more sustainable and environmentally friendly. This approach is particularly appealing in regions with high sunlight exposure, where solar panels can generate enough power to run mining operations effectively.

| Aspect | Description |

|---|---|

| Initial Setup Costs | Higher upfront investment for solar panels and related equipment. |

| Long-Term Savings | Potential to reduce or eliminate electricity costs, increasing profitability. |

| Environmental Impact | Reduces the carbon footprint of mining operations. |

ASICs Integrated with Home Heating Systems

Another innovative trend is the use of ASIC miners as a source of heat. ASICs generate a significant amount of heat, and rather than dissipating this energy, some miners are repurposing it to heat their homes or even warm their swimming pools. This dual-purpose approach not only makes mining more cost-effective by reducing heating bills but also addresses one of the environmental concerns associated with Bitcoin mining.

| Aspect | Description |

|---|---|

| Efficiency | Effective utilization of the heat generated by ASICs for home heating purposes. |

| Cost Savings | Reduction in traditional heating costs, making mining more profitable. |

| Practicality | Ideal for colder climates where heating is a significant household expense. |

Conclusion

In conclusion, mining Bitcoin at home presents both a unique opportunity and a set of challenges. From understanding the complexities of Bitcoin mining to setting up an efficient rig, navigating the legal and tax implications, and finally selling the mined Bitcoin, each step requires careful consideration and planning. With the evolving landscape of cryptocurrency, staying informed and adaptable is key. Whether it’s leveraging new trends like solar-powered mining or choosing the right exchange for selling Bitcoin, each decision plays a critical role in the success of your home mining venture. Remember, while the path may be intricate, the potential rewards and the thrill of participating in the crypto economy can make it a worthwhile endeavor.

FAQs

Is Bitcoin mining at home profitable?

Yes, it can be profitable, but it depends on factors like the efficiency of your mining rig, electricity costs, current Bitcoin price, and network difficulty.

What are the basic requirements for mining Bitcoin at home?

The key requirements include a powerful ASIC miner, a stable internet connection, a suitable location for the rig (like a garage or a dedicated room with proper ventilation), and a sound understanding of the mining process.

How do legal and tax implications affect home Bitcoin mining?

In the USA and Canada, the legality and tax implications vary by state and province. Generally, mining rewards are taxed as income, and there are specific regulations regarding the operation of mining rigs, especially concerning electricity usage and environmental impact.

Which is better for home miners: joining a mining pool or solo mining?

For most home miners, joining a mining pool is more practical. It provides more consistent but smaller rewards compared to the high-risk, high-reward nature of solo mining.

Can I mine Bitcoin using home solar panels?

Yes, solar-powered mining is a growing trend. It can reduce operational costs and is environmentally friendly, but it requires a significant initial investment and technical knowledge.