The Bitcoin mining rig stands as a testament to innovation and progress. As the backbone of the Bitcoin network, understanding these rigs is crucial for both enthusiasts and investors. This article sheds light on the intricacies of Bitcoin mining rigs, emphasizing the dominance of ASIC devices and offering insights into maximizing profitability.

Table of Contents

What is a Mining Rig?

Understanding the Mining Marvel

A crypto mining rig is a specialized computer system designed for one purpose: mining. But what does this entail?

Components of the Rig

- Processor: The brain of the operation, where ASIC devices now reign supreme.

- Memory: Storing the blockchain and facilitating transactions.

- Storage: For the ever-growing blockchain data.

- Cooling System: Essential to keep the rig from overheating.

- Power Supply: Fueling the mining process.

These components work in harmony, validating and adding transactions to the blockchain, ensuring its security and integrity.

The Rise of ASIC Devices

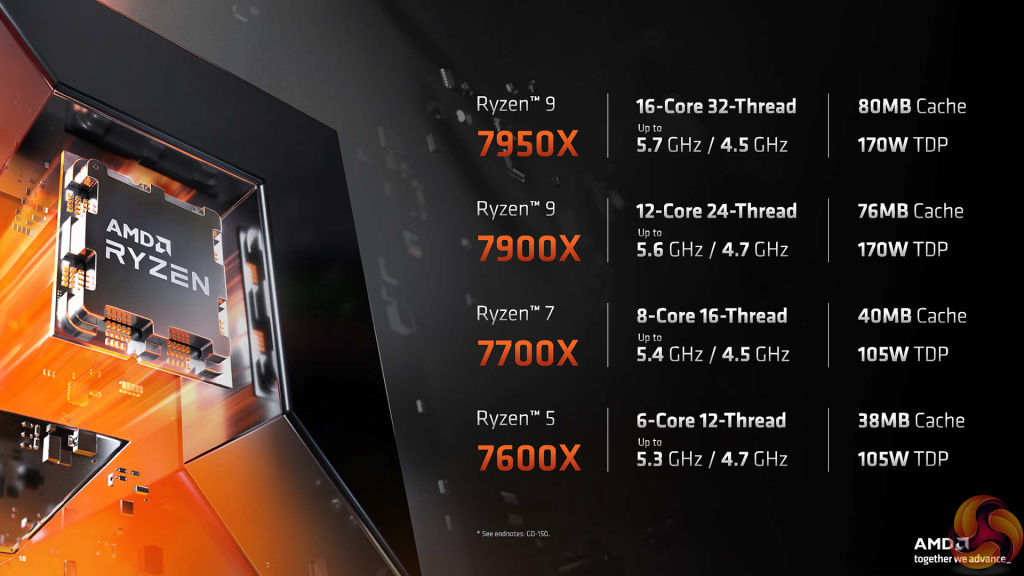

In the early days of Bitcoin, anyone with a computer could mine the cryptocurrency. However, as the network grew and the mining difficulty increased, the need for more powerful and efficient mining methods became evident. This led to the evolution from using Central Processing Units (CPUs) to Bitcoin mining rigs based on Graphics Processing Units (GPUs) and, eventually, to the development and dominance of Application-Specific Integrated Circuit (ASIC) devices. Let’s delve deeper into this transformative journey.

A Brief History of Bitcoin Mining Hardware

CPU Mining

The inception of Bitcoin mining began with CPUs. These are the general-purpose processors found in most computers. Satoshi Nakamoto, Bitcoin’s pseudonymous creator, intended for Bitcoin to be mined on CPUs. However, as more miners joined the network, the difficulty of the cryptographic puzzles that needed to be solved to earn Bitcoin increased, making CPU mining inefficient and less profitable.

GPU Mining

Miners soon discovered that GPUs, typically used for rendering video graphics, were also capable of mining Bitcoin at a much faster rate than CPUs. GPUs can handle more data and perform more calculations simultaneously, making them a popular choice for early miners. They offered a significant speedup over CPUs and allowed for Bitcoin mining rigs with multiple GPUs, further increasing the mining power.

Enter ASICs: The Game Changer

Bitcoin Mining Rigs: A Look Back at 2016 and 2017

The years 2016 and 2017 were pivotal for the cryptocurrency world, with Bitcoin experiencing significant price surges, increased adoption, and heightened public interest. As a result, the Bitcoin mining industry also saw substantial developments during this period.

Transition to More Efficient Hardware

- ASIC Dominance: By 2016, Application-Specific Integrated Circuit (ASIC) miners had firmly established their dominance in the Bitcoin mining sector. These specialized devices, designed solely for mining purposes, offered far superior efficiency and performance compared to the earlier CPU and GPU mining setups.

2016 & 2017 Popular Mining Rigs

- Antminer S9: Released in 2016 by Bitmain, the Antminer S9 quickly became one of the most popular and efficient miners of its time. With a hash rate of around 13.5 TH/s and power efficiency of approximately 0.098 J/GH, it was a favorite among both hobbyists and professional miners.

- AvalonMiner 741: Another notable miner from this period was the AvalonMiner 741 by Canaan, offering a hash rate of 7.3 TH/s. It was praised for its build quality and stability.

What is ASIC?

An Application-Specific Integrated Circuit (ASIC) is a chip designed for a specific application, as opposed to a general-purpose chip like a CPU. In the context of Bitcoin, ASICs are designed exclusively for mining the cryptocurrency.

- Unparalleled Efficiency: ASIC miners are optimized to compute the SHA-256 hashing algorithm used in the Bitcoin proof-of-work consensus mechanism. This specialization means they can mine Bitcoin at a much faster rate than any previous method, with some ASICs offering a billion times more computational power per unit of energy than a CPU.

- Economic Implications: The introduction of ASICs made Bitcoin mining more of an industrial activity. The efficiency of ASICs meant that they quickly became the only viable hardware for Bitcoin mining. This led to the establishment of large-scale mining farms, often located in areas with cheap electricity. The high entry cost of ASIC mining also meant that individual miners had to pool their resources, leading to the rise of mining pools.

The Modern Bitcoin Mining Rig

A Bitcoin mining rig today isn’t just a solitary machine humming away in someone’s basement. It’s a sophisticated setup, often comprising hundreds or even thousands of ASIC (Application-Specific Integrated Circuit) machines. These machines are meticulously arranged in vast warehouses or data centers, optimized for cooling, power distribution, and overall performance.

Centralization of Mining Power

The sheer computational demands of contemporary Bitcoin mining have led to a trend of centralization. Here’s what that looks like:

- Aggregation of ASICs: Today’s mining rig is essentially an aggregation of multiple ASIC machines. These machines are designed from the ground up to perform the specific task of mining Bitcoin, making them exponentially more efficient than their predecessors, like CPUs and GPUs.

- Single Ownership: These massive setups are often owned, operated, and maintained by a single entity, be it an individual or a company. This centralization stems from the high capital requirements for setting up and running a modern mining rig, which often puts it out of reach for casual miners.

- Optimized Infrastructure: Beyond the machines themselves, today’s mining rigs feature advanced infrastructure components. This includes specialized cooling systems to dissipate the immense heat generated by the ASICs, advanced electrical setups to ensure consistent power delivery, and state-of-the-art security measures to protect the valuable equipment and mined Bitcoins.

Benefits and Criticisms

| Aspect | Pros | Cons |

|---|---|---|

| Efficiency | Centralized rigs with ASIC machines maximize hash rate and minimize power consumption. | – |

| Maintenance & Upgrades | Streamlined maintenance and quicker implementation of hardware and software upgrades. | – |

| Economies of Scale | Cost savings from bulk hardware purchases, optimized power contracts, and efficient cooling. | – |

| Centralization Concerns | – | Concentration of mining power can deviate from Bitcoin’s decentralization ethos and pose network risks. |

| Barrier to Entry | – | High capital requirements make it challenging for individual miners or small groups to compete effectively. |

Best Bitcoin Mining Rig

With the increasing difficulty level of Bitcoin mining, it’s crucial to have the most efficient mining rigs to maximize profitability. Here’s a comparative analysis of some of the best Bitcoin mining rigs available now and those expected to be available in 2025:

| Product | Hashrate (TH/s) | Power on Wall (Watt) | Power Efficiency (J/TH) | Price (USD) | Availability |

|---|---|---|---|---|---|

| Antminer S19j XP | 151 | 3247 | 21.5 | $4,983 | Available Now |

| WhatsMiner M50S++ | 144 | 3080 | 22 | $3,500 | Available Now |

| WhatsMiner M56S++ | 250 | 5588 | 22 | $6,350 | Available Now |

| Antminer S21 | 200 | 3500 | 17.5 | Not Specified | Available Now |

| Antminer S21 Hyd. | 335 | 5360 | 16.0 | Not Specified | Available Now |

Observations:

- Power Efficiency: The Antminer S21 Hyd. stands out with a power efficiency of 16.0 J/TH, making it the most efficient among the listed rigs. This is crucial as power efficiency directly impacts the profitability of mining operations.

- Hashrate: The Antminer S21 Hyd. also boasts the highest hashrate of 335 TH/s, indicating its superior mining capability.

- Price: The Antminer S19j XP is priced at $4,983, making it a mid-range option in terms of cost. However, the exact prices for the 2025 models are not specified.

- Availability: While the first three models are available for purchase now, the Antminer S21 and S21 Hyd. are expected to be available in 2025.

- Cooling Technology: It’s noteworthy that the Antminer S21 Hyd. uses hydro-cooling technology, which might offer better cooling efficiency compared to traditional air-cooled models.

Efficiency in Bitcoin Mining

Bitcoin mining, at its core, is a computational race. Miners around the world compete to solve complex mathematical puzzles, and the winner gets rewarded with newly minted Bitcoins. However, as the Bitcoin network has grown and matured, so has the competition and the energy consumption associated with mining. This has made efficiency not just a desirable trait, but an absolute necessity for miners who aim to remain profitable. Let’s explore the concept of efficiency in Bitcoin mining in greater depth.

The Essence of Efficiency

Efficiency in Bitcoin mining refers to the ratio of computational power (hash rate) a Bitcoin mining rig can produce to the amount of energy it consumes. In simpler terms, it’s about getting the maximum output (in terms of mined Bitcoins) for the least input (in terms of energy costs).

Why Efficiency Matters

- Cost Implications: Electricity isn’t free. In many regions, it’s quite expensive. An inefficient mining rig that consumes a lot of power can quickly eat into the profits made from mining, especially when the price of Bitcoin is volatile.

- Environmental Impact: The global energy consumption of Bitcoin mining has been a topic of debate and concern. Efficient mining reduces the environmental footprint of the Bitcoin network.

- Hardware Longevity: Efficient mining rigs generate less heat. Excessive heat can reduce the lifespan of the mining hardware, leading to more frequent replacements and increased costs.

Factors Influencing Mining Efficiency

- Hardware: The type of hardware used plays a pivotal role. ASIC (Application-Specific Integrated Circuit) miners, designed specifically for Bitcoin mining, are currently the most efficient.

- Software: Mining software optimized for performance can enhance the efficiency of the mining process. Regular updates can also address bugs or compatibility issues that might hinder performance.

- Cooling Solutions: Efficient cooling ensures that mining rigs operate at optimal temperatures, which can boost performance and hardware longevity.

- Electricity Costs: Even with the most efficient hardware, regions with high electricity costs can make mining unprofitable. This is why many large-scale mining operations are located in areas with cheap electricity.

Measuring Efficiency

Efficiency is typically measured in terms of “W/GH,” which stands for watts per gigahash. A lower W/GH value indicates a more efficient miner. For instance:

- If Miner A has an efficiency of 0.5 W/GH and Miner B has an efficiency of 0.8 W/GH, Miner A is more efficient.

Setting Up Your ASIC Bitcoin Mining Rig

1. Choosing the Right ASIC Device

- Research: Before purchasing, research the latest ASIC models available in the market. Look for devices that offer the best balance between hash rate, power consumption, and cost.

- Reputable Manufacturers: Stick to well-known manufacturers like Bitmain, MicroBT (brand Whatsminer), and Canaan. They have a track record of producing reliable and efficient machines.

2. Location and Infrastructure

- Space: Ensure you have a dedicated space for your mining setup. This could be a spare room, garage, or a commercial space for larger operations.

- Cooling: ASIC devices generate significant heat. Ensure the location has good ventilation. Consider investing in additional cooling solutions like fans or air conditioning units.

- Noise Considerations: ASIC miners can be noisy. If setting up at home, consider soundproofing measures or placing the rig in a location where noise won’t be an issue.

3. Powering Your Bitcoin Mining Rig

- Power Supply Units (PSUs): Ensure you have a high-quality PSU that can handle the power demands of your ASIC device. Some ASIC miners come with their PSUs, while others require a separate purchase.

- Electricity Costs: Be aware of your local electricity rates. High electricity costs can eat into your mining profits. Some miners relocate their rigs to areas with cheaper electricity.

4. Setting Up the Mining Software

- Firmware: Ensure your ASIC device is running the latest firmware. Manufacturers often release updates that improve performance or fix bugs.

- Mining Software: While some ASIC devices come with pre-installed mining software, others require manual installation. Popular choices include CGMiner, BFGMiner, and EasyMiner. Choose software that’s compatible with your ASIC model.

- Configuration: Once installed, configure the software by entering details like the Bitcoin wallet address (for receiving payouts) and the mining pool details (if you’re joining a pool).

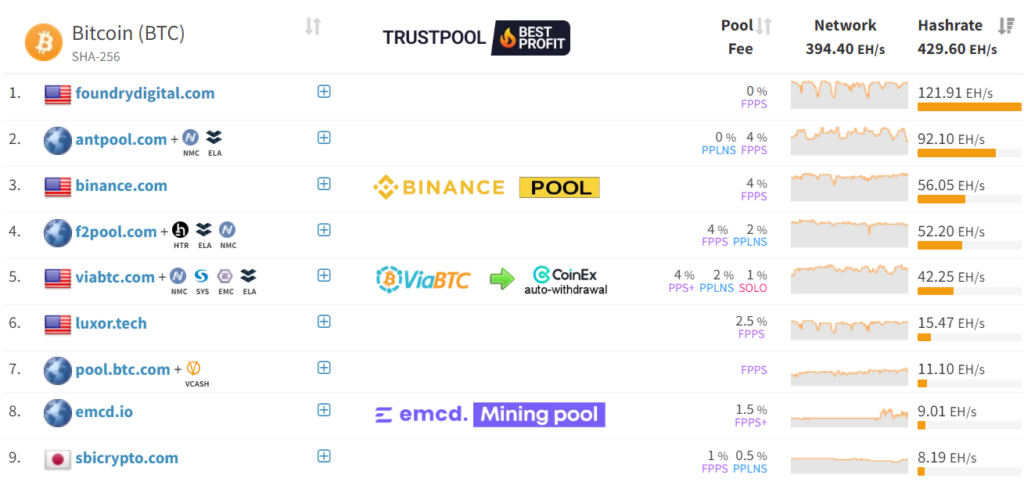

5. Joining a Mining Pool

- Why Join a Pool?: Mining pools are groups of miners who combine their computational power to increase the chances of solving a block. While individual rewards are smaller, they are more frequent, leading to a more consistent income.

- Choosing a Pool: Research and choose a reputable mining pool. Consider factors like pool fees, payout methods, and the pool’s size and track record.

6. Monitoring and Maintenance

- Monitoring Tools: Use software tools to monitor the performance of your Bitcoin mining rig / ASIC miner. Track metrics like temperature, hash rate, and uptime.

- Routine Maintenance: Regularly clean your ASIC device to remove dust and ensure efficient cooling. Check for software updates and make necessary upgrades.

7. Security Measures

- Protect Your Earnings: Use secure wallets with strong passwords and consider hardware wallets for added security.

- Network Security: Ensure your internet connection is secure. Consider using a dedicated VPN or firewall to protect against potential attacks.

Maximizing Profitability

Bitcoin mining, once a hobby for tech enthusiasts, has evolved into a complex and competitive industry. With the increasing difficulty of mining and the volatile nature of Bitcoin prices, miners are constantly seeking ways to maximize their profitability. Ensuring a positive return on investment requires a combination of technical optimization, strategic decision-making, and staying updated with industry trends. Let’s explore the various strategies to enhance profitability in Bitcoin mining.

1. Efficient Hardware Selection

- ASIC Dominance: Application-Specific Integrated Circuit (ASIC) devices are the gold standard in Bitcoin mining today. They offer unparalleled efficiency compared to older methods like CPU or GPU mining. Regularly updating to the latest and most efficient ASIC models can significantly boost profitability.

2. Electricity Costs: The Silent Profit Eater

- Location Matters: One of the most significant recurring costs for miners is electricity. Some regions offer much cheaper electricity rates than others. Large-scale mining operations often relocate to areas with lower electricity costs to maximize profits.

- Renewable Energy: Exploring renewable energy sources, such as solar or wind power, can lead to substantial savings in the long run. Some miners invest in their own renewable energy setups to reduce dependence on the grid.

3. Joining a Mining Pool

- Consistent Returns: While solo mining can offer larger payouts, they are infrequent and unpredictable. Joining a mining pool allows miners to combine their computational power, increasing the chances of solving blocks. This results in smaller, but more consistent payouts.

- Pool Selection: Not all mining pools are created equal. Factors like pool fees, payout structures, and the reputation of the pool can impact overall profitability.

4. Optimal Cooling Solutions

- Heat Reduction: Mining devices, especially ASICs, generate significant heat. Efficient cooling solutions ensure that devices run optimally, reducing wear and tear and extending their lifespan.

- Ventilation and Airflow: Proper ventilation in the mining setup can significantly reduce the need for additional cooling equipment, leading to cost savings.

5. Software and Configuration

- Optimized Mining Software: Using well-optimized mining software can enhance the performance of mining devices. Regular updates can also address bugs or compatibility issues that might hinder performance.

- Fine-tuning Settings: Tweaking settings like clock speeds or power usage can strike a balance between performance and electricity consumption, leading to better profitability.

6. Stay Informed

- Market Trends: The price of Bitcoin is a significant factor in mining profitability. Keeping an eye on market trends can help in making informed decisions, such as when to sell the mined Bitcoins.

- Industry Updates: The world of cryptocurrency is dynamic. Regulatory changes, technological advancements, or shifts in network difficulty can all impact profitability. Staying updated allows miners to adapt and strategize accordingly.

Home Bitcoin Mining Rig vs Bitcoin Mining Rig Container

enthusiasts and professionals alike are constantly seeking innovative solutions to optimize their operations. Two such solutions that have gained traction in recent years are the “home bitcoin mining rig” and the “bitcoin mining rig container.” Let’s delve into these concepts and understand their significance, advantages, and potential challenges.

Home Bitcoin Mining Rig: Bringing Mining to Your Living Room

A home bitcoin mining rig refers to a setup where individuals mine Bitcoin using specialized equipment right from the comfort of their homes. This setup is typically smaller in scale compared to industrial mining operations and is designed to fit into residential spaces.

Interestingly, some tech enthusiasts have found innovative ways to harness the heat generated by ASIC rigs. By integrating these rigs into their home’s heating or water heating systems, they effectively repurpose the byproduct heat, eliminating the need for traditional heating methods. This not only offsets the cost of heating but also adds a unique eco-friendly dimension to the mining process.

Advantages:

- Flexibility: Easy to set up, modify, or dismantle based on individual preferences.

- Cost-effective: Eliminates the need for renting commercial spaces or warehouses.

- Hands-on Experience: Offers enthusiasts a firsthand experience of the mining process.

Challenges:

- Noise and Heat: Mining equipment, especially ASICs, can be noisy and generate significant heat, which might be disruptive in a home environment.

- Limited Scalability: Due to space constraints, there’s a limit to how much one can expand their home mining setup.

Read our How to Mine Bitcoin at Home article for more details.

Bitcoin Mining Rig Container: The Mobile Mining Powerhouse

Bitcoin mining rig containers are essentially modular, portable data centers designed specifically for mining. These are large shipping containers equipped with racks for mining hardware, cooling systems, and power supplies.

Advantages:

- Portability: Can be transported to locations with cheaper electricity or favorable climatic conditions.

- Scalability: Designed to house a large number of mining devices, allowing for significant scalability.

- Efficient Cooling: Comes with built-in cooling solutions, ensuring optimal performance of the mining equipment.

- Security: Containers can be equipped with security measures to protect the valuable equipment inside.

Challenges:

- Initial Setup Cost: The upfront cost for a mining container, along with the necessary equipment, can be high.

- Maintenance: Requires regular maintenance to ensure the systems inside the container run smoothly.

- Space Requirement: While portable, these containers still require ample space for setup, preferably in areas with low noise restrictions.

Conclusion

As the Bitcoin network continues to mature and the complexity of its underlying algorithms increases, the feasibility of home bitcoin mining with ASICs has been progressively diminishing. The days when individuals could mine Bitcoin profitably with a simple home setup are fading. The increasing difficulty level necessitates more powerful and energy-efficient equipment, which often comes with higher noise levels and heat generation. This makes it not only challenging but also less cost-effective for home miners to compete with large-scale mining operations.

For those still keen on home mining, GPU mining rigs present a more viable option. These rigs, while less powerful than ASICs, are more versatile and can be used to mine a variety of cryptocurrencies, not just Bitcoin. They also tend to be quieter and produce less heat, making them more suitable for a home environment.

Risks and Challenges of Buying a Bitcoin Mining Rig

Bitcoin mining, while lucrative for many, is not without its share of challenges. As the industry has matured, miners have had to grapple with a range of risks that can significantly impact profitability and the viability of their operations. Two of the most prominent factors are the periodic Bitcoin halvings and the inherent price volatility of the cryptocurrency. Let’s delve deeper into these challenges and other associated risks in the world of Bitcoin mining.

1. Bitcoin Halving: The Reward Reduction

- What is Halving? Approximately every four years (or technically, every 210,000 blocks), the reward for mining a new Bitcoin block is halved. This event is known as “halving.” It’s a built-in feature of Bitcoin’s protocol, designed to control the cryptocurrency’s supply.

- Impact on Miners: The immediate consequence of a halving is a 50% reduction in the potential revenue for miners. Unless there’s a corresponding increase in the price of Bitcoin, miners could see a significant drop in profitability overnight.

- Adaptation Strategies: Miners often prepare for halvings by upgrading to more efficient hardware, reducing operational costs, or even temporarily halting operations if profitability drops too low.

2. Price Volatility: The Double-Edged Sword

- Unpredictable Fluctuations: Bitcoin’s price is known for its volatility. Rapid and significant price swings can occur within short time frames, influenced by factors ranging from regulatory news to macroeconomic events.

- Implications for Mining: A surge in Bitcoin’s price can mean windfall profits for miners. Conversely, a sharp decline can render mining unprofitable, especially when combined with other fixed costs like electricity.

- Risk Management: Miners often employ strategies like futures contracts or holding reserves in stablecoins to hedge against extreme price volatility.

3. Hardware Obsolescence

- Rapid Technological Advancements: The pace of innovation in mining hardware is swift. Newer and more efficient models of ASIC devices are regularly released, rendering older models less competitive.

- Economic Implications: Investing in top-tier hardware can be capital-intensive. The rapid obsolescence means miners need to upgrade frequently to stay competitive, leading to increased capital expenditure.

4. Regulatory and Legal Challenges

- Changing Landscape: Cryptocurrencies, including Bitcoin, operate in a regulatory gray area in many jurisdictions. Governments can suddenly impose bans, restrictions, or new regulations that impact mining operations.

- Operational Risks: Regulatory changes can lead to forced shutdowns, confiscation of equipment, or hefty fines. Miners need to be aware of the legal landscape in their operating region and be prepared for sudden shifts.

5. Energy Consumption and Environmental Concerns

- High Energy Demands: Bitcoin mining is energy-intensive. The environmental impact of mining, especially when reliant on non-renewable energy sources, has been a topic of debate and criticism.

- Public Perception and Regulation: Growing environmental concerns can lead to negative public perception and increased regulatory scrutiny, posing challenges for large-scale mining operations.

Conclusion

The realm of Bitcoin mining rigs has witnessed a remarkable evolution. From the rudimentary setups of the early days to the sophisticated ASIC-dominated operations of today, the journey has been marked by rapid technological advancements and shifting paradigms. As we’ve explored, the landscape is multifaceted, encompassing everything from home-based endeavors to large-scale containerized solutions.

Home-based Bitcoin mining, once a promising avenue for crypto enthusiasts, is facing the challenges of increased mining difficulty and the superior efficiency of industrial-grade operations. While ASIC machines offer unparalleled power, their integration into home environments presents challenges, especially concerning heat and noise. However, the crypto community’s innovative spirit shines through, with some miners repurposing the heat generated by ASICs for domestic heating, turning a challenge into an advantage.

On the other end of the spectrum, Bitcoin mining rig containers represent the industry’s future, offering scalability, portability, and efficiency. These mobile powerhouses, designed for large-scale operations, highlight the industry’s shift towards centralization and the pursuit of optimal mining conditions, be it cheaper electricity or cooler climates.

Yet, amidst these shifts, one thing remains clear: the significance of power efficiency. Whether evaluating current models or anticipating the rigs of 2025, the “Power Efficiency on Wall” parameter stands out as a critical determinant of a rig’s viability and profitability.

In wrapping up our exploration, it’s evident that the world of Bitcoin mining rigs is as dynamic as it is complex. As miners, enthusiasts, and investors navigate this space, staying informed, adaptable, and forward-thinking is paramount. The Bitcoin mining rig industry, with its blend of technology and strategy, encapsulates the broader crypto journey: challenging, ever-evolving, but teeming with opportunities for those prepared to seize them.

FAQs

What is a Bitcoin mining rig?

A specialized hardware / ASIC designed exclusively for mining Bitcoins.

Why are ASIC devices preferred for Bitcoin mining?

They offer unmatched efficiency and speed tailored for Bitcoin’s cryptographic puzzles.

How much does a bitcoin mining rig cost?

The cost of a Bitcoin mining rig varies widely based on its efficiency, brand, and model. As of recent years, prices can range from a few hundred dollars for older models to several thousand dollars for top-tier, latest-generation ASIC miners.

How to build a bitcoin mining rig?

To build a Bitcoin mining rig:

* Choose the appropriate ASIC device.

* Install and configure mining software / firmware.

* Join a mining pool for better chances of earning rewards.

* Monitor and maintain the rig for optimal performance.