In the ever-evolving world of cryptocurrencies, the crypto mining rig stands as a testament to human ingenuity and the relentless pursuit of profit. As digital currencies continue to shape the financial landscape, understanding the intricacies of crypto mining rigs becomes paramount. Whether you’re a seasoned miner or a curious enthusiast, this guide promises to shed light on every corner of the crypto mining rig universe.

Table of Contents

What is a Crypto Mining Rig?

A crypto mining rig is not just another computer. It’s a specialized machine, fine-tuned to solve complex mathematical problems, enabling the creation and validation of cryptocurrency transactions. While your everyday computer can perform a myriad of tasks, a crypto mining rig is purpose-built, optimized for efficiency, and power in the crypto mining process.

Types of Crypto Mining Rigs

The world of cryptocurrency mining has seen significant advancements in technology, leading to the development of various types of crypto mining rigs. Each type has its own set of characteristics, making it suitable for specific mining needs.

| Type of Crypto Mining Rig | Overview | Advantages | Disadvantages |

|---|---|---|---|

| GPU (Graphics Processing Unit) | Utilizes graphics cards designed for video rendering but repurposed for mining due to parallel processing capabilities. | – Versatile: Can mine multiple cryptocurrencies. – Resale Value: Retains value for gaming market. – Upgradable: Easy to replace individual GPUs. | – High Power Consumption. – Significant Heat Production. |

| ASIC (Application-Specific Integrated Circuit) | Custom chips designed specifically for a crypto algorithm, offering high efficiency. | – High Efficiency: Unparalleled hashing power for specific algorithms. – Compact Size: Smaller than GPU setups. | – Lack of Versatility: Tied to a specific algorithm. – Noise: Can be loud in operation. – Low Resale Value: Becomes obsolete quickly. |

| FPGA (Field-Programmable Gate Array) | Integrated circuits that can be programmed post-manufacture, offering a balance between GPUs and ASICs. | – Efficiency: Better than GPUs and competitive with ASICs. – Flexibility: Can be reprogrammed for different algorithms. – Lower Power Consumption: More energy-efficient than GPUs. | – Complexity: Requires technical expertise. – Cost: High-end units are expensive. |

Here’s a comprehensive look:

GPU Mining Rigs (Graphics Processing Unit)

Overview: GPU mining rigs utilize graphics cards, which are primarily designed for rendering video and image content. However, their parallel processing capabilities make them suitable for crypto mining, especially for algorithms that are memory-intensive.

Advantages:

- Versatility: GPUs can mine multiple cryptocurrencies, allowing miners to switch between different coins based on profitability.

- Resale Value: Unlike other mining hardware, GPUs retain a decent resale value, especially in the gaming market.

- Upgradability: Miners can easily upgrade individual GPUs in a rig, ensuring continued efficiency.

Disadvantages:

- Power Consumption: GPUs can be power-hungry, especially high-end models.

- Heat Production: They tend to produce a significant amount of heat, necessitating efficient cooling solutions.

ASIC Mining Rigs (Application-Specific Integrated Circuit)

Overview: ASIC miners are custom chips designed for a specific crypto algorithm. This specialization makes them incredibly efficient for their intended purpose.

Advantages:

- High Efficiency: ASICs offer unparalleled hashing power for specific algorithms, maximizing potential profits.

- Compact Size: They are generally smaller and more streamlined than bulky GPU setups.

Disadvantages:

- Lack of Versatility: ASICs are tailored for a specific crypto algorithm. If the cryptocurrency’s protocol changes or if another coin becomes more profitable, the ASIC becomes obsolete.

- Noise: High-performance ASICs can be noisy, which might be a concern in residential settings.

- Resale Value: Their specialized nature means they have little to no resale value once they become outdated.

FPGA Mining Rigs (Field-Programmable Gate Array)

Overview: FPGA miners are integrated circuits that can be programmed post-manufacture. They bridge the gap between GPUs and ASICs, offering a balance of flexibility and efficiency.

Advantages:

- Efficiency: FPGAs provide better efficiency than GPUs and can be competitive with certain ASICs.

- Flexibility: They can be reprogrammed, allowing miners to switch between different mining algorithms.

- Lower Power Consumption: Generally, FPGAs consume less power than GPUs, making them more energy-efficient.

Disadvantages:

- Complexity: Setting up and programming an FPGA requires a higher technical skill level compared to GPUs and ASICs.

- Cost: High-end FPGA units can be expensive, potentially increasing the initial investment for miners.

Key Components of a Crypto Mining Rig

Every crypto mining rig is more than the sum of its parts. Let’s delve into the essential components:

Mining Hardware

Graphics Cards (GPUs) vs. ASIC Chips:

- Graphics Cards (GPUs): These are the heart of GPU mining rigs. They handle the computational tasks of the mining process. High-end GPUs with more computational power and memory are preferred for their higher hash rates.

- ASIC Chips: These are the core of ASIC mining rigs. Unlike GPUs, which are general-purpose graphics cards, ASIC chips are designed specifically for a particular crypto algorithm, making them highly efficient but less versatile.

Importance of Hash Rate and Efficiency:

- Hash Rate: Represents the number of calculations a miner can perform in one second. A higher hash rate increases the chances of solving a block and earning rewards.

- Efficiency: Refers to the power consumption relative to performance. More efficient miners produce more hashes per watt of electricity consumed.

Power Supply Unit (PSU)

The PSU provides the necessary power to the crypto mining rig components. It’s crucial to ensure that the PSU can handle the total power consumption of the rig.

- Importance of Energy Efficiency: A more efficient PSU will waste less electricity as heat, saving on energy costs.

- Calculating the Right Wattage: The PSU’s wattage should exceed the rig’s total power consumption. It’s recommended to have a buffer, typically 20%, to ensure safety and account for potential upgrades.

Cooling and Ventilation

Heat is a byproduct of the intense computational processes in mining. Efficient cooling ensures the longevity and stability of the crypto mining rig.

- The Role of Cooling: Overheating can reduce the lifespan of components and cause them to throttle, reducing performance. Effective cooling solutions prevent these issues.

- Popular Cooling Solutions: These include air cooling (using fans), liquid cooling (using coolants and radiators), and immersion cooling (immersing components in a non-conductive liquid).

Motherboard and CPU

While the GPU or ASIC chip does the heavy lifting in mining, the motherboard and CPU play supporting roles.

While the GPU or ASIC chip often takes center stage in mining, the motherboard and CPU play vital supporting roles, and in some cases, can even be the primary miners.

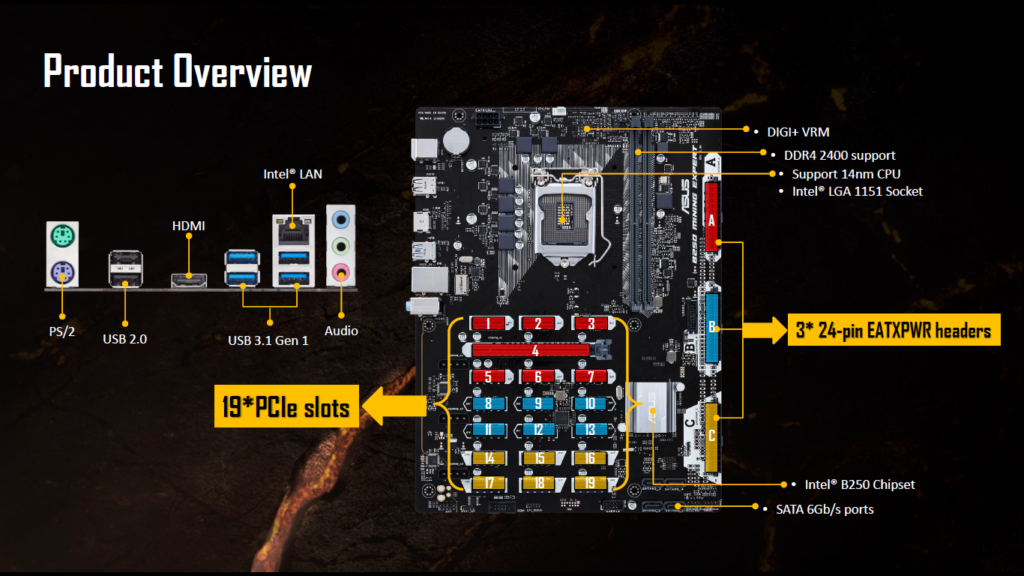

- Selecting the Right Motherboard:

- The motherboard should have enough slots (PCIe) to accommodate all GPUs in the crypto mining rig. It should also be compatible with other components and support overclocking if desired.

- Special Mining Motherboards: For dedicated mining operations, specialized mining motherboards are recommended. These motherboards are designed to maximize stability, compatibility, and performance in mining setups.

- CPU’s Role in a Crypto Mining Rig:

- The CPU handles tasks like running the operating system, mining software, and managing the GPUs. While it’s not as crucial as the GPUs or ASICs for most mining tasks, it’s essential for smooth operation.

- CPU Mining: Some cryptocurrencies, like Raptoreum or coins based on the RandomX algorithm, are optimized for CPU mining. In such cases, the CPU becomes the primary miner, and its performance directly impacts mining profitability.

Software Essentials for Crypto Mining

The software component of crypto mining is just as crucial as the hardware. It’s the software that interfaces with the hardware, manages the mining process, and connects miners to the blockchain network. Let’s delve deeper into the essential software components for crypto mining:

Mining Operating Systems

A mining operating system (OS) is specialized software that manages the hardware of a crypto mining rig and provides a user-friendly interface for monitoring and control.

Popular OS Options:

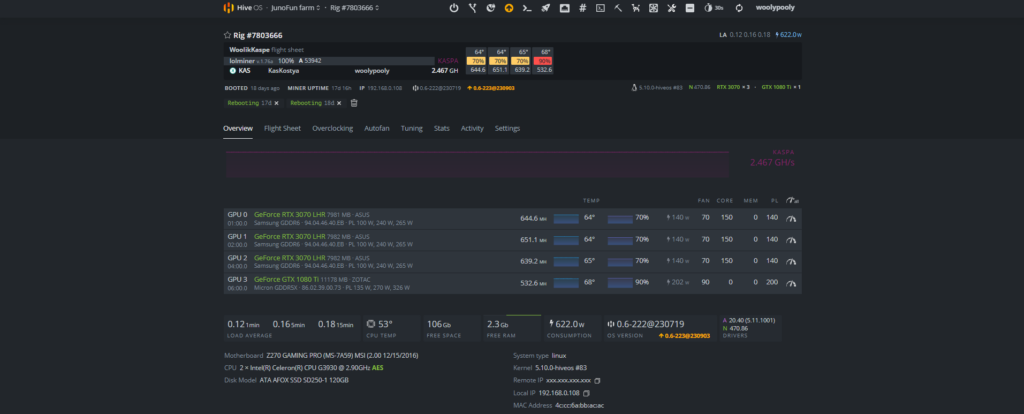

- HiveOS: A Linux-based OS tailored for mining. It offers robust monitoring tools, overclocking options, and supports a wide range of GPUs and ASICs.

- NiceHash OS: An OS designed to work seamlessly with the NiceHash mining platform. It’s optimized for profitability as it auto-switches to mine the most profitable coin based on market conditions.

- RaveOS: Another Linux-based solution, RaveOS provides a stable environment for both ASIC and GPU mining, with a focus on monitoring and optimization features.

Mining Software (Clients)

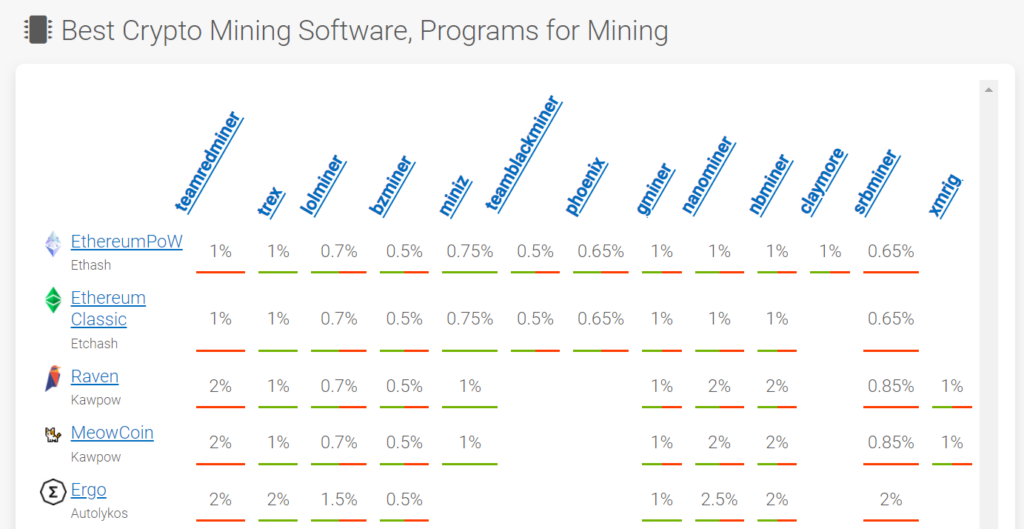

Mining software, often referred to as clients, interfaces with the mining hardware and performs the actual mining process by solving cryptographic puzzles.

Popular Mining Clients:

- Lolminer: A versatile miner that supports multiple algorithms and coins. It’s known for its dual mining feature, where two different coins can be mined simultaneously.

- GMiner: Known for its high performance and support for multiple algorithms.

- BZMiner: Offers a user-friendly interface and is optimized for both AMD and Nvidia GPUs.

Mining Pools

While not software in the traditional sense, mining pools are platforms where individual miners combine their computational power to increase the chances of solving a block. In return, rewards are distributed among participants based on contributed hash power.

Popular Mining Pools:

- WoolyPooly: Offers support for a variety of coins, user-friendly tools, and detailed statistics for miners.

- F2Pool: A multi-currency pool that supports a wide range of cryptocurrencies.

Wallets

Once you’ve mined cryptocurrencies, you need a secure place to store them. Digital wallets allow users to manage their crypto holdings, make transactions, and ensure security. There are plenty types of crypto wallets you can choose from.

Setting Up Your Crypto Mining Rig

From assembling hardware to software configuration, setting up your crypto mining rig can be a rewarding experience.

Assembling the Hardware

The foundation of a successful mining operation lies in the correct assembly of the hardware components.

Choosing a Location

Opt for a spacious, well-ventilated area to set up your crypto mining rig. Proper ventilation ensures efficient heat dissipation, which is crucial for the longevity of your components.

Mounting Components on a Frame

Whether you’re using a custom-built frame or a commercial mining rig frame, securely mount all components, ensuring they’re spaced out to prevent overheating.

Connecting Power to the Motherboard

Properly connecting the power supply to the motherboard is crucial for the crypto mining rig’s operation. For a detailed guide, refer to Connecting Power to Motherboard.

Connecting GPUs

Once the motherboard is powered, the next step is to connect the GPUs. Each GPU should be securely slotted into the PCIe slots on the motherboard. For power connections and additional setup details, check out How to Connect GPU to PSU.

Setting Up Cooling Solutions

Install fans or other cooling solutions to ensure a steady airflow across all components. Remember, efficient cooling can significantly extend the life of your mining rig.

Installing and Configuring Software

With the hardware in place, it’s time to breathe life into your rig with the right software.

Installing the Mining OS

Choose a mining OS that suits your needs, such as HiveOS, RaveOS, or NiceHash OS. Install it on a USB or SSD and boot up your rig.

Configuring the Mining Client

Based on the cryptocurrency you intend to mine, install and configure the appropriate mining client. Ensure that it’s compatible with your hardware and the chosen mining pool.

Joining a Mining Pool

While solo mining is an option, joining a mining pool like WoolyPooly can increase your chances of regular rewards. Configure your mining client to connect to the pool, inputting the necessary pool address and port details.

Setting Up a Wallet

To receive your mining rewards, you’ll need a digital wallet (non-custodial wallet is better). Set one up, ensuring it’s compatible with the cryptocurrency you’re mining, and input the address into your mining client or pool settings.

Testing and Monitoring

Once everything is set up:

Initial Testing

Power on your rig and monitor for any issues. Check for component recognition, temperature levels, and connection stability.

Ongoing Monitoring

Regularly monitor your rig’s performance, temperature, and hash rate. Many mining OSs provide built-in monitoring tools for this purpose.

Mining Rig Efficiency and Profitability

Mining rig efficiency and profitability are paramount concerns for anyone venturing into the world of cryptocurrency mining. Let’s delve deeper into these aspects:

Understanding Efficiency

Efficiency in the context of crypto mining refers to the amount of computational power a rig can deliver relative to its power consumption. An efficient rig maximizes output (hash rate) while minimizing input (electricity).

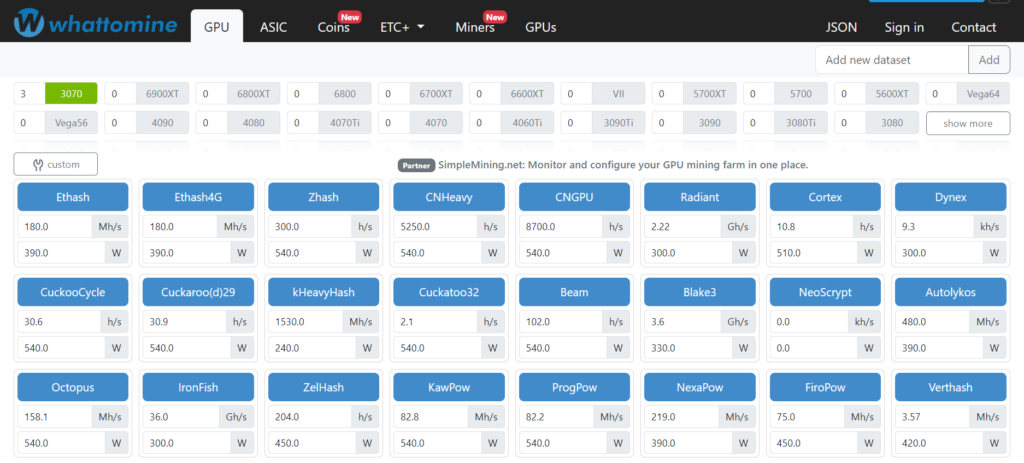

- Hash Rate: This is the number of calculations your rig can perform every second. A higher hash rate increases the chances of solving a block and earning rewards.

- Power Consumption: Mining is energy-intensive. The amount of electricity your rig consumes directly impacts your operational costs and, by extension, your profitability.

- Hardware Efficiency: Over time, hardware can become less efficient due to wear and tear or technological advancements. Regularly updating or optimizing your hardware can help maintain efficiency.

Calculating Profitability

Profitability is the bottom line for miners. It’s the difference between the revenue from mined coins and the costs of mining (including electricity, hardware depreciation, and other expenses).

- Mining Calculators: These are online tools that help estimate potential profits based on current cryptocurrency prices, hash rate, power consumption, and other factors. For accurate estimates, consider using:

- Factors Affecting Profitability:

- Electricity Costs: One of the most significant operational costs. Locations with cheaper electricity rates can significantly boost profitability.

- Cryptocurrency Market Prices: The value of the cryptocurrency you’re mining can fluctuate. Higher prices can lead to increased profitability, but the reverse is also true.

- Mining Difficulty: As more miners join the network, the difficulty of solving blocks can increase, potentially reducing rewards.

- Hardware and Maintenance Costs: The initial investment in the rig and ongoing maintenance costs can impact overall profitability.

Optimizing for Profitability

- Energy Efficiency: Opt for energy-efficient hardware components, especially PSUs and GPUs/ASICs. This reduces operational costs and boosts profitability.

- Overclocking: This involves pushing your hardware components, especially GPUs, beyond their factory-set limits to increase performance. However, it can lead to increased power consumption and potential hardware risks.

- Joining Profitable Pools: Mining pools like WoolyPooly often optimize for the most profitable coins, ensuring miners get the best possible returns.

- Regular Monitoring: Keep an eye on your rig’s performance, the cryptocurrency market, and electricity costs. Adjust your mining strategy accordingly to maximize profits.

Safety and Maintenance Tips

Electrical Safety

Mining rigs consume a significant amount of electricity, making electrical safety a top priority.

- Quality Power Supply: Invest in a high-quality PSU (Power Supply Unit) that can handle the power demands of your rig. Ensure it has an 80 PLUS certification, indicating energy efficiency.

- Avoid Overloading: Never overload power strips or outlets. Distribute the power load evenly and consider dedicated circuits for larger mining setups.

- Regularly Check Cables: Inspect power cables for wear, tear, or damage. Replace frayed or exposed cables immediately.

- Grounding: Ensure your mining setup is properly grounded to prevent electrical shocks.

Thermal Management

Heat is a major byproduct of mining, and managing it is crucial for the longevity and safety of your rig.

- Adequate Ventilation: Place your rig in a well-ventilated area. Ensure there’s ample space around it for air circulation.

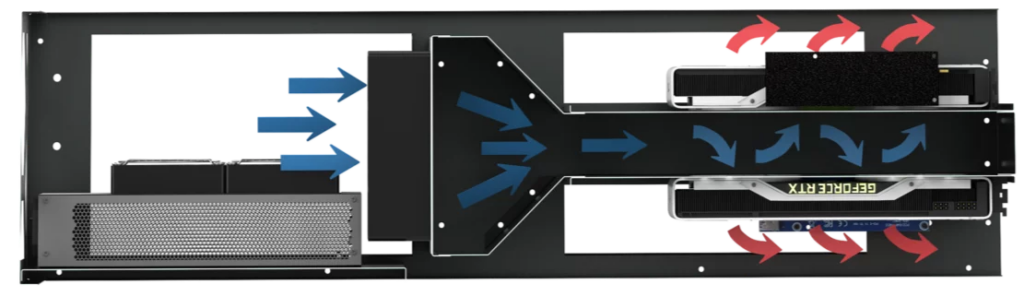

- Efficient Cooling Solutions: Use high-quality fans, and consider advanced cooling solutions like Donnager with separation of flows into hot and cold.

- Monitor Temperatures: Use software tools to keep an eye on component temperatures. If any component consistently runs too hot, it may be time for maintenance or replacement.

Dust and Cleanliness

Dust can be a miner’s enemy, leading to reduced airflow and increased temperatures.

- Regular Cleaning: Periodically turn off and clean your rig. Use compressed air to blow out dust from components, especially fans and heatsinks.

- Environment: If possible, place your rig in a room with minimal dust. Consider using air purifiers or dust filters.

Software and Security

While hardware safety is crucial, software security is equally important to protect your mining rewards and system integrity.

- Regular Updates: Keep your mining OS, software, and drivers updated. This not only ensures optimal performance but also patches potential security vulnerabilities.

- Firewall and Antivirus: Use a reliable antivirus and enable a firewall to prevent malware attacks, especially those targeting crypto miners.

- Wallet Security: Ensure your cryptocurrency wallet is secure. Consider using hardware wallets for added security.

Regular Maintenance Checks

- Hardware Inspection: Periodically inspect all hardware components for signs of wear, damage, or malfunction. This includes checking the integrity of GPUs, motherboards, and other components.

- Software Diagnostics: Run diagnostic tests on your mining software to ensure it’s operating optimally. Check for any errors or inconsistencies.

- Backup: Always have backup solutions in place. This includes backup power solutions, backup hardware components, and backup data solutions for your mining configurations and wallet details.

Future of Crypto Mining and Hardware

Technological Advancements in Hardware

- Next-Generation ASICs: ASIC (Application-Specific Integrated Circuit) miners are continually evolving. Future ASICs are expected to be even more energy-efficient, providing higher hash rates while consuming less power.

- Advancements in GPU Technology: GPUs will continue to see improvements in processing power, memory, and energy efficiency. This will allow them to remain competitive, especially for cryptocurrencies that resist ASIC mining.

- Hybrid Systems: We might see systems that combine the best of ASICs, GPUs, and even FPGAs (Field-Programmable Gate Arrays) to create versatile and powerful mining rigs.

Energy Efficiency and Green Mining

- Renewable Energy Sources: With increasing concerns about the environmental impact of crypto mining, there’s a growing trend towards using renewable energy sources like solar, wind, and hydroelectric power for mining operations.

- Heat Recapture: Innovations are being explored to harness the heat generated from mining operations, converting it into energy or using it for heating purposes.

Decentralization and Home Mining

- Resurgence of Home Mining: As hardware becomes more efficient and affordable, we might see a resurgence in home mining, allowing individuals to participate competitively in the mining landscape.

- Decentralized Mining Pools: To combat the centralization of mining power in large pools, future systems might promote more decentralized pooling methods, ensuring a more equitable distribution of rewards.

Proof-of-Stake and Beyond

- Shift from Proof-of-Work: Many major cryptocurrencies are considering or have already started transitioning from the energy-intensive Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS) or hybrid models. This shift will significantly impact the traditional mining landscape.

- New Consensus Mechanisms: Beyond PoS, the crypto world is exploring other consensus mechanisms that are more energy-efficient and secure. These new mechanisms might redefine the concept of “mining.”

Regulatory and Geopolitical Impacts

- Regulatory Clarity: As governments around the world gain a better understanding of the crypto space, clearer regulations might emerge, impacting how and where mining operations are conducted.

- Geopolitical Shifts: Countries with favorable regulations, low energy costs, and a positive stance on cryptocurrencies might become the new hubs for crypto mining, leading to a shift in the global mining landscape.

Enhanced Security and Quantum Computing

- Quantum-Resistant Algorithms: The advent of quantum computing poses a potential threat to the cryptographic foundations of many cryptocurrencies. In response, new quantum-resistant mining algorithms might emerge.

- Hardware Security: As the value of cryptocurrencies grows, so will the incentive for hardware-based attacks. Future mining hardware will likely incorporate advanced security features to counteract potential threats.

Conclusion

The realm of cryptocurrency mining is a dynamic fusion of technology, economics, and innovation. From its humble beginnings, where enthusiasts could mine coins using personal computers, to today’s sophisticated mining farms harnessing the power of specialized hardware, the journey has been nothing short of revolutionary.

As we’ve delved into the intricacies of mining rigs, their components, and the software that drives them, it’s evident that the mining landscape is a meticulous blend of hardware prowess and software optimization. The emphasis on efficiency, profitability, and safety underscores the seriousness and potential of this endeavor.

But beyond the present, the horizon of crypto mining is shimmering with possibilities. The continuous evolution of hardware, the increasing focus on green mining practices, and the potential shifts in consensus mechanisms all point towards a future that’s not just about securing blockchain networks but also about redefining the very ethos of decentralized systems.

Moreover, as the world grapples with the broader implications of cryptocurrencies – from regulatory challenges to their role in global economics – mining stands at the crossroads of technology and policy. It’s a testament to the transformative power of blockchain technology and a beacon for the future of decentralized finance.

For enthusiasts, investors, and technologists alike, the world of crypto mining offers a fascinating glimpse into the potential of decentralized systems. As we stand on the cusp of this technological frontier, one thing is certain: crypto mining, in all its complexity and innovation, is set to play a pivotal role in shaping the digital future.

FAQs

What’s the best crypto mining rig for beginners?

Start with a GPU mining rig for versatility and ease of use.

How much can I earn with a crypto mining rig?

Earnings vary based on multiple factors. Use online calculators for estimates.

Is crypto mining still profitable in 2025?

Yes, with the right setup and market conditions, it remains a viable venture.