In the dynamic world of cryptocurrency, knowing how to short crypto can be a game-changer. Shorting crypto, a strategy often used in volatile markets, involves betting on the price of a cryptocurrency to fall. This approach can be a powerful tool for traders, but it also comes with its own set of risks. This comprehensive guide will walk you through the process, helping you understand the intricacies of shorting crypto and how to navigate its potential pitfalls.

Table of Contents

Understanding the Basics of Shorting Crypto

Shorting, or short selling, is a trading strategy that is used across various financial markets, including the cryptocurrency market. The basic principle of shorting involves profiting from a decline in the price of an asset. Here’s a deeper dive into understanding the basics of shorting crypto.

What is Shorting in the Crypto World?

In the world of cryptocurrency, shorting is a strategy where a trader anticipates a decline in the price of a cryptocurrency. The trader borrows a certain amount of the cryptocurrency and sells it at the current market price. The goal is to buy it back later at a lower price, return the borrowed amount to the lender, and pocket the difference as profit.

For example, if a trader believes that Bitcoin‘s price will fall, they can borrow and sell one Bitcoin at the current price of $50,000. If the price drops to $40,000, they can buy back the Bitcoin at this lower price, return the borrowed Bitcoin, and make a profit of $10,000 (minus any fees or interest paid to the lender).

Imagine you believe that the price of Bitcoin (BTC) will drop in the coming weeks. You decide to short 1 BTC, which is currently valued at $50,000. To do this, you borrow the 1 BTC and immediately sell it. A week later, your prediction comes true, and the price of Bitcoin falls to $45,000. You then buy back the 1 BTC at this lower price, returning the borrowed Bitcoin and pocketing the $5,000 difference as your profit.

Shorting vs. Traditional Crypto Trading

Traditional crypto trading, also known as “going long,” involves buying a cryptocurrency with the expectation that its price will rise. Traders profit from selling the cryptocurrency at a higher price than the purchase price.

On the other hand, shorting allows traders to profit from price drops. This key difference makes shorting a unique and valuable strategy, especially in bear markets or during periods of high volatility when prices are expected to decline.

Why the Buzz Around Shorting Crypto?

Shorting crypto has garnered significant attention in recent years, primarily due to the volatile nature of the cryptocurrency market. This crypto volatility offers traders numerous opportunities to capitalize on price fluctuations, both upward and downward. Shorting, in particular, allows traders to profit from these downward trends, making it an attractive strategy during bearish market phases.

Here’s a detailed chart to break down the reasons behind the growing interest in shorting crypto:

| Reason | Description | Benefits for Traders |

|---|---|---|

| Profit in Bear Markets | Even when the overall market is in decline, shorting provides a chance to earn. | Potential for consistent profits in downtrends. |

| Hedging Against Losses | Shorting can act as a protective measure against potential downturns in a trader’s long positions. | Reduces overall portfolio risk. |

| Speculation | Some traders believe certain cryptocurrencies are overvalued and will correct soon. | Opportunity to capitalize on perceived market bubbles. |

| Leverage Opportunities | Many platforms offer leverage when shorting, amplifying potential profits (and losses). | Higher returns on successful trades. |

| Diversification | Shorting adds another tool to a trader’s arsenal, allowing for a more diversified trading strategy. | Balances long positions, leading to a robust portfolio. |

The Mechanics of Shorting Crypto

Shorting crypto involves a series of steps that are facilitated by a cryptocurrency exchange or other financial institution. Here’s a detailed look at the mechanics of shorting crypto.

Step-by-Step Guide on How to Short Crypto

Choose a Reliable Crypto Exchange

The first step in shorting crypto is to choose a reliable crypto exchange that allows shorting. Not all exchanges offer this feature, so it’s important to do your research. Some popular exchanges that allow shorting include MEXC (without KYC under 10 BTC per day), Binance, Gate.io, OKX, Bingx.

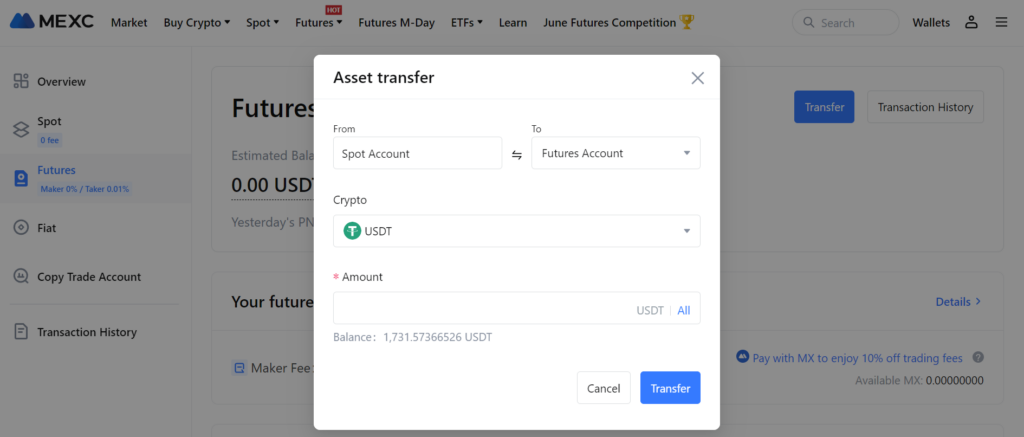

Open a Margin / Futures Account

To short crypto, you’ll need to open a margin account with the exchange. A margin account allows you to borrow funds or assets from the exchange to make trades.

Borrow the Crypto

Once your margin account is set up, you can borrow the cryptocurrency that you want to short. The amount you can borrow will depend on the terms of the exchange and the amount of collateral you have in your account.

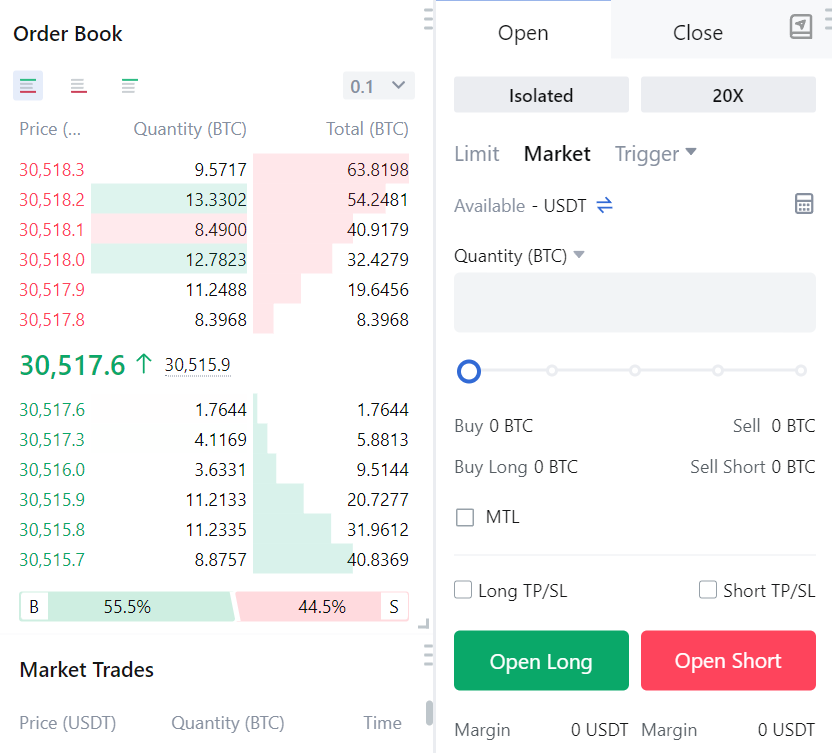

Sell the Borrowed Crypto

After borrowing the crypto, you sell it at the current market price. The proceeds from this sale are held in your margin account as collateral for the borrowed crypto.

Wait for the Price to Drop

Now, you wait for the price of the crypto to fall. This is the most uncertain step in the process because it’s dependent on market movements.

Buy Back the Crypto

If the price of the crypto falls as you anticipated, you buy back the same amount of crypto that you initially borrowed. Ideally, you’ll be buying back the crypto at a significantly lower price than you sold it for.

Return the Borrowed Crypto

After buying back the crypto, you return the borrowed amount to the exchange. This is typically done automatically when you close your short position.

Profit from the Price Difference

The profit from shorting crypto is the difference between the price at which you sold the borrowed crypto and the price at which you bought it back, minus any fees or interest paid to the exchange.

Understanding Margin Trading, Futures, and Options

Margin trading is a method of trading assets using funds provided by a third party. When compared to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions. Essentially, margin trading amplifies trading results so that traders can realize larger profits on successful trades.

Futures and options are both derivative contracts and are used for hedging risks or for speculation. Futures contracts are agreements to buy or sell an asset at a specific price on a specific date. Options contracts provide the right, but not the obligation, to buy or sell an asset at a set price, on or before a certain date.

The Role of Crypto Exchanges in Shorting Crypto

Crypto exchanges play a crucial role in shorting crypto. They provide the platform where traders can borrow and sell crypto, and later buy it back to return the borrowed amount. Exchanges enforce the rules and requirements for shorting, such as the need for a margin account and collateral, and they charge fees or interest for the service of lending crypto.

Top Platforms for Shorting Crypto

Choosing the right platform is half the battle. Here’s a quick comparison:

| Exchange | Liquidity | Max Short Leverage | Maker Fees | Taker Fees | KYC |

|---|---|---|---|---|---|

| MEXC | High | 200x | 0% | 0.03% | No (30 BTC/day) |

| OKX | High | 125x | 0.02% | 0.05% | No (10 BTC/day) |

| BingX | Moderate | 150x | 0.02% | 0.04% | No (50K USDT/day) |

| Bitget | Moderate | 125x | 0.02% | 0.06% | Yes |

| Gate.io | High | 125x | 0.015% | 0.05% | Yes |

| Bybit | High | 100x | 0.02% | 0.04% | Yes |

| Binance | High | 125x | 0.02% | 0.04% | Yes |

| KuCoin | High | 100x | 0.02% | 0.06% | Yes |

| CoinEx | Low | 100x | 0.03% | 0.05% | No (10k USDT/day) |

| Huobi | High | 200x | 0.02% | 0.04% | No (5 BTC/day) |

MEXC – Best Exchange for Shorting Crypto Overall

MEXC, with its high liquidity and lowest fees, has become a go-to platform for many traders looking to short cryptocurrencies. The exchange offers a wide range of trading pairs, allowing users to take advantage of market fluctuations. With a maximum leverage of up to 200x, traders have the flexibility to amplify their positions, though it’s crucial to understand the risks associated with high leverage. Also, MEXC is a no KYC crypto exchange.

Pros and Cons of Shorting Crypto on MEXC:

| Pros | Cons |

|---|---|

| High Liquidity: MEXC boasts high liquidity, ensuring smooth trading experiences and minimal slippage. | Leverage Risks: While offering up to 200x leverage can amplify gains, it can also magnify losses. |

| Competitive Fees: With 0% maker fees and a mere 0.03% taker fee, MEXC offers one of the most competitive fee structures in the market. | Regional Restrictions: MEXC services are not available in certain countries or regions. |

| No KYC Requirement: Traders can withdraw up to 30 BTC per day without undergoing KYC verification. | |

| Frequent Promotions: Regular events and challenges can provide additional bonuses and incentives for traders. | |

| Mobile Trading: The MEXC mobile app allows users to manage their trades on-the-go. |

OKX Exchange

OKX is a leading global cryptocurrency exchange known for its vast range of crypto assets and advanced trading features. Established as a go-to platform for crypto enthusiasts, OKX offers spot trading, futures, and even a dedicated section for Web 3.0, catering to a diverse audience.

Pros and Cons of Shorting Crypto on OKX:

| Pros | Cons |

|---|---|

| High Liquidity: OKX boasts significant trading volumes, ensuring smooth trading experiences and minimal slippage. | KYC Requirements: OKX might require KYC verification for certain features and higher withdrawal limits. |

| Advanced Trading Tools: OKX offers a variety of trading services, from spot trading to futures, catering to traders of all levels. | Regional Restrictions: OKX services are not available in certain regions, including the United States. |

| Educational Resources: OKX provides a plethora of tutorials, articles, and videos to help users navigate the crypto landscape. | Complex Interface: The platform’s myriad of features might be overwhelming for newcomers. |

| Secure and Safeguarded: OKX places a strong emphasis on security, ensuring the safety of user funds and data. | Customer Support: Some users have reported delays in response times from the customer support team. |

Strategies for Shorting Crypto

Shorting crypto involves predicting that the price of a cryptocurrency will fall. There are several strategies that traders can use to make these predictions and profit from shorting crypto. Here’s a closer look at some of these strategies.

Trend Following

Trend following is a strategy that involves identifying and following the existing trend of a cryptocurrency’s price. If the price is trending downwards, a trader might decide to short the cryptocurrency with the expectation that the price will continue to fall. This strategy requires careful analysis of price charts and may also involve the use of technical indicators to confirm the trend.

Mean Reversion

Mean reversion is based on the assumption that the price of a cryptocurrency will revert to its average or mean price over time. If the price of a cryptocurrency is significantly higher than its mean price, a trader using the mean reversion strategy might decide to short the cryptocurrency with the expectation that the price will fall back to the mean.

News Trading

News trading involves making trading decisions based on news events that are expected to affect the price of a cryptocurrency. For example, if negative news about a cryptocurrency is released, a trader might decide to short the cryptocurrency with the expectation that the news will cause the price to fall.

Swing Trading

Swing trading is a strategy that involves taking advantage of price swings or fluctuations. A trader using the swing trading strategy might decide to short a cryptocurrency when the price is at the peak of a swing, with the expectation that the price will fall.

Choosing the Right Strategy Based on Market Conditions

The right strategy for shorting crypto depends on the market conditions and the trader’s risk tolerance and trading style. For example, in a bear market where prices are generally falling, trend following might be a good strategy. On the other hand, in a volatile market with large price swings, swing trading might be more suitable.

It’s important to note that all trading strategies involve risks and there is no guarantee of profit. Traders should use risk management techniques, such as setting stop losses and only risking a small portion of their trading capital on each trade, to protect themselves from large losses. It’s also recommended to backtest a strategy using historical price data before using it in live trading.

Risks and Rewards of Shorting Crypto

Shorting crypto, like any investment strategy, comes with its own set of potential rewards and risks. Understanding these can help traders make informed decisions and manage their risk effectively.

Potential Rewards of Shorting Crypto

Profit from Falling Prices

The primary reward from shorting crypto is the potential to make a profit when the price of a cryptocurrency falls. If a trader’s prediction is correct and the price of the cryptocurrency they shorted drops, they can buy it back at a lower price and make a profit from the price difference.

Portfolio Diversification

Shorting can also be used as a way to diversify a trading portfolio. By taking both long and short positions, traders can potentially make profits in both rising and falling markets.

Hedging

Shorting can be used as a hedging strategy. If a trader has a long position in a cryptocurrency but believes its price may fall in the short term, they can open a short position as a hedge. If the price does fall, the profit from the short position can offset the loss from the long position.

Risks Involved in Shorting Crypto

Potential for Unlimited Losses

When you buy a cryptocurrency (or any asset), your potential loss is limited to the amount you invested. However, when you short, your potential loss is theoretically unlimited. If the price of the cryptocurrency rises instead of falls, you could lose more than your initial investment.

Margin Calls and Liquidation

Shorting crypto typically involves borrowing funds and trading on margin. If the price of the cryptocurrency moves against your position, you may face a margin call, requiring you to add more funds to your account. If you can’t meet the margin call, your position may be liquidated at a loss.

Short Squeeze

A short squeeze occurs when the price of a cryptocurrency rises sharply, forcing short sellers to buy the cryptocurrency to cover their positions and prevent further losses. This buying can drive the price up even further, potentially leading to significant losses for short sellers.

Borrowing Costs

When you short a cryptocurrency, you’re borrowing it from a lender who may charge interest. These borrowing costs can eat into your potential profits or add to your losses.

Regulatory Risks

Some jurisdictions have regulations that restrict short selling. It’s important to be aware of the regulations in your jurisdiction before you start shorting crypto.

Given these potential rewards and risks, it’s crucial for traders to have a risk management strategy in place when shorting crypto. This might include setting stop losses to limit potential losses, diversifying their trading portfolio, and keeping up to date with market news and regulations.

Real-world Examples of Shorting Crypto

Shorting crypto, while risky, has been a profitable strategy for some traders. Here are a few real-world examples of shorting crypto:

- The Bitcoin Short of 2017: In December 2017, Bitcoin reached its all-time high of nearly $20,000. Some traders, however, believed that this price was unsustainable and decided to short the cryptocurrency. They were correct. By the end of 2018, Bitcoin’s price had fallen to around $3,000, resulting in significant profits for those who had shorted it.

- The Bitcoin Short of 2021: In April 2021, Bitcoin reached a ATH of over $64,000. However, some traders believed that this price level was unsustainable and decided to short the cryptocurrency. They were proven right when by May 2021, Bitcoin’s price had fallen to around $30,000, resulting in significant profits for those who had shorted it.

- Again, in November 2021, Bitcoin reached another high of $67,000. Traders who anticipated a price correction and shorted Bitcoin at this point would have seen substantial profits when by January 2022, Bitcoin’s price had dropped to around $34,000.

- The same pattern was observed with Ethereum. Traders who shorted Ethereum when it was at its peak would have made significant profits when the price fell. These examples illustrate the potential profitability of shorting in the crypto market, but also underscore the risk and timing involved in such strategies.

Please note that these examples are provided for informational purposes only and do not constitute financial advice. Shorting crypto is a high-risk strategy that can result in significant losses. Always do your own research and consider seeking advice from a financial advisor before engaging in short selling.

Lessons Learned from These Case Studies

The key lessons from these case studies include the importance of understanding the market, having a clear trading plan, managing risks effectively, and being prepared for unexpected market movements.

Conclusion

Shorting crypto can be a powerful strategy for profiting from price drops in the volatile crypto market. However, it also involves significant risks and requires a deep understanding of the market dynamics and trading mechanisms.

The ability to profit from falling prices is a unique advantage of shorting. It provides opportunities for profit in bear markets and during periods of high volatility. Moreover, shorting can be used as a hedging strategy to protect other investments in a trader’s portfolio.

However, the risks involved in shorting should not be underestimated. These include the potential for unlimited losses, margin calls, and the risk of a short squeeze. Additionally, the costs of borrowing assets to short can eat into potential profits.

Choosing the right platform for shorting is crucial. Platforms vary in terms of their security measures, fees, user-friendliness, and the range of available cryptocurrencies. Some of the top platforms for shorting crypto include Binance, Kraken, Bitfinex, and MXC.

There are various strategies for shorting crypto, including trend following, mean reversion, and news trading. The choice of strategy should be based on the trader’s risk tolerance, trading style, and the prevailing market conditions.

Real-world examples of shorting crypto demonstrate both the potential for high returns and the risks involved. They underscore the importance of careful analysis, risk management, and timing in shorting.

In conclusion, shorting crypto is not for everyone. It’s a high-risk strategy that requires knowledge, experience, and a well-thought-out risk management plan. As with any investment strategy, it’s important to do your own research, understand the risks involved, and consider seeking advice from a financial advisor before shorting crypto.

FAQs

What is shorting crypto?

Shorting crypto is a trading strategy where a trader borrows a certain amount of crypto, sells it at the current market price, and then buys it back at a lower price to make a profit.

Can you short Bitcoin?

Can you short crypto?

Yes, you can short crypto if you find an exchange or market that allows shorting of the specific coin. Always check the leverage ratio and other terms before proceeding.

How to short Ethereum?

To short Ethereum, you would need to use a cryptocurrency exchange that offers Ethereum futures or margin trading. You would borrow Ethereum, sell it at the current price, and then buy it back later at a lower price to make a profit.

Where can you short crypto?

What is a short position in crypto?

A short position in crypto is when a trader borrows a cryptocurrency and sells it with the expectation that its price will fall. The trader aims to buy it back at a lower price, return the borrowed amount, and pocket the difference as profit.