In the ever-evolving landscape of cryptocurrencies, one term that has been making waves is “Tether Printing”. This phenomenon, while complex, plays a pivotal role in the crypto market dynamics. This article aims to demystify Tether Printing, shedding light on its impact, controversies, and what the future holds.

Understanding Tether Printing

What is Tether Printing?

Tether Printing is a term that has been coined by the cryptocurrency community to describe the process by which Tether Ltd., the organization behind the USDT (Tether) cryptocurrency, creates or ‘prints’ new tokens. This process is somewhat analogous to how a central bank prints new money, hence the term “Tether Printing”.

Tether (USDT) is a type of cryptocurrency known as a ‘stablecoin’. The value of Tether is designed to be directly pegged to the value of the US dollar, with Tether Ltd. claiming that for every unit of Tether in circulation, there is an equivalent amount of USD held in reserve. This is intended to provide stability in the often volatile cryptocurrency markets.

When Tether Ltd. decides to print more Tether, they are essentially creating more USDT tokens that can be bought and sold on the crypto market. The decision to print more Tether is usually based on demand from investors and the overall health of the crypto market.

How Tether Printing Works

The process of Tether Printing begins when Tether Ltd. decides that more USDT tokens need to be introduced into the market. This decision is typically based on a variety of factors, including the demand for Tether, the overall health of the crypto market, and the company’s strategy.

Once the decision has been made, Tether Ltd. creates new USDT tokens. These tokens are then released into the market, where they can be bought and sold just like any other cryptocurrency. The newly printed Tether increases the overall supply of USDT in circulation.

The Impact of Tether Printing

Impact on Tether’s Value

In theory, the process of Tether Printing should not directly affect the value of individual Tether tokens. This is because Tether is a stablecoin, designed to maintain a 1:1 peg with the US dollar. For every Tether token (USDT) in circulation, Tether Ltd. claims to hold an equivalent amount of USD in reserve. Therefore, even when more Tether is printed, the value of each token should remain stable at around one dollar.

However, the crypto market is influenced by a multitude of factors, including investor sentiment and market speculation. Therefore, there can be instances where the value of Tether slightly deviates from its 1:1 peg with the dollar, especially during periods of high market volatility.

Impact on Other Cryptocurrencies

The process of Tether Printing can have a significant impact on other cryptocurrencies, particularly Bitcoin. This is because Tether is often used as a ‘bridge’ between fiat currencies (like the US dollar) and other cryptocurrencies.

When new Tether tokens are printed and enter the market, they increase the overall liquidity of the crypto market. This means that there are more funds available for investors to buy other cryptocurrencies. If a significant portion of the newly printed Tether is used to purchase Bitcoin, it can drive up the demand for Bitcoin, leading to an increase in its price.

This relationship between Tether Printing and Bitcoin’s price has been observed multiple times in the crypto market. For instance, some analysts have noted that periods of intensive Tether Printing have often coincided with bullish trends in the price of Bitcoin.

Impact on the Overall Crypto Market

Tether Printing can also influence the overall health and dynamics of the crypto market. As one of the most widely used stablecoins, Tether plays a crucial role in providing liquidity in the crypto market. By printing more Tether, Tether Ltd. can ensure that there are sufficient funds circulating in the market, which can help to stabilize prices and prevent market volatility.

However, the process of Tether Printing has also raised concerns about market manipulation. Critics argue that by controlling the supply of Tether, Tether Ltd. could potentially influence the prices of cryptocurrencies. These concerns have led to calls for greater transparency and regulation in the process of Tether Printing.

Controversies Surrounding Tether Printing

Overview of the Controversies

Tether Printing has been at the center of several controversies and debates within the cryptocurrency community. One of the primary concerns revolves around the question of whether Tether Ltd. holds sufficient reserves to back all the Tether it has printed.

As a stablecoin, Tether is supposed to be backed 1:1 by US dollars or equivalent assets. This means that for every Tether token in circulation, Tether Ltd. should have an equivalent amount of real-world assets in reserve. However, critics have questioned whether this is truly the case, especially during periods when large amounts of Tether are printed.

Detailed Analysis of Major Controversies

One of the most significant controversies occurred in 2019 when the New York Attorney General’s office accused Bitfinex, a cryptocurrency exchange closely linked with Tether Ltd., of covering up an $850 million loss with funds from Tether’s reserves. This raised serious questions about the transparency and integrity of Tether’s operations.

Another controversy revolves around the impact of Tether Printing on the prices of other cryptocurrencies. Some critics argue that Tether Printing is used to manipulate the prices of cryptocurrencies. They point to instances where large amounts of Tether were printed and the price of Bitcoin subsequently increased.

Response from Tether Ltd. and Other Stakeholders

In response to these controversies, Tether Ltd. has repeatedly asserted that all Tether tokens are fully backed by reserves. The company has also published several transparency updates and reserve attestations in an attempt to provide more transparency about its operations.

However, these efforts have not fully quelled the concerns of critics. Some argue that the company’s transparency efforts are insufficient and call for more rigorous audits and regulatory oversight.

Case Studies

Case Study 1: Tether Printing and Bitcoin’s 2017 Bull Run

One of the most notable case studies related to Tether Printing is its potential influence on Bitcoin’s historic bull run in 2017. During this period, Bitcoin’s price skyrocketed from around $1,000 at the beginning of the year to nearly $20,000 by December.

During the same period, there was a significant increase in the amount of Tether being printed. Some analysts have suggested that there was a correlation between these two events. They argue that the influx of new Tether provided liquidity that fueled the bull run, allowing more investors to buy Bitcoin and driving up its price.

However, it’s important to note that correlation does not imply causation. While there was a correlation between Tether Printing and the Bitcoin bull run, it’s not clear whether the printing of Tether directly caused the increase in Bitcoin’s price. The 2017 bull run was likely influenced by a multitude of factors, including increased public interest in cryptocurrencies, media hype, and broader market trends.

Case Study 2: Tether Printing and the 2020 Crypto Market Recovery

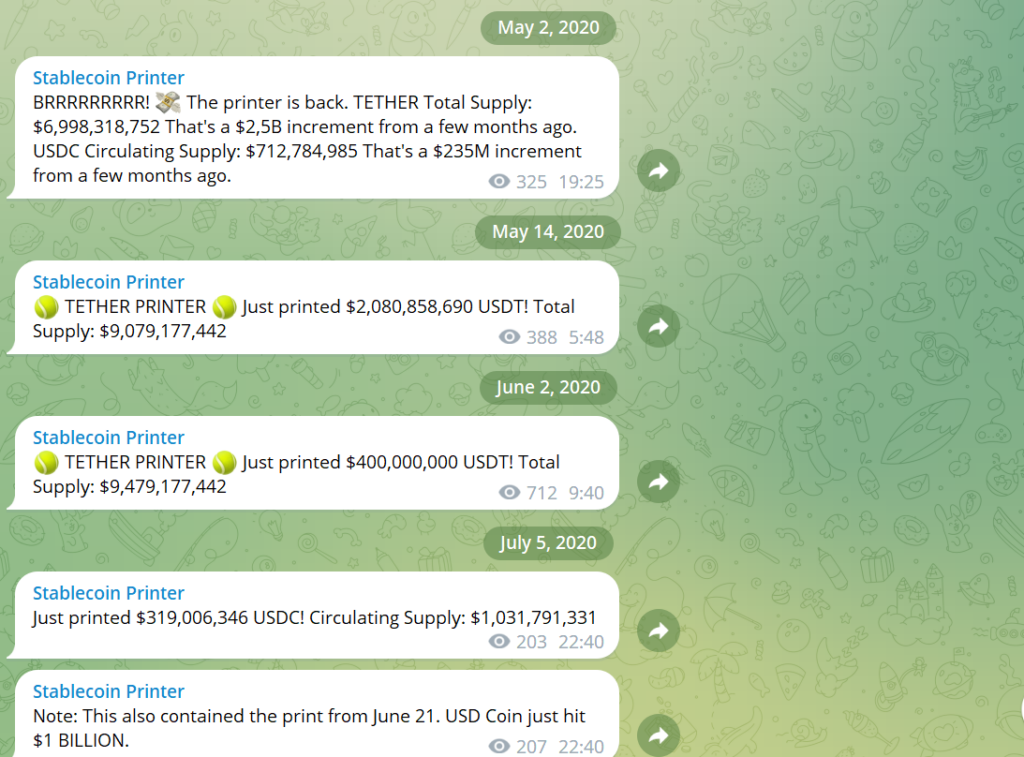

Another interesting case study is the role of Tether Printing in the recovery of the crypto market in 2020. In March 2020, the crypto market experienced a significant crash in response to the global economic uncertainty caused by the COVID-19 pandemic. However, the market quickly recovered and entered a new bull run.

During this period, there was a significant increase in the amount of Tether being printed.

Some analysts have suggested that this influx of new Tether helped to stabilize the market and fuel the recovery. By providing liquidity, the newly printed Tether may have made it easier for investors to buy cryptocurrencies, helping to drive up prices.

Again, it’s important to note that these are complex phenomena that are likely influenced by a multitude of factors. While Tether Printing may have played a role, it’s not the sole factor that determines market trends.

These case studies highlight the potential influence of Tether Printing on the crypto market. However, they also underscore the complexity of these phenomena and the need for further research and analysis.

Tether Printers Monitors

Here are some resources where you can check the Tether printer stats:

| Platform | Channel Name | Link |

|---|---|---|

| Stablecoin Printer | Link | |

| Telegram | Same but on Telegram | Link |

| Telegram | EtherDrops Tracking Bot | Link |

Expert Opinions

Crypto Experts on Tether Printing

Crypto experts have diverse views on Tether Printing, reflecting the complexity of this issue. Some see it as a necessary mechanism for providing liquidity in the crypto market, while others express concerns about its potential to influence the prices of cryptocurrencies.

- Hilary Allen, a finance expert at American University, has stated that “Tether is really the lifeblood of the crypto ecosystem.” This underscores the crucial role that Tether, and by extension Tether Printing, plays in the functioning of the crypto market.

Financial Analysts on Tether Printing

Financial analysts, particularly those with a focus on cryptocurrencies, have also shared their views on Tether Printing. They often discuss the impact of Tether Printing on the stability of the crypto market and the prices of cryptocurrencies.

- An article from BeInCrypto compared the amount of money printed by Tether Ltd. and the US Federal Reserve in March 2023, highlighting the growing influence of stablecoins like Tether in the crypto market.

Legal Experts on Tether Printing

Legal experts, especially those specializing in financial regulations and cryptocurrencies, have also expressed their opinions on Tether Printing. They often focus on the need for greater transparency and regulatory oversight.

- A report from Cointelegraph highlighted that no Ethereum-based Tethers have ever been burned, even though new ones are constantly being printed. This raises questions about the transparency of Tether’s operations and the need for more robust regulatory oversight.

These expert articles and opinions highlight the diverse views on Tether Printing. While it’s seen as a crucial part of the crypto market, there are valid concerns about transparency, potential market manipulation, and the need for better regulations.

Future of Tether Printing

Predictions for Future Tether Printing Events

Predicting the future of Tether Printing is a complex task, as it depends on a multitude of factors, including the demand for Tether, the overall health of the crypto market, and the strategies of Tether Ltd.

However, as long as Tether continues to be a dominant stablecoin in the crypto market, it’s likely that Tether Printing will continue. The frequency and volume of Tether Printing may vary based on market conditions. For instance, during periods of high demand for cryptocurrencies, we might see an increase in Tether Printing to provide the necessary liquidity.

Potential Impact on the Crypto Market

The future of Tether Printing could have significant implications for the crypto market. If Tether continues to print more tokens, it could provide the liquidity needed for the market to grow. However, if the controversies surrounding Tether Printing are not addressed, it could lead to increased scrutiny and potentially stricter regulations, which could impact the crypto market.

Possible Regulatory Changes and Their Implications

The future of Tether Printing could also be influenced by changes in regulatory frameworks. As cryptocurrencies become more mainstream, regulators around the world are paying closer attention to the crypto market, including practices like Tether Printing.

If regulators decide to impose stricter rules on Tether Printing, it could lead to greater transparency and potentially reduce the risks associated with this practice. However, stricter regulations could also limit the flexibility of Tether Ltd. to print new tokens, which could impact the liquidity in the crypto market.

Conclusion

Tether Printing is a complex and controversial aspect of the cryptocurrency market. As we’ve explored in this article, it plays a crucial role in providing liquidity and can significantly influence the prices of cryptocurrencies, particularly Bitcoin. However, the process has also been the subject of numerous controversies, with critics raising concerns about transparency, potential market manipulation, and the need for better regulations.

The future of Tether Printing is uncertain and will likely be influenced by a combination of market dynamics, regulatory changes, and the strategies of Tether Ltd. As such, it’s an area that warrants close attention for anyone involved in the crypto market.

While Tether Printing is a unique aspect of the crypto market, the debates surrounding it reflect broader issues in the world of cryptocurrencies. These include the need for greater transparency, the potential for market manipulation, and the role of regulation. As the crypto market continues to evolve, these issues will likely continue to be at the forefront of discussions.

In conclusion, Tether Printing is a fascinating topic that offers a window into the workings of the crypto market. By understanding this process, we can gain deeper insights into the dynamics of the crypto market and the factors that influence the prices of cryptocurrencies. As the crypto market continues to grow and evolve, the role of Tether Printing and the debates surrounding it will undoubtedly continue to be of great interest.

FAQs

What is Tether Printing?

Tether Printing refers to the process by which Tether Ltd., the company behind the USDT cryptocurrency, creates new tokens. This process is similar to how a central bank prints money, hence the term “Tether Printing”. Tether is a stablecoin, which means its value is pegged to a stable asset, in this case, the US dollar. Tether Ltd. claims to hold an equivalent amount of USD in reserve for every unit of Tether in circulation.

How does Tether Printing impact the crypto market?

Tether Printing can have a significant impact on the crypto market. It provides liquidity, which means there are more funds available for investors to buy and sell cryptocurrencies. This can help stabilize prices and prevent market volatility. However, Tether Printing can also influence the prices of other cryptocurrencies, particularly Bitcoin. An influx of new USDT tokens often leads to an increase in Bitcoin’s price.