In the dynamic world of cryptocurrency, one term stands out as a beacon for both novice and experienced investors alike: DYOR, or “Do Your Own Research”. This article will guide you through the importance of DYOR in the crypto space, and provide a comprehensive roadmap to conducting your own research effectively.

Table of Contents

What is DYOR?

DYOR is an acronym that stands for “Do Your Own Research”. It’s a phrase that’s become a cornerstone in the world of investing, particularly within the realm of cryptocurrency. The term is a reminder that each investor is ultimately responsible for their own investment decisions, and that these decisions should be based on thorough, independent research.

In the context of cryptocurrency, DYOR involves a deep dive into the specifics of a particular digital asset before making an investment decision. This includes understanding the technology behind the coin or token, the problem it’s trying to solve, the team behind the project, the coin’s supply and demand dynamics, and its market position among other factors.

Doing your own research is a way of ensuring that you’re not just following the crowd or getting swept up in the hype of the latest trend. It’s about making informed decisions based on facts and analysis, rather than relying on rumors or speculation.

The importance of DYOR in cryptocurrency investing cannot be overstated. The crypto market is known for its volatility, with prices that can skyrocket or plummet in a matter of hours. Furthermore, the market is relatively new and unregulated compared to traditional financial markets, making it a prime target for scams and fraudulent schemes.

By doing your own research, you can gain a better understanding of the risks involved and make investment decisions that align with your financial goals and risk tolerance. Whether you’re a seasoned investor or a beginner in the crypto space, DYOR is a crucial step in your investment journey.

Why is DYOR Important in Crypto Investing?

The importance of DYOR in crypto investing cannot be overstated. The cryptocurrency market is a rapidly evolving space, characterized by high volatility, technological complexity, and regulatory uncertainty. These factors make it a potentially high-reward but also high-risk investment environment. Here’s why DYOR is crucial in crypto investing:

Understanding the Volatility

Cryptocurrency prices can fluctuate wildly in a short period. Without a solid understanding of the market dynamics and the factors influencing these price changes, investors can easily get caught in the hype during a price surge or panic sell during a dip. DYOR helps investors understand these dynamics, make informed decisions, and potentially mitigate losses during market downturns.

Avoiding Scams and Fraud

The crypto market, due to its relative novelty and lack of regulation, has been a fertile ground for scams and fraudulent schemes. From Ponzi schemes to exit scams, investors have lost millions of dollars. By doing thorough research, investors can identify red flags and avoid falling victim to these scams.

Understanding the Technology

Cryptocurrencies are more than just digital assets; they are underpinned by complex technologies like blockchain and cryptography. Understanding these technologies is crucial to evaluate the potential and viability of a cryptocurrency. DYOR helps investors understand the technology behind a crypto asset, its use cases, and its potential for future growth.

Making Informed Investment Decisions

Investing in cryptocurrencies is not just about buying low and selling high. It’s about understanding the asset’s long-term potential and how it fits into an overall investment strategy. DYOR allows investors to evaluate a cryptocurrency on its merits, understand its risks, and make investment decisions that align with their financial goals and risk tolerance.

As you see, DYOR is not just a buzzword in the crypto community. It’s a crucial practice that can make the difference between a successful investment and a costly mistake. It empowers investors to take control of their investment decisions and navigate the complex and volatile world of crypto investing with confidence and knowledge.

Steps to DYOR in Crypto

Doing your own research in the crypto space can seem daunting given the complexity and volatility of the market. However, breaking it down into manageable steps can make the process more approachable. Here are the key steps to DYOR in crypto:

Understanding the Basics of Cryptocurrency

Before you can effectively research individual cryptocurrencies, it’s important to understand the basics of what cryptocurrency is and how it works. This includes understanding the concept of blockchain technology, which underpins most cryptocurrencies, as well as key terms and concepts such as decentralization, smart contracts, and consensus mechanisms.

Researching the Crypto Asset

Once you have a solid understanding of the basics, the next step is to research the specific crypto asset you’re interested in. This involves several sub-steps:

- Reading the Whitepaper: The whitepaper is a document that outlines the purpose and mechanics of the cryptocurrency. It’s a great starting point for understanding what the crypto asset is designed to do and how it works.

- Understanding the Use Case: What problem is the cryptocurrency trying to solve? How does it plan to solve it? A cryptocurrency with a clear, compelling use case is more likely to succeed in the long term.

- Evaluating the Team: Who are the people behind the cryptocurrency? What is their track record? A strong, experienced team can increase the chances of a cryptocurrency’s success.

- Understanding the Tokenomics: Tokenomics refers to the economic framework of a cryptocurrency. It includes aspects like the total supply of tokens, the emission rate (how new tokens are created), the distribution plan, and any token burn or staking mechanisms. Understanding the tokenomics can give you insights into the potential future value of the cryptocurrency.

Analyzing Market Trends

Understanding the market trends can give you insights into the potential future performance of the cryptocurrency. This involves looking at price charts, trading volumes, and other market indicators. It’s also important to understand the concept of crypto market cycles, as the crypto market tends to move in cycles of booms and busts.

Evaluating Community and Social Media Presence

The strength and activity level of a cryptocurrency’s community can be a good indicator of its health and potential for growth. You can evaluate this by looking at the cryptocurrency’s social media channels, forums, and other community platforms.

Understanding Regulatory and Legal Considerations

The regulatory environment can have a significant impact on a cryptocurrency’s potential. It’s important to understand the legal considerations of investing in a particular cryptocurrency, including any potential regulatory risks.

By following these steps, you can conduct thorough research and make informed decisions about your crypto investments. Remember, the goal of DYOR is not to predict the future with certainty, but to understand the potential risks and rewards of a crypto investment and make decisions that align with your financial goals and risk tolerance.

Common Mistakes to Avoid When Doing Your Own Research

While doing your own research is essential when investing in cryptocurrencies, there are several common mistakes that investors often make during this process. Being aware of these pitfalls can help you avoid them and make more informed decisions.

Relying Solely on Price and Market Cap

While price and market cap are important indicators, they should not be the only factors in your decision-making process. A high price or large market cap does not necessarily mean a cryptocurrency is a good investment. It’s important to look at other factors such as the technology behind the coin, the team, the use case, and the coin’s potential for future growth.

Ignoring the Whitepaper

The whitepaper is a crucial document that provides detailed information about a cryptocurrency. Ignoring the whitepaper can lead to a lack of understanding about the coin’s purpose, technology, and potential. Always take the time to read and understand the whitepaper of any cryptocurrency you’re considering investing in.

Following the Crowd

In the world of crypto investing, it can be tempting to follow the crowd and invest in whatever coin is currently trending. However, this can often lead to buying high and selling low. Instead, do your own research and make investment decisions based on your own analysis, not on what everyone else is doing.

Not Considering the Risks

Investing in cryptocurrencies can be risky, and it’s important to consider these risks before making an investment. This includes understanding the volatility of the market, the potential for scams, and the regulatory risks. Always consider your own risk tolerance and never invest more than you can afford to lose.

Neglecting Ongoing Research

Doing your own research is not a one-time task. The crypto market is constantly changing, and it’s important to stay updated on the latest news and developments. Regularly review your investments and stay informed about changes in the market.

By avoiding these common mistakes, you can improve the quality of your research and make more informed investment decisions. Remember, the goal of DYOR is to understand the potential risks and rewards of a crypto investment and make decisions that align with your financial goals and risk tolerance.

Tools and Resources for DYOR in Crypto

When conducting your own research in the crypto space, it’s important to have the right tools and resources at your disposal. Here are some of the most useful ones:

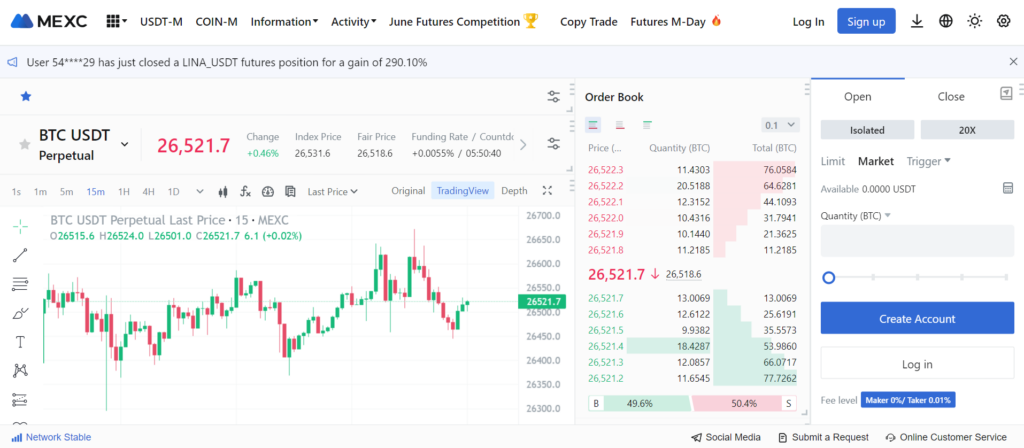

Cryptocurrency Exchanges

Cryptocurrency exchanges like Binance, Coinbase, and Mexc provide a wealth of information about different cryptocurrencies, including their price history, trading volume, and market cap. They also often have news sections where you can stay updated on the latest developments.

Coin Market Cap and CoinGecko

Coinmarketcap and Coingecko provide comprehensive data on thousands of cryptocurrencies. You can find information about a coin’s price, market cap, trading volume, circulating supply, and more. They also provide links to a coin’s official website and social media channels, where you can find more detailed information.

Crypto News Sites

Staying updated on the latest news is crucial when investing in cryptocurrencies. Websites like CoinDesk, Cointelegraph, and CryptoSlate provide news articles, analysis, and market updates.

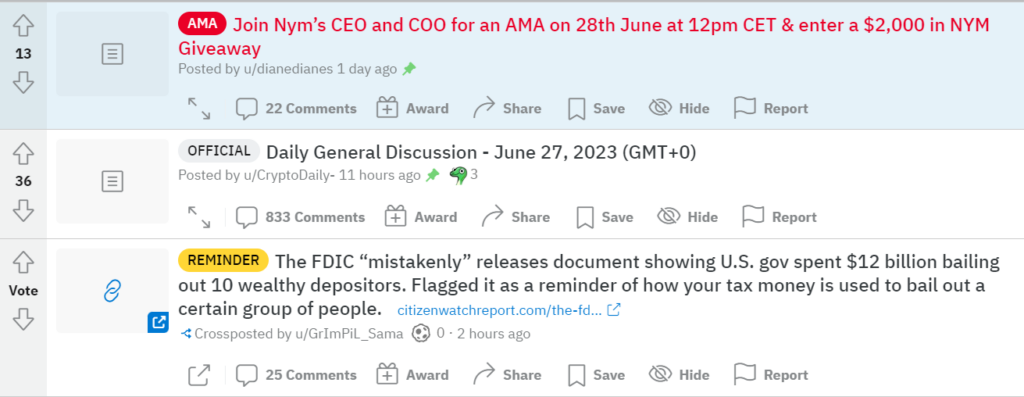

Crypto Forums and Social Media

Communities like Reddit’s r/CryptoCurrency, Bitcointalk, and Twitter are great places to get insights from other investors and stay updated on the latest trends. However, always remember to take information from these sources with a grain of salt and verify it with your own research.

Whitepapers

A coin’s whitepaper is one of the most important resources for understanding its technology, use case, and potential. Always make sure to read and understand the whitepaper of any coin you’re considering investing in.

Blockchain Explorers

Blockchain explorers like Etherscan for Ethereum-based tokens allow you to view transaction data on the blockchain. This can be useful for verifying a coin’s circulating supply and transaction volume.

By using these tools and resources, you can gather a wealth of information about a cryptocurrency and conduct thorough research. However, always remember to critically analyze the information you find and make decisions based on your own understanding and judgment.

Case Studies of Successful DYOR

Successful DYOR can lead to profitable investment decisions. Here are a couple of case studies that illustrate the power of thorough research in the crypto space:

Case Study 1: Early Bitcoin Investors

One of the most famous examples of successful DYOR is the early investors in Bitcoin. These individuals recognized the potential of Bitcoin’s revolutionary blockchain technology and decentralized nature at a time when it was largely unknown and unproven. They read the Bitcoin whitepaper, understood its use case, and believed in its potential to disrupt traditional financial systems. Their research and belief in the technology paid off handsomely as Bitcoin’s value skyrocketed in the following years.

Case Study 2: Ethereum Investors

Ethereum is another example where DYOR paid off. Early investors recognized the potential of Ethereum’s smart contract functionality, which allows for the creation of decentralized applications (dApps) on its platform. They understood that this feature set Ethereum apart from Bitcoin and other cryptocurrencies and had the potential to drive widespread adoption. Their research and understanding of Ethereum’s unique features led them to invest early, resulting in significant returns as Ethereum grew to become one of the largest cryptocurrencies by market cap.

Case Study 3: Kaspa Investors

Kaspa is another example of successful DYOR leading to significant returns. Kaspa is an open-source, decentralized, and fully scalable Layer-1 platform that utilizes the world’s first blockDAG, a digital ledger enabling parallel blocks and instant transaction confirmation. It was built by industry pioneers and is maintained by the Kaspa community.

Investors who conducted thorough research into Kaspa’s technology, use case, and team saw the potential of this innovative platform. They understood that Kaspa’s blockDAG network, which generates multiple blocks every second for posting transactions to the ledger, combined with fully confirmed transactions in 10 seconds, made Kaspa ideal for everyday transactions. They also recognized the potential of Kaspa’s efficient proof-of-work consensus mechanism and its security features.

These investors also took note of Kaspa’s fair launch, with no pre-mining or any other pre-allocation of coins, which aligns with the ethos of coins like Bitcoin, Litecoin, or Monero. This indicated a commitment to decentralization and fairness, which further increased their confidence in the project.

These case studies highlight the importance of DYOR in identifying promising cryptocurrencies before they become widely recognized. They also underscore the need to understand the technology and use case of a cryptocurrency, rather than basing investment decisions solely on price trends or market hype. Remember, successful DYOR involves thorough research, critical analysis, and a long-term perspective on the potential of a cryptocurrency.

Conclusion

Investing in the world of cryptocurrencies can be a thrilling yet complex journey. The volatility of the market, the technological intricacies of different cryptocurrencies, and the potential for high returns make it a unique investment landscape. However, the key to navigating this landscape successfully lies in the principle of DYOR – Do Your Own Research.

Through the course of this article, we’ve explored what DYOR means, why it’s crucial in crypto investing, and how to effectively conduct it. We’ve also highlighted common mistakes to avoid during the research process and provided a list of tools and resources that can aid your research. Furthermore, we’ve shared case studies of successful DYOR, including early investors in Bitcoin, Ethereum, and Kaspa, who reaped significant returns through their diligent research.

However, it’s important to remember that DYOR is not a one-time task, but an ongoing process. The crypto market is dynamic and constantly evolving, and staying informed about the latest developments is crucial. Regularly review your investments, stay updated on market trends, and continue to learn and grow as an investor.

Finally, while DYOR is an essential practice, it’s also important to consult with a financial advisor or conduct further research before making any investment decisions. Remember, the goal of DYOR is to understand the potential risks and rewards of a crypto investment and make decisions that align with your financial goals and risk tolerance.

In conclusion, DYOR is more than just a buzzword in the crypto community. It’s a critical practice that can make the difference between a successful investment and a costly mistake. It empowers investors to take control of their investment decisions and navigate the complex and volatile world of crypto investing with confidence and knowledge. Always remember, the key to successful investing in the crypto market is to always Do Your Own Research!

FAQs

What does DYOR mean in crypto?

DYOR stands for “Do Your Own Research”. In the context of cryptocurrency, it means conducting thorough and independent research before making investment decisions. This includes understanding the technology behind a cryptocurrency, its use case, the team behind it, market trends, and regulatory considerations.

Why is DYOR important in crypto investing?

DYOR is crucial in crypto investing due to the volatility and complexity of the market. It helps investors understand the risks and potential rewards of a cryptocurrency, make informed decisions, and avoid scams and poor investments. Without proper research, investors risk losing their capital in the volatile crypto market.

What are some common mistakes to avoid when doing your own research?

Common mistakes to avoid when doing your own research include relying solely on price and market cap, ignoring the whitepaper, following the crowd, not considering the risks, and neglecting ongoing research. It’s important to look at a variety of factors, critically analyze the information you find, and stay updated on the latest developments.

Can you provide examples of successful DYOR in crypto?

Yes, some examples of successful DYOR include early investors in Bitcoin, Ethereum, and Kaspa. These investors conducted thorough research into the technology, use case, and potential of these cryptocurrencies, and their investments resulted in significant returns.

Remember, the goal of DYOR is not to predict the future with certainty, but to understand the potential risks and rewards of a crypto investment and make decisions that align with your financial goals and risk tolerance. Always do your own research before making any investment decisions.