In the dynamic realm of cryptocurrency, staying updated with your investments is paramount. Enter the world of crypto portfolio tracking. This invaluable tool offers investors a bird’s-eye view of their assets, ensuring they remain at the forefront of the crypto revolution. But with a plethora of tools available, which ones truly stand out in 2025?

Table of Contents

Why Track Your Crypto Portfolio?

The world of cryptocurrency is characterized by its rapid pace and volatility. As digital currencies continue to gain traction and become integral to modern financial systems, the need for effective crypto portfolio tracking and oversight of one’s crypto assets becomes paramount. Here’s a comprehensive look at why tracking your crypto portfolio is essential:

Real-time Value Assessment

- Instantaneous Insight: Cryptocurrencies are known for their price fluctuations. Prices can soar or plummet within minutes. Tracking your portfolio gives you an instantaneous snapshot of its current value, ensuring you’re always informed.

- Strategic Planning: By understanding the real-time value of your investments, you can make timely decisions, whether it’s cashing in on a high-performing asset or mitigating losses on a declining one.

Performance Analysis

- Historical Data Review: Tracking tools often provide historical data, allowing you to review how your investments have performed over time. This retrospective look can offer insights into patterns and trends.

- Refining Investment Strategies: By gauging the success and failures of your past investment choices, you can refine your future strategies, ensuring a more informed and calculated approach.

Tax Implications

- Accurate Reporting: Many countries require citizens to report cryptocurrency transactions for tax purposes. A well-tracked portfolio simplifies this process, providing accurate records of all transactions.

- Avoiding Legal Repercussions: Failing to report or inaccurately reporting crypto transactions can lead to legal consequences. Regular tracking ensures you’re always compliant with tax regulations.

Informed Decision Making

- Data-Driven Choices: In the world of investment, decisions driven by emotions can lead to significant losses. A tracked portfolio provides data-driven insights, ensuring your choices are based on facts and figures rather than gut feelings.

- Risk Management: By keeping a close eye on your portfolio, you can quickly identify assets that are underperforming or exhibiting high volatility. This allows for timely interventions, such as diversifying investments to spread risk.

Holistic Financial Overview

- Complete Financial Picture: For those who diversify their investments across various assets – stocks, bonds, real estate, and crypto – tracking provides a holistic view of one’s financial health.

- Integration with Broader Financial Goals: Tracking allows investors to see how their crypto investments fit into their broader financial goals, be it buying a home, retirement planning, or funding higher education.

Key Features to Look for in a Crypto Portfolio Tracking

Choosing the right crypto portfolio tracker is crucial for effectively managing and overseeing your digital assets. Here’s what to prioritize:

Multi-Platform Support

- Seamless Accessibility: In today’s digital age, investors operate across various devices – desktops, smartphones, tablets, and even smartwatches. A tracker that offers multi-platform support ensures you can access your portfolio anytime, anywhere.

- Synchronized Data: Multi-platform support should also ensure that data is synchronized across devices. Any change or update made on one device should reflect instantly on others, ensuring consistent and up-to-date information.

Wide Range of Supported Cryptocurrencies

- Diverse Portfolio Management: With thousands of cryptocurrencies in the market, investors often diversify their portfolios across various coins and tokens. A tracker should support a wide range of cryptocurrencies, ensuring all your assets are under one roof.

- Support for New and Emerging Coins: The crypto landscape is ever-evolving. New coins and tokens emerge regularly. A good tracker should be proactive in adding support for these new assets.

Security Features

- Robust Encryption: Given the sensitive nature of financial data, the tracker should employ state-of-the-art encryption methods to protect user data from breaches and hacks.

- Two-Factor Authentication (2FA): An additional layer of security, 2FA requires users to provide two types of identification before accessing their portfolio, adding an extra layer of protection against unauthorized access.

- Cold Storage Integration: Some trackers allow integration with cold storage solutions (like hardware wallets), ensuring that even if the tracker is compromised, the assets remain safe.

User-Friendly Interface

- Intuitive Design: A tracker should be easy to navigate, even for those new to the world of crypto. Clear dashboards, simple graphics, and organized layouts enhance the user experience.

- Customization: Every investor is unique. A good tracker should allow users to customize their dashboard, set alerts, and choose display preferences tailored to their needs.

Advanced Analytics and Reporting

- In-depth Analysis: Beyond just displaying the value of assets, a tracker should provide in-depth analytics, showcasing performance over time, historical data, and predictive insights.

- Tax Reporting: Given the tax implications associated with crypto transactions in many countries, some trackers offer tax reporting features, simplifying the process of calculating and reporting crypto-related taxes.

- Exportable Data: For those who wish to further analyze their data using external tools or share their portfolio details with financial advisors, the ability to export data in various formats (like CSV) is invaluable.

Real-time Price Updates

- Live Market Data: Cryptocurrency prices are highly volatile and can change rapidly. A tracker should provide real-time price updates, ensuring users always have the most current data at their fingertips.

- Multiple Exchange Integration: Prices can vary across different exchanges. A comprehensive tracker integrates data from multiple exchanges, offering a more holistic view of the market.

Alerts and Notifications

Stay Informed: Whether it’s a sudden price drop, a significant gain, or news about a particular cryptocurrency, a tracker should allow users to set up alerts and notifications, ensuring they’re always in the loop.

Top Crypto Portfolio Tracking Tools in 2025

All trackers below supports web and mobile platforms.

| Name | Features | Pros | Cons |

|---|---|---|---|

| Delta | – Supports thousands of cryptocurrencies – Real-time prices and market data – Detailed coin analysis – Sync data across multiple devices | – Comprehensive crypto support – Real-time data updates – Multi-device synchronization | – Might be overwhelming for beginners |

| CoinMarketCap | – Real-time price data from major exchanges – Sync data between desktop and mobile app – Track current portfolio balance and profit/loss | – Trusted name in the crypto industry – Real-time data updates – Data security prioritized | – Limited advanced analytics |

| CoinStats | – Real-time holdings tracking – Connect to 300+ wallets & exchanges – Customizable dashboard – Performance analysis tools | – Supports DeFi and NFTs – Wide range of wallet & exchange integrations – Customizable user interface | – Might have a learning curve for new users |

| CoinGecko | – Real-time price data for 10,000+ coins – Synced across web & mobile app – Create multiple portfolios – Performance tracking over time | – Supports a vast number of coins – Multi-platform synchronization – Daily portfolio updates | – Limited tax reporting features |

| CoinTracker | – Real-time price data – Synced portfolios across devices – Performance tracking over time – Tax loss harvesting for pro users | – Seamless integration with wallets & exchanges – Tax-loss harvesting opportunities – Regular data updates | – Free version is limited |

| 1inch Portfolio Tracker | – Multi-Wallet Support – DeFi Analytics – User Base Insight – Interface Efficiency – Wallet Integration (like Kaikas wallet) | – Comprehensive Tracking: Provides a complete view of a user’s crypto portfolio. – Ease of Use: Simplifies portfolio management by aggregating data from different sources. | Made for DeFi projects |

Delta

Overview

Delta is a comprehensive crypto portfolio tracking tool that offers a wide range of features for both beginners and advanced users. It provides a clear overview of your total portfolio balance, total profit/loss since you started investing or since the last 24 hours.

Key Features

- Supports thousands of cryptocurrencies.

- Real-time prices and market data.

- Detailed coin analysis.

- Sync data across multiple devices.

- Portfolio analytics and insights.

- Secure and private.

CoinMarketCap Portfolio Tracker

Overview

CoinMarketCap, a well-known name in the crypto industry, offers a free, secure, and private portfolio tracker. It provides real-time data updates and supports thousands of coins and tokens.

Key Features

- Real-time price data from major exchanges.

- Sync data between desktop and mobile app.

- Track current portfolio balance and profit/loss.

- Thousands of coins and tokens supported.

- Data security and privacy prioritized.

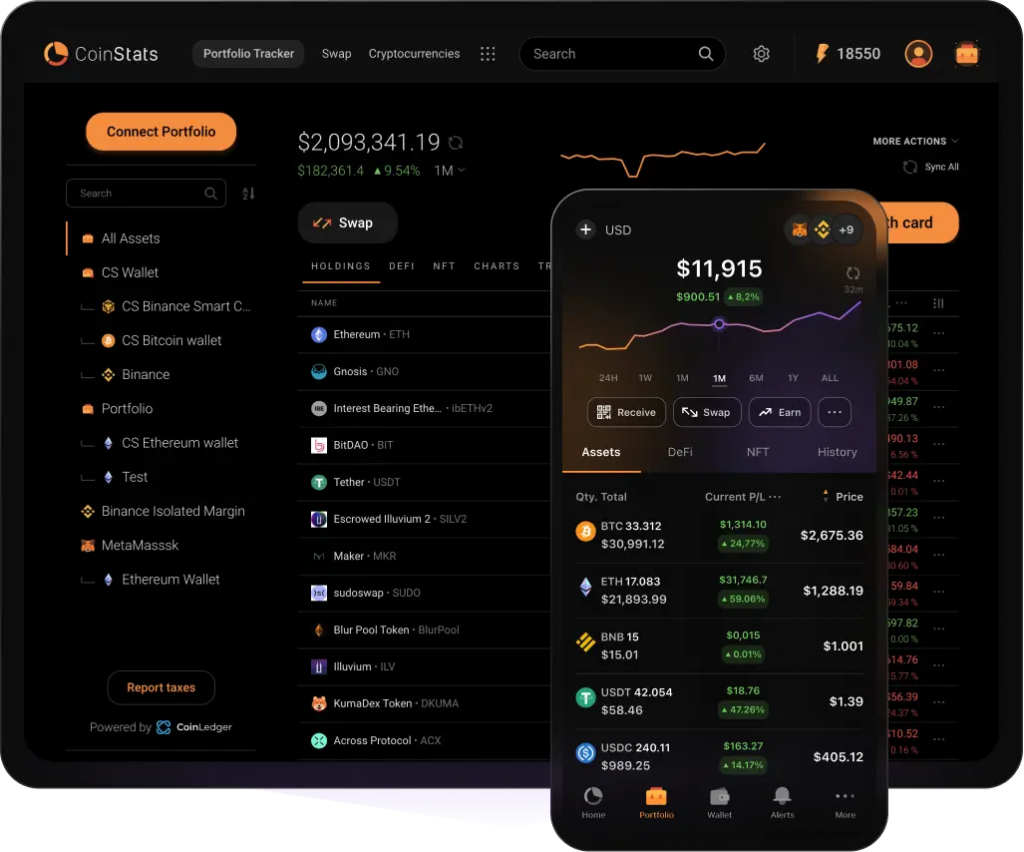

CoinStats

Overview

CoinStats offers a unified dashboard to manage your entire crypto portfolio, including DeFi and NFTs. It supports over 300 different wallets, exchanges, and blockchains.

Key Features

- Real-time holdings tracking.

- Connect to 300+ wallets & exchanges.

- Customizable dashboard.

- Performance analysis tools.

- Crypto tax reporting features.

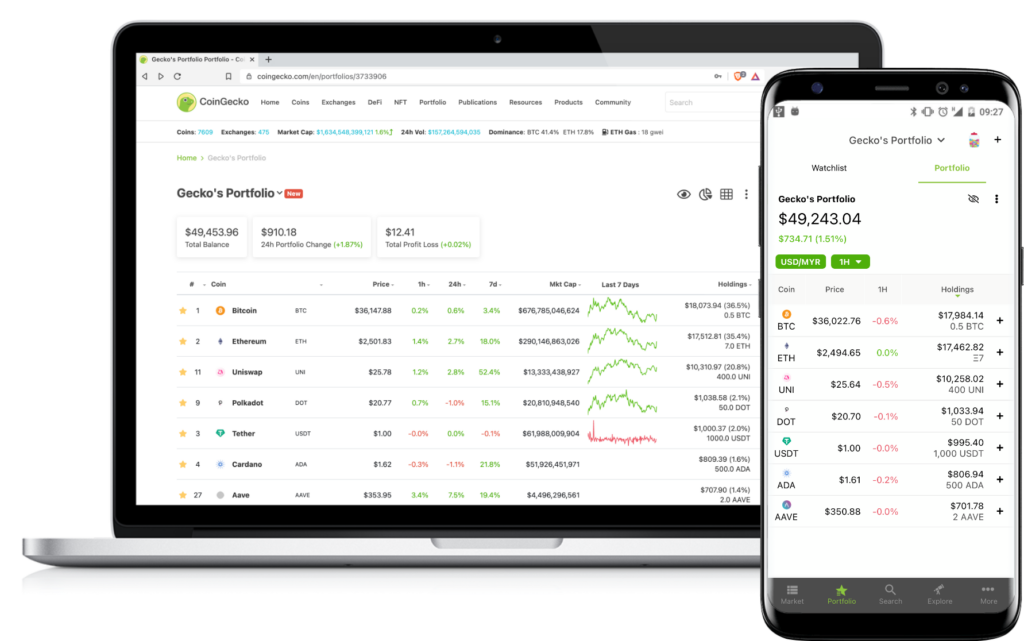

CoinGecko

Overview

CoinGecko is not just a price tracking website; it also offers a powerful crypto portfolio tracker. It provides real-time price data for over 10,000 coins and is synced across both web and mobile apps.

Key Features

- Real-time price data for 10,000+ coins.

- Synced across web & mobile app.

- Create multiple portfolios.

- Performance tracking over time.

- Daily portfolio updates.

CoinTracker

Overview

CoinTracker is a robust crypto portfolio manager that integrates seamlessly with various wallets and exchanges. It offers insights into your portfolio’s performance and provides tax-loss harvesting opportunities for pro users.

Key Features

- Real-time price data.

- Synced portfolios across devices.

- Performance tracking over time.

- Tax loss harvesting for pro users.

- Supports over ten thousand crypto assets.

1inch Portfolio Tracker

The tracker is based on the 1inch Portfolio API, allowing users to monitor both current portfolio data and detailed analytics on a single screen.

Key Features:

- Multi-Wallet Support: It supports multiple wallets, gathering data from various networks.

- DeFi Analytics: Offers advanced analytics in the decentralized finance (DeFi) sector.

- User Base Insight: Designed considering that most clients have between two to five wallets.

- Interface Efficiency: Enables monitoring of all crypto storages through a single interface.

- Wallet Integration: Includes support for Kaikas wallet, integrated in August 2023.

Tips for Effective Crypto Portfolio Tracking

Effective crypto portfolio management is crucial for maximizing returns and minimizing risks in the volatile world of digital currencies. Master the art of crypto investment with these expert tips:

Regularly Update and Review Your Portfolio

- Consistent Monitoring: The crypto market is known for its rapid fluctuations. Regularly reviewing your portfolio ensures you’re aware of any significant changes and can take timely action.

- Rebalancing: Over time, the value of individual assets within your portfolio can shift, causing some to become overrepresented while others become underrepresented. Periodically rebalancing your portfolio ensures that it aligns with your intended asset allocation and risk tolerance.

Diversify Your Investments

- Spread the Risk: Just as with traditional investments, it’s essential not to put all your eggs in one basket. Diversifying across various cryptocurrencies can help mitigate the risk associated with the potential underperformance of a single asset.

- Explore Different Sectors: The crypto space comprises various sectors, including decentralized finance (DeFi), non-fungible tokens (NFTs), and stablecoins. Diversifying across these sectors can offer additional layers of protection against market volatility.

Stay Informed on Market Trends

- Continuous Learning: The crypto landscape is continuously evolving. Staying updated with the latest news, technological advancements, and market trends can provide valuable insights for informed decision-making.

- Use Reliable Sources: Given the plethora of information available online, it’s crucial to rely on reputable and trusted sources for market insights and news.

Avoid Emotional Decision Making

- Stick to Your Strategy: Emotional reactions, such as panic selling during a market dip or buying impulsively during a surge, can lead to regrettable decisions. Having a clear investment strategy and sticking to it can help navigate market volatility.

- Long-Term Perspective: While short-term market movements can be tempting, it’s essential to have a long-term perspective. Consider your long-term financial goals and avoid making hasty decisions based on short-term market events.

Use Secure and Reliable Tracking Tools

- Safety First: Ensure that any tool or platform you use prioritizes security, offers features like two-factor authentication, and regularly updates to protect against potential threats.

- Regular Backups: Regularly back up your portfolio data to prevent potential losses from technical glitches or security breaches.

Understand the Tax Implications

- Stay Compliant: Many countries have specific tax regulations related to cryptocurrency transactions. Understanding these regulations and ensuring compliance can prevent potential legal issues.

- Document Transactions: Maintain detailed records of all your crypto transactions. This documentation will be invaluable for tax reporting and for tracking the performance of your investments.

Set Clear Investment Goals

- Define Your Objectives: Whether you’re investing for long-term growth, regular income, or hedging against traditional markets, having clear objectives can guide your investment decisions.

- Regularly Review Goals: As personal circumstances and market conditions change, it’s essential to review and, if necessary, adjust your investment goals.

Conclusion

The realm of cryptocurrency offers both exhilarating opportunities and intricate challenges. At the heart of navigating this dynamic world lies the essence of crypto portfolio tracking. As digital assets continue to reshape the contours of traditional finance, the significance of adeptly managing and tracking one’s crypto investments becomes paramount.

Crypto tracking isn’t just about monitoring asset values. It encompasses understanding the ebb and flow of market trends, diversifying investments wisely, making informed decisions based on real-time data, and continuously adapting to the ever-changing crypto landscape. The insights and best practices shared in this article aim to empower both newcomers and seasoned crypto enthusiasts, providing a compass to steer through the complexities of the digital currency world.

As the crypto sector matures, the tools and methodologies behind crypto portfolio tracking will undoubtedly evolve, becoming more refined and user-centric. Staying updated, harnessing the right tracking tools, and adhering to strategic best practices will be pivotal for successful crypto investment.

In summation, while the crypto universe is vast and ever-changing, effective portfolio tracking serves as an anchor, grounding investors and enabling them to navigate the tumultuous seas of digital finance with clarity and confidence.

FAQs

Why is crypto portfolio tracking crucial for investors?

It offers real-time insights, performance metrics, and aids in tax calculations.

How often should I review my crypto portfolio?

Ideally, review it weekly, but always after significant market events.