In the ever-evolving landscape of cryptocurrency, the term “crypto pump” has emerged as a buzzword. But what does it mean, and why is it crucial for traders to understand? Enter the crypto pump detector, a tool designed to spot and navigate these market manipulations. In this comprehensive guide, we’ll unravel the mysteries behind crypto pumps and the technology that detects them.

Table of Contents

What is a Crypto Pump?

A “crypto pump” refers to a sudden and often artificial increase in the price of a cryptocurrency. This spike is typically orchestrated by a coordinated group or influential individuals who buy large amounts of the coin to drive up demand and price. Once the price reaches a peak, these orchestrators sell off their holdings for a profit, causing the price to plummet. Unsuspecting investors who bought in during the rising phase often suffer losses during the subsequent “dump.” In essence, a crypto pump is a form of market manipulation that preys on less-informed crypto traders and the volatility of the cryptocurrency market.

The Mechanics Behind Crypto Pumps

Crypto pumps, often referred to as “pump and dump” schemes, are coordinated efforts to artificially inflate the price of a cryptocurrency for profit. Here’s a brief look into their mechanics:

1. Coordination

Typically, a group of individuals or a single entity organizes these pumps. They choose a low-volume cryptocurrency, ensuring that even small trades can significantly impact its price.

2. Promotion

Once a target cryptocurrency is chosen, the organizers use social media, forums, and sometimes even paid advertisements to hype it up. They spread rumors, make false claims about upcoming partnerships, or use other tactics to create a buzz.

3. The Pump

As more and more people buy into the hype, the coin’s price starts to rise. The organizers, who bought in early, benefit from this price surge.

4. The Dump 🙂

Once the price reaches a satisfactory level, the organizers sell off their holdings, leading to a sharp price drop. Those who bought in late, attracted by the hype, are left with devalued coins.

Decoding the Crypto Pump Detector

The world of cryptocurrency, with its volatility and rapid shifts, has given rise to various tools designed to help traders navigate its tumultuous waters. Among these tools, the crypto pump detector stands out as a beacon for those looking to avoid the pitfalls of market manipulation. But what exactly is this tool, and how does it work? Let’s decode the intricacies of the crypto pump detector.

The Core Functionality

At its heart, a crypto pump detector is a sophisticated software that continuously monitors cryptocurrency prices across various exchanges. It’s designed to identify unusual trading activity or rapid price increases that might indicate a pump in progress.

Pattern Recognition

One of the primary ways these detectors work is by employing advanced algorithms to recognize patterns in trading data. By analyzing past pumps, these tools can identify similar patterns emerging in real-time.

Volume Analysis

A sudden surge in trading volume can be a telltale sign of a pump. Crypto pump detectors keep a keen eye on volume spikes, especially when they aren’t aligned with any significant market news.

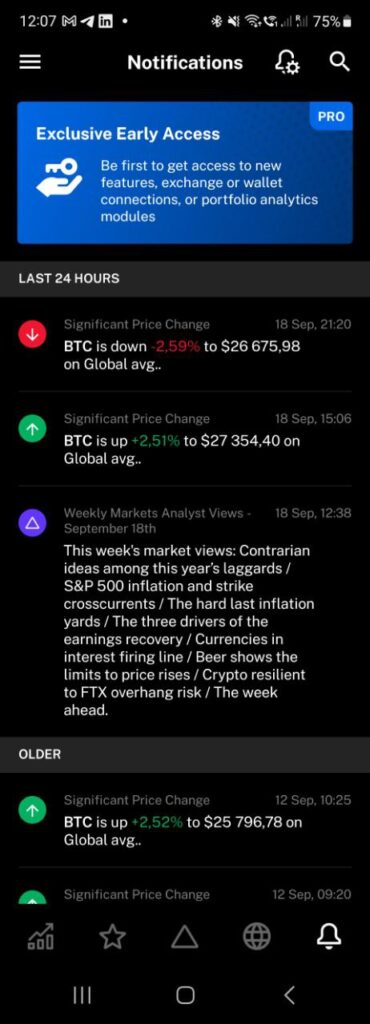

Alert Systems

An effective crypto pump detector doesn’t just identify potential pumps – it also alerts users in real-time. These alerts can be customized based on user preferences, ensuring that traders receive timely notifications that are relevant to their portfolio.

Integration with News Feeds

To provide a holistic view, some advanced detectors integrate with news feeds. This feature helps in distinguishing between genuine price surges resulting from market news and artificial pumps.

Spotlight on the Best Crypto Pump Detectors

| Platform | Key Features |

|---|---|

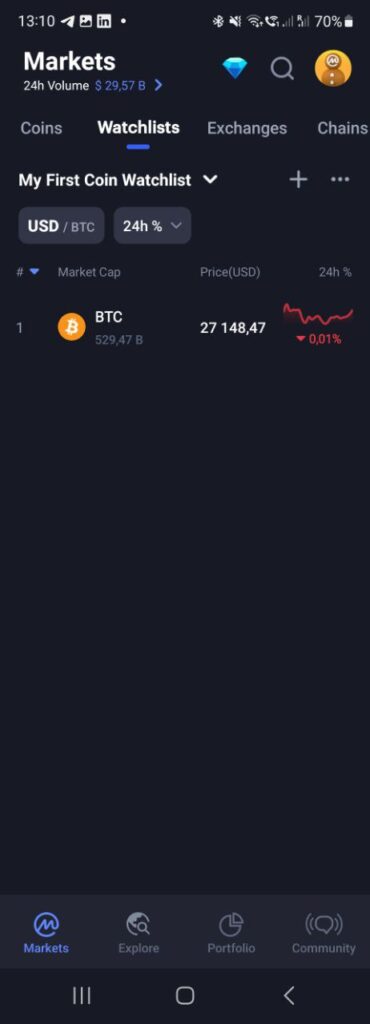

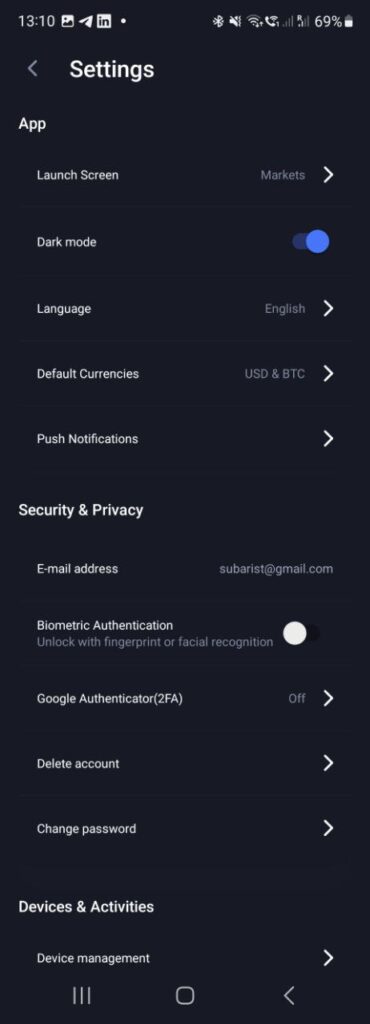

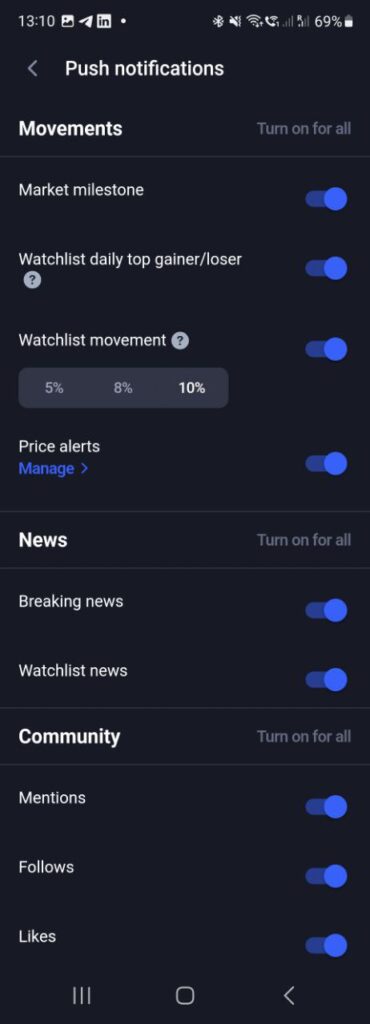

| Delta | – Push notifications for significant price changes of followed coins. |

| CoinMarketCap App | – Push notifications for 5%, 8%, 10% price changes of followed coins. – Custom price alerts. |

| CoinGecko App | – Push notifications for significant price changes of BTC or ETH. – Custom price alerts. |

| CryptoPumpFinder | – Real-time alerts for coins with at least 5% change in the last 10 minutes. |

1. Delta Investment Tracker

Website: https://delta.app/en

Key Feature:

- Push Notifications: Delta offers push notifications to alert users of significant price changes for the cryptocurrencies they are following. This ensures that users are always informed about major price movements in real-time, allowing them to make timely investment decisions.

2. CoinMarketCap App

Website: https://coinmarketcap.com/mobile/

Key Features:

- Push Notifications for Price Changes: CoinMarketCap provides users with push notifications when there’s a 5%, 8%, or 10% price change in the cryptocurrencies they are tracking. This feature is particularly useful for traders and investors who want to stay updated on significant market movements.

- Custom Price Alerts: Users have the flexibility to set specific price alerts. For instance, if a user wants to be notified when a particular cryptocurrency drops below a certain price, they can set this up within the app. This ensures that users can act promptly based on their investment strategies.

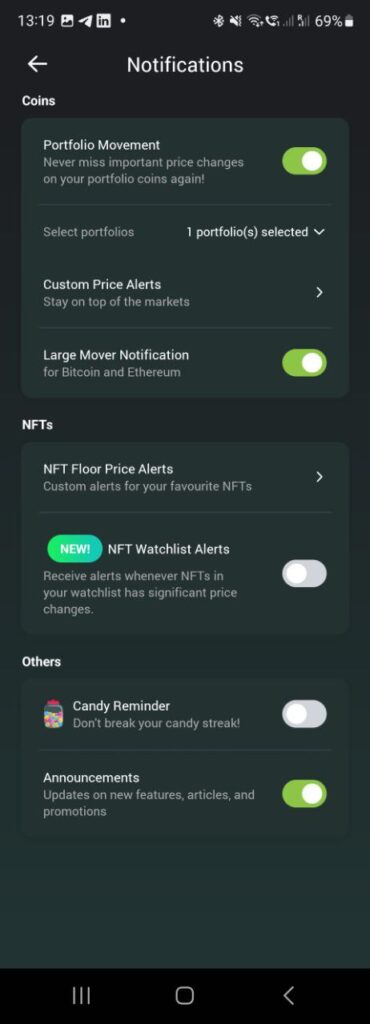

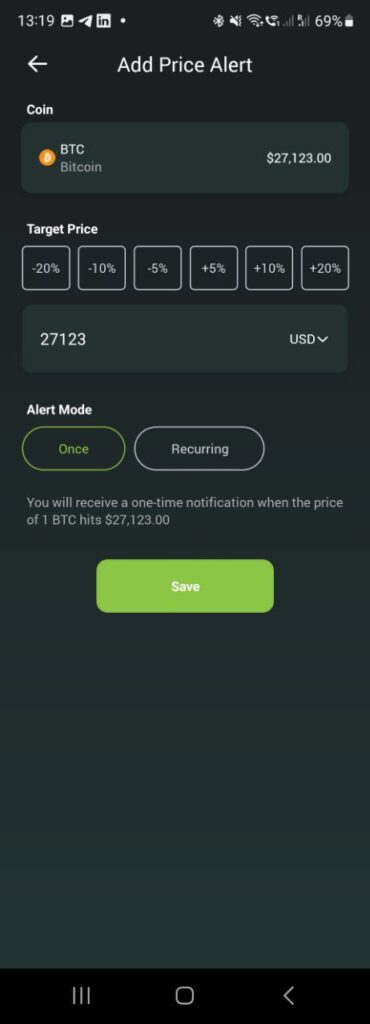

3. CoinGecko App

Website: https://www.coingecko.com/en/mobile

Key Features:

- Push Notifications for Major Coins: CoinGecko offers push notifications for significant price changes specifically for major cryptocurrencies like BTC and ETH. Given the influence of these coins on the broader market, such alerts are crucial for most crypto enthusiasts.

- Custom Price Alerts: Similar to CoinMarketCap, CoinGecko also allows users to set custom price alerts. If a user wants to be notified when a specific cryptocurrency’s price goes below a set threshold, they can configure this in the app.

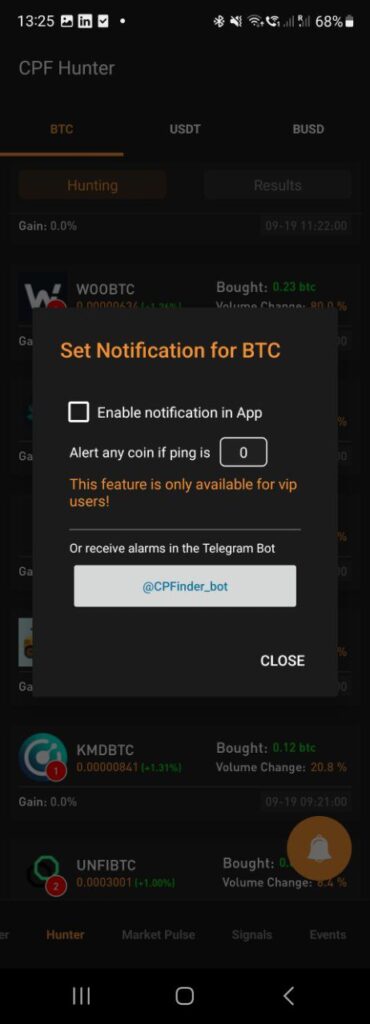

4. CryptoPumpFinder

Website: https://cryptopumpfinder.com/

Key Feature:

- Real-time Percentage Change Detection: CryptoPumpFinder specializes in monitoring and alerting users of percentage changes within defined time spans. For example, it can list all cryptocurrencies that have risen or dipped by at least 5% during the last 10 minutes. This feature is particularly valuable for traders looking to capitalize on short-term market movements.

In summary, each of these platforms offers unique features tailored to the needs of cryptocurrency enthusiasts. While Delta and CoinGecko focus on broad market movements and major coins, CoinMarketCap and CryptoPumpFinder provide more granular control over price alerts and real-time percentage changes. These tools, when used effectively, can greatly enhance a trader’s ability to navigate the volatile crypto market.

Mastering the Crypto Pump Detector

The crypto pump detector has emerged as an invaluable tool for traders, but mastering its use requires more than just setting up alerts. Let’s delve into the intricacies of effectively utilizing a crypto pump detector.

Understanding the Basics

Before diving deep, it’s essential to grasp the fundamental workings of a crypto pump detector. At its core, this tool monitors cryptocurrency prices in real-time, identifying sudden and significant price movements that might indicate a pump.

Customization is Key

Tailored Alerts

Most crypto pump detectors allow users to customize their alerts. Whether you’re interested in a specific percentage change or particular coins, ensure your settings reflect your trading interests and strategies.

Timeframes Matter

Some pumps happen within minutes, while others might take hours. Adjusting the tool to monitor different timeframes can help you capture various types of price movements.

Interpretation Over Notification

Receiving an alert is just the first step. Understanding the potential reasons behind a pump is crucial.

Market News

Always cross-reference sudden price movements with recent market news. A genuine reason, like a new partnership or technological advancement, might back some pumps.

Volume Analysis

A significant price change accompanied by a substantial increase in trading volume often indicates a more substantial market movement, rather than a short-lived pump.

Conclusion

The realm of cryptocurrency is a blend of innovation, potential, and unpredictability. As traders and enthusiasts, we’re constantly on the lookout for tools that not only enhance our understanding but also safeguard our investments. The crypto pump detector emerges as one such beacon, illuminating the often murky waters of sudden price movements.

However, as with any tool, its true power is unlocked not just by its features but by the adeptness of its user. Mastering the crypto pump detector is more than just understanding its functionalities; it’s about integrating its insights into a broader trading strategy. It’s about recognizing that in the dynamic world of crypto, information is power, but interpretation is the key.

As we venture further into this digital frontier, let’s remember to trade with both intelligence and integrity. The crypto pump detector, when used ethically and effectively, can be our compass, guiding us towards informed decisions in a market known for its volatility.

In the end, the goal isn’t just to detect pumps but to navigate the crypto landscape with foresight, responsibility, and confidence.

FAQs

How does a crypto pump detector work?

It analyzes market data to spot potential pumps in real-time.