In the ever-evolving financial landscape, cryptocurrency day trading has emerged as a lucrative and exciting opportunity. This article aims to provide a comprehensive guide to day trading in the cryptocurrency world, highlighting its potential benefits and risks. We will delve into the key criteria for choosing the best cryptocurrencies for day trading and discuss effective strategies to maximize your profits.

Table of Contents

Understanding Cryptocurrency Day Trading

Day trading in the cryptocurrency world involves buying and selling digital currencies within a single trading day. Unlike traditional stock day trading, cryptocurrency day trading is marked by higher volatility and liquidity. The market capitalization of a cryptocurrency can significantly impact its suitability for day trading, making it an essential factor to consider.

What is Cryptocurrency Day Trading?

Cryptocurrency day trading is a type of short-term trading strategy where the trader, or day trader, opens and closes positions within the same trading day. The primary objective of this strategy is to generate profits from the small price fluctuations that occur within the 24-hour trading period.

Unlike traditional financial markets, which have specific trading hours, the cryptocurrency market operates 24/7. This round-the-clock operation provides day traders with more opportunities to trade, as they can choose to trade at any time of the day or night.

Cryptocurrency day trading involves a high level of risk due to the volatile nature of the cryptocurrency market. Prices of cryptocurrencies can change rapidly in a very short time, making it possible for traders to experience significant profits or losses.

To be successful in cryptocurrency day trading, a trader needs to have a good understanding of the market and the ability to analyze market trends and indicators. They also need to be comfortable with taking risks and making quick decisions.

Day traders typically use technical analysis tools to help them predict market movements. These tools can include chart patterns, indicators like moving averages and Relative Strength Index (RSI), and other forms of price and volume analysis.

In addition, successful day traders often employ risk management strategies to protect their capital. This can include setting stop-loss orders to limit potential losses and only risking a certain percentage of their trading capital on any single trade.

How Does it Differ from Traditional Stock Day Trading?

Cryptocurrency day trading and traditional stock day trading share the same basic principle: buying and selling assets within a single trading day to profit from short-term price fluctuations. However, there are several key differences between the two due to the unique characteristics of the cryptocurrency market. Here’s a comparison chart to illustrate these differences:

| Aspect | Cryptocurrency Day Trading | Traditional Stock Day Trading |

|---|---|---|

| Market Hours | The cryptocurrency market operates 24/7, providing continuous trading opportunities. | Stock markets have specific trading hours, typically 9:30 AM to 4:00 PM EST in the U.S. |

| Volatility | Cryptocurrencies are known for their high volatility, which can lead to larger price swings and potentially higher profits (or losses). | Stocks generally have lower volatility compared to cryptocurrencies. |

| Liquidity | Liquidity can vary significantly between different cryptocurrencies. Popular ones like Bitcoin and Ethereum have high liquidity, while others may have low liquidity. | Stocks of large companies typically have high liquidity, making it easy to buy and sell shares. |

| Access to Global Markets | Cryptocurrencies can be traded by anyone with an internet connection, providing access to a global market. | Stock trading may require access to different exchanges based on the location of the listed companies. |

| Regulation | The cryptocurrency market is less regulated, which can lead to increased risk but also greater opportunities. | Stock markets are heavily regulated by financial authorities, providing a level of protection for traders. |

| Short Selling | Short selling is possible and common in cryptocurrency trading, although it often requires using derivatives or trading on margin. | Short selling in stock trading is also possible, but it may be subject to certain restrictions. |

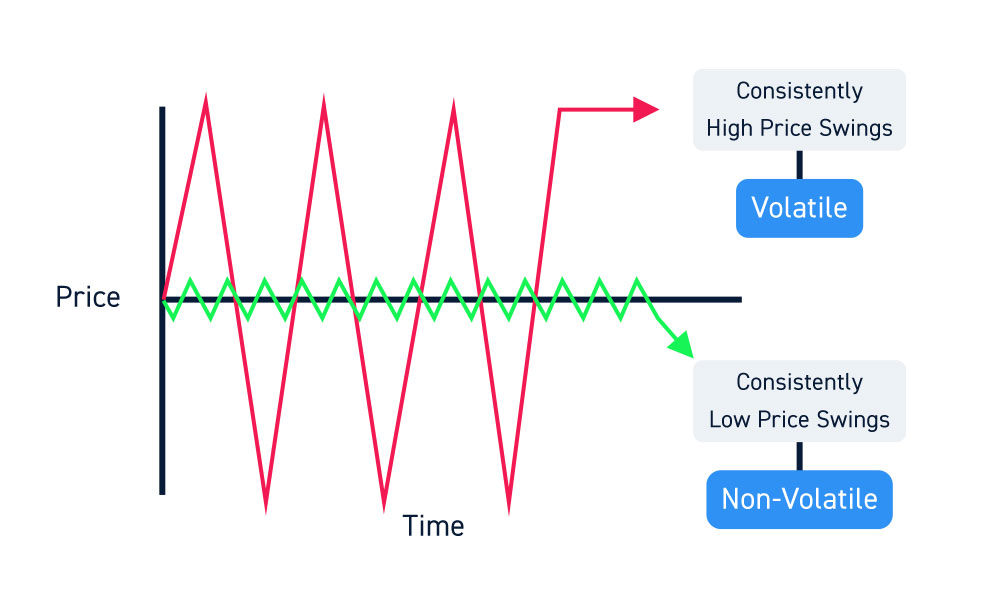

The Role of Volatility and Liquidity in Day Trading

Volatility and liquidity are crucial in day trading. High volatility provides more opportunities for profit, while high liquidity allows traders to buy and sell without significantly affecting the market price.

How Market Capitalization Impacts Cryptocurrency Day Trading

Market capitalization, often referred to as market cap, is a significant factor in cryptocurrency day trading. It’s calculated by multiplying the current price of a cryptocurrency by its total circulating supply. This figure gives traders an idea of the size of a cryptocurrency in comparison to others.

Here’s how market capitalization impacts cryptocurrency day trading:

- Price Stability: Cryptocurrencies with larger market caps, like Bitcoin or Ethereum, tend to have more price stability than those with smaller market caps. This is because larger market cap cryptocurrencies have a wider distribution and greater liquidity, making them less susceptible to price manipulation or drastic price swings. For day traders, this means that while the potential for massive short-term gains might be lower, the risk of sudden, large-scale losses is also reduced.

- Liquidity: Cryptocurrencies with a high market cap usually have high liquidity, meaning there are many buyers and sellers in the market. High liquidity is essential for day trading as it allows traders to quickly enter and exit positions without causing significant price changes.

- Volatility: Smaller market cap cryptocurrencies, often referred to as ‘altcoins’, can be highly volatile. While this increased volatility can present more opportunities for high percentage gains within a single day, it also comes with increased risk.

- Influence of Whales: In the world of cryptocurrency, a ‘whale’ is an individual or entity that holds a large amount of a particular cryptocurrency. In smaller market cap cryptocurrencies, a single whale can have a significant impact on the price, which can be a risk for day traders. In contrast, the impact of whales is less pronounced in larger market cap cryptocurrencies due to their wider distribution.

- Impact of News and Events: Larger market cap cryptocurrencies are often more influenced by macro events, such as regulatory news or significant changes in market sentiment. Smaller market cap cryptocurrencies, on the other hand, can be heavily influenced by micro events, like news about a new partnership or project development.

In conclusion, understanding market capitalization and its impact on price stability, liquidity, volatility, and the influence of whales and news events is crucial for any cryptocurrency day trader. It can help them choose the right cryptocurrencies to trade and develop effective trading strategies.

Key Criteria for Choosing the Best Cryptocurrencies for Day Trading

Choosing the right cryptocurrency for day trading can be a daunting task. Here are some key criteria to consider:

Importance of High Trading Volume

Trading volume is a critical factor in cryptocurrency day trading. It refers to the number of shares or contracts traded in a security or an entire market during a given period. In the context of cryptocurrencies, it’s the total number of coins traded within a specific timeframe, usually 24 hours.

Here’s why high trading volume is important in cryptocurrency day trading:

| Aspect | Importance in Cryptocurrency Day Trading |

|---|---|

| Liquidity | High trading volume typically indicates high liquidity, which is crucial for day trading. In a highly liquid market, orders can be executed quickly, and traders are less likely to experience slippage. |

| Price Stability | Cryptocurrencies with high trading volumes tend to have more price stability. They are less susceptible to price manipulation or drastic price swings caused by large orders. |

| Market Sentiment | Trading volume can be an indicator of market sentiment. A sudden increase in trading volume can signal a growing interest in the cryptocurrency, possibly leading to a price increase. Conversely, a sudden decrease in trading volume could indicate a declining interest, potentially leading to a price drop. |

| Technical Analysis | Trading volume is a key component of many technical analysis tools and indicators, such as Volume Weighted Average Price (VWAP), On Balance Volume (OBV), and Money Flow Index (MFI). These tools can help traders identify potential trading opportunities and make informed decisions. |

Role of Market Volatility in Potential Gains

Market volatility refers to the degree of variation in the price of a financial instrument over time. In the context of cryptocurrencies, high volatility means that the price of a cryptocurrency can change rapidly in a very short time, making it possible for traders to experience significant gains or losses.

Here’s how market volatility plays a role in potential gains in cryptocurrency day trading:

- Profit Opportunities: High volatility can create significant price swings, providing more opportunities for traders to enter and exit trades at profitable prices. In a volatile market, the potential for high percentage gains within a single day is greater.

- Risk and Reward: While high volatility can lead to large profits, it also comes with increased risk. The price can move against the trader’s position just as quickly as it can move in their favor. Therefore, effective risk management strategies are crucial when trading in volatile markets.

- Technical Analysis: Volatility is a key factor in many technical analysis tools and indicators, such as Bollinger Bands and the Average True Range (ATR). These tools can help traders identify periods of high volatility and potentially profitable trading opportunities.

Need for a Robust, Trustworthy, and User-friendly Trading Platform

A robust, trustworthy, and user-friendly trading platform is a crucial tool for any cryptocurrency day trader. It’s the primary interface where traders execute their trades, analyze market trends, and manage their portfolios. Here’s why these characteristics are essential:

- Robustness: A robust trading platform should be able to handle high volumes of trades efficiently and without lag. It should provide real-time data, have minimal downtime, and offer advanced features like different order types (e.g., limit, market, stop orders), which can help traders execute their strategies effectively.

- Trustworthiness: Trustworthiness is paramount when it comes to choosing a trading platform. The platform should have strong security measures in place to protect users’ funds and personal information. It should also be regulated and comply with relevant laws and regulations.

- User-friendly: A user-friendly platform is easy to navigate, even for beginners. It should have an intuitive interface, clear instructions, and readily available customer support. A steep learning curve can hinder trading, especially for those new to cryptocurrency day trading.

One platform that meets these criteria is MEXC. MEXC is a Singapore-based cryptocurrency exchange that offers a wide range of cryptocurrencies for trading. It’s known for its robust trading engine, high security standards, and user-friendly interface. It also provides advanced trading features, comprehensive customer support, and educational resources, making it a suitable choice for both beginner and experienced traders.

Relevance of News and Market Sentiment

News and market sentiment play a significant role in the cryptocurrency market, often causing price fluctuations and trends. Here’s why they’re relevant to cryptocurrency day trading:

- Impact on Prices: News events can have a direct impact on cryptocurrency prices. For instance, regulatory news, changes in technology or infrastructure, partnership announcements, or macroeconomic events can cause prices to rise or fall. Traders who stay informed about these events can anticipate price movements and make trades accordingly.

- Market Sentiment: Market sentiment refers to the overall attitude of investors towards a particular market or asset. It can be bullish (expecting prices to rise) or bearish (expecting prices to fall). Understanding market sentiment can help traders predict trends and make informed decisions. For example, if the market sentiment is bullish, it might be a good time to enter a long position.

- Trading Volume: News and market sentiment can also affect trading volume. Positive news or bullish sentiment can attract more traders to the market, increasing the trading volume, and vice versa.

- Volatility: Major news events can cause increased volatility in the market. Traders can take advantage of this volatility to make profits, but it also comes with increased risk.

Need for a Strong and Active Community

A strong and active community can be a valuable resource for cryptocurrency day traders. Here’s why:

- Information Sharing: Cryptocurrency communities often serve as hubs for sharing news, insights, and analysis. Traders can gain valuable information from community discussions that can help them make informed trading decisions.

- Sentiment Analysis: The sentiment within a community can provide clues about market trends. For instance, if the majority of community members are bullish about a particular cryptocurrency, it could indicate a potential upward price movement.

- Support and Guidance: Especially for beginners, a supportive community can be a great place to ask questions and learn from more experienced traders. It can also provide emotional support during challenging market conditions.

- Networking: Being part of a community can provide opportunities to network with other traders, which can lead to collaborations, partnerships, or simply the exchange of valuable ideas.

- Influence on Prices: In some cases, particularly with smaller cryptocurrencies, a large and active community can influence prices. If the community is actively promoting a coin and attracting new buyers, it can drive the price up.

Best Crypto to Daytrade

Choosing the best cryptocurrencies for day trading depends on a variety of factors, including volatility, liquidity, trading volume, and market capitalization. Here are a few cryptocurrencies that are often considered good for day trading:

- Bitcoin (BTC): As the largest and most well-known cryptocurrency, Bitcoin often has high liquidity and trading volume, making it a popular choice for day traders. Its price can be influenced by macroeconomic events, making it crucial for traders to stay updated with the latest news.

- Ethereum (ETH): Ethereum is another high market cap cryptocurrency that is widely traded. It’s known for its smart contract functionality, which has led to the development of many decentralized applications (dApps) and has contributed to its popularity.

- Ripple (XRP): Ripple is a digital payment protocol that also has its own cryptocurrency, XRP. It often has high trading volume and is popular among traders due to its partnerships with financial institutions.

- Litecoin (LTC): Often referred to as the silver to Bitcoin’s gold, Litecoin has been around for a long time and is widely recognized. It often has high liquidity and is popular among traders.

- Kaspa (KAS): Kaspa is the fastest, open-source, decentralized & fully scalable Layer-1 in the world. It has a strong community and has seen significant volatility, making it interesting for day traders.

Remember, the suitability of these cryptocurrencies for day trading can vary based on market conditions and individual trading strategies. It’s important for traders to conduct their own research and consider their risk tolerance before deciding which cryptocurrencies to trade.

Here’s the information presented as a chart:

| Cryptocurrency | Description | Why It’s Good for Day Trading |

|---|---|---|

| Bitcoin (BTC) | The first and most well-known cryptocurrency. | High liquidity and trading volume. |

| Ethereum (ETH) | Known for its smart contract functionality. | High trading volume and wide usage. |

| Ripple (XRP) | A digital payment protocol with its own cryptocurrency. | High trading volume and partnerships with financial institutions. |

| Litecoin (LTC) | Often referred to as the silver to Bitcoin’s gold. | High liquidity and wide recognition. |

| Kaspa (KAS) | Fastest, open-source, decentralized & fully scalable Layer-1 project. | High volatility and strong community. |

In conclusion, while these cryptocurrencies are often considered good for day trading, the best choice depends on individual trading strategies, risk tolerance, and market conditions.

Tools and Strategies for Cryptocurrency Day Trading

Successful cryptocurrency day trading requires the right tools and strategies. Here are some to consider:

Popular Technical Analysis Tools

Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Here are some popular technical analysis tools used by cryptocurrency day traders:

- Moving Averages (MA): Moving averages smooth out price data to form a trend-following indicator. They do not predict price direction but rather define the current direction with a lag. The two most common types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. It’s used to identify overbought or oversold conditions in a market.

- Bollinger Bands: Bollinger Bands are a volatility indicator that creates a band of three lines—the middle line is a simple moving average, and the outer lines are standard deviations away from the middle line. They are used to identify overbought and oversold levels and volatility in the market.

- Fibonacci Retracement: This tool is used to identify potential support and resistance levels. These levels are based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, signal line, and the histogram.

- Volume: Volume is one of the most basic and used technical analysis tools. It provides clues about the trend and helps traders confirm the trend.

Here’s the information presented as a chart:

| Technical Analysis Tool | Description |

|---|---|

| Moving Averages (MA) | Smooths out price data to form a trend-following indicator. |

| Relative Strength Index (RSI) | A momentum oscillator used to identify overbought or oversold conditions. |

| Bollinger Bands | A volatility indicator used to identify overbought and oversold levels and volatility. |

| Fibonacci Retracement | Used to identify potential support and resistance levels. |

| MACD (Moving Average Convergence Divergence) | A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. |

| Volume | Provides clues about the trend and helps traders confirm the trend. |

Use of Trading Bots for Automating Trades

Trading bots are software programs that connect to a user’s cryptocurrency exchange account and carry out trades on their behalf. They work by following the market’s price movement and reacting according to a set of predefined and pre-programmed rules. Here’s why they’re used in cryptocurrency day trading:

- 24/7 Market: The cryptocurrency market operates 24/7, which means trading opportunities can arise at any time. Trading bots can operate continuously, allowing traders to take advantage of opportunities even when they’re not actively trading.

- Speed: Trading bots can react to market changes and execute trades faster than a human trader. This can be particularly beneficial in a volatile market like cryptocurrency.

- Emotionless Trading: Trading bots follow the rules set by the trader without being influenced by emotions like fear or greed. This can help prevent impulsive trading decisions and ensure a consistent trading strategy.

- Backtesting: Many trading bots allow traders to backtest their strategies using historical market data. This can help traders refine their strategies and increase their chances of success.

- Diversification: Trading bots can manage and trade multiple cryptocurrencies at once, which can help diversify a trader’s portfolio and spread risk.

However, it’s important to note that while trading bots can be a useful tool, they’re not a guarantee of profit. They’re only as good as the trading strategy they’re programmed to follow, and they can’t account for unforeseen market changes or technical issues. Therefore, they should be used as part of a broader trading strategy, and traders should still closely monitor their bot’s performance and the market conditions.

Risk Management Strategies in Day Trading

Risk management is a crucial aspect of any trading strategy, including day trading. It involves identifying, assessing, and taking steps to mitigate the risks associated with trading. Here are some common risk management strategies used in day trading:

- Setting Stop-Loss Orders: A stop-loss order is an order placed with a broker to buy or sell a specific stock once it reaches a certain price. It’s designed to limit an investor’s loss on a position.

- Position Sizing: This involves deciding how much of your portfolio to risk on each trade. A common rule is to never risk more than 1% of your portfolio on a single trade.

- Diversification: This involves spreading your investments across various assets to reduce exposure to any one asset. In the context of day trading, this could mean trading a variety of different cryptocurrencies.

- Limiting Leverage: While leverage can amplify profits, it can also amplify losses. It’s important to use leverage cautiously and understand the risks involved.

- Regularly Reviewing and Adjusting Your Strategy: The market is constantly changing, and what worked yesterday may not work today. Regularly reviewing and adjusting your strategy can help keep it effective.

Risks and Challenges in Cryptocurrency Day Trading

While cryptocurrency day trading can be profitable, it also comes with risks and challenges:

High-Risk Nature of Day Trading

Day trading, particularly in the volatile cryptocurrency market, is inherently risky. Here are some reasons why:

- Market Volatility: Cryptocurrencies are known for their high volatility, with prices that can change rapidly in a very short time. While this can create opportunities for high returns, it also increases the risk of significant losses.

- Leverage: Many day traders use leverage to amplify their potential profits. However, while leverage can increase profits, it can also amplify losses. A small price movement in the wrong direction can result in substantial losses for a leveraged trader.

- Speed of Trading: Day trading involves making quick decisions and executing trades within a short time frame. This leaves little room for error, and mistakes can be costly.

- Lack of Regulation: The cryptocurrency market is less regulated than traditional financial markets. This lack of regulation can increase the risk of market manipulation and scams.

- Emotional Trading: The fast-paced nature of day trading can lead to emotional trading decisions, such as chasing losses or making impulsive trades, which can result in significant losses.

- Complexity: Day trading involves a deep understanding of the market and the ability to analyze complex charts and indicators. Without the necessary knowledge and skills, traders can make poor trading decisions and incur losses.

Potential Losses and the Risk of Scams

In the world of cryptocurrency day trading, potential losses and the risk of scams are significant concerns. Here’s why:

- Potential Losses: Due to the volatile nature of the cryptocurrency market, prices can swing dramatically in a short period. While this volatility can present opportunities for profit, it also means that traders can incur substantial losses if the market moves against their positions. Furthermore, the use of leverage can amplify these losses.

- Risk of Scams: The cryptocurrency market is still relatively new and less regulated than traditional financial markets, making it a target for scammers. Scams can take many forms, including:

- Pump and Dump Schemes: These involve artificially inflating the price of a low-market-cap cryptocurrency (the “pump”) and then selling off the inflated shares once other traders start buying (the “dump”).

- Fake ICOs (Initial Coin Offerings) or Presales: Scammers create a fake ICO, hype it up to attract investors, and then steal the investments when the ICO launches.

- Fraudulent Exchanges: Some scammers set up fake cryptocurrency exchanges to lure users. Once users deposit their funds, the scammers disappear with the money.

- Malware: Scammers can use malware to gain access to users’ wallets and steal their coins.

To mitigate these risks, traders should employ sound risk management strategies, stay informed about the latest scams, and only use reputable platforms for trading. It’s also crucial to keep in mind the old adage: “If it sounds too good to be true, it probably is.”

Regulatory Uncertainties and Their Impact on Day Trading

Regulatory uncertainties can have a significant impact on cryptocurrency day trading. Cryptocurrencies operate in a relatively new and rapidly evolving field, and the regulatory environment around them varies widely from one jurisdiction to another. Here’s how regulatory uncertainties can impact day trading:

- Price Volatility: Regulatory news can cause significant price volatility. For example, news of a country banning or imposing strict regulations on cryptocurrencies can lead to a sharp drop in prices, while positive regulatory news can lead to price surges.

- Market Access: Depending on the regulatory environment, traders in certain jurisdictions may be unable to access certain cryptocurrency markets or exchanges. This can limit trading opportunities.

- Legal Risks: Traders need to be aware of the legal and tax implications of their trading activities. These can vary widely and can change as new regulations are introduced.

- Risk of Exchange Shutdown: In some cases, regulatory actions can lead to cryptocurrency exchanges being shut down, which can result in traders losing access to their assets.

- Uncertainty: Overall, regulatory uncertainty can create a climate of fear, uncertainty, and doubt (often referred to as “FUD“) in the market, which can lead to increased volatility and risk.

Tips for Successful Cryptocurrency Day Trading

Successful cryptocurrency day trading requires a combination of knowledge, skills, and disciplined strategy. Here are some tips that can help traders increase their chances of success:

- Education: Understanding the basics of blockchain technology and how cryptocurrencies work is crucial. Traders should also learn about market indicators, chart patterns, and trading strategies.

- Stay Updated: The cryptocurrency market is influenced by news and events. Traders should stay updated with the latest news, including regulatory developments and major technological advancements.

- Risk Management: Traders should use risk management strategies to protect their capital. This includes setting stop-loss orders, diversifying their portfolio, and only risking a small percentage of their capital on each trade.

- Emotional Control: Trading can be an emotional roller coaster. It’s important to stay calm and stick to the trading plan, avoiding impulsive decisions based on fear or greed.

- Practice: Many trading platforms offer demo accounts where traders can practice their strategies with virtual money. This can be a great way to gain experience without risking real money.

- Use Reliable Tools: Using reliable trading platforms and tools can make the trading process more efficient and effective. This includes trading platforms, charting tools, and trading bots.

- Continuous Learning: The cryptocurrency market is constantly evolving. Successful traders never stop learning and adapting their strategies to the changing market.

Conclusion

Cryptocurrency day trading can be a profitable venture if approached with knowledge, strategy, and discipline. While it comes with its risks, understanding these risks and how to mitigate them can lead to significant rewards. As a prospective trader, your journey is just beginning. Continue learning, stay updated on market trends, and always strive to refine your trading strategies.