In the vast universe of digital currencies, one question frequently emerges: “How crypto mining works?” This article aims to demystify the complex processes behind crypto mining, offering readers a clear understanding of its mechanics, significance, and future.

Table of Contents

What is Crypto Mining?

At its core, crypto mining is the digital equivalent of mining precious metals. Miners use powerful computers to solve complex mathematical problems. Upon solving these problems, they’re rewarded with cryptocurrency, thus validating and adding new transactions to a blockchain.

How Crypto Mining Works

Crypto mining, often likened to the digital equivalent of mining precious metals, is a complex process that plays a pivotal role in the cryptocurrency ecosystem. To truly grasp its intricacies, one must understand the foundational principles, algorithms, and systems that govern it.

The Role of Miners

Miners are the backbone of the cryptocurrency network. Their primary role is twofold:

- Transaction Validation: Miners verify the legitimacy of transactions, ensuring that the same coin isn’t spent twice (preventing double-spending).

- Block Addition: Once transactions are verified, they’re grouped into a block. Miners then add this block to the blockchain, a public ledger of all transactions.

Proof of Work (PoW)

Most cryptocurrencies, including Bitcoin, operate on a consensus mechanism called Proof of Work (PoW). Here’s how it functions:

- Miners compete to solve a complex mathematical puzzle, which requires significant computational power.

- The first miner to solve the puzzle gets the right to add a new block to the blockchain.

- Other miners then verify the solution. If a majority agrees, the block is added to the chain.

- The successful miner is rewarded with newly minted cryptocurrency (block reward) and transaction fees from the block’s transactions.

Mining Difficulty

To maintain a consistent rate of block addition (for Bitcoin, it’s approximately every 10 minutes), the network adjusts the difficulty of the puzzle:

- If blocks are being added too quickly, the puzzle’s difficulty increases.

- If blocks are being added too slowly, the difficulty decreases. This self-adjusting mechanism ensures the stability and security of the network.

Rewards and Incentives

The crypto network incentivizes miners in two ways:

- Block Rewards: Miners receive a certain number of newly minted coins for adding a block. This reward halves periodically, an event known as “halving.”

- Transaction Fees: Users can attach fees to their transactions as an incentive for miners to prioritize and validate them. These fees serve as an additional reward for miners.

Evolution of Mining

Over the years, mining has evolved significantly:

- Solo Mining: Initially, individual miners used personal computers to mine cryptocurrencies.

- Pool Mining: As difficulty increased, miners pooled resources to increase their chances of earning rewards.

- Rental Mining: Individuals can now rent mining power from companies like Nicehash or MiningRigRentals, eliminating the need for personal hardware.

Mining Algorithms

Cryptocurrency mining algorithms are the mathematical processes that underpin the creation and verification of new blocks on a blockchain. Different cryptocurrencies use different algorithms, each optimized for specific types of hardware. Here’s a detailed chart of some of the most famous mining algorithms:

| Algorithm | Preferred Hardware | Associated Coins |

|---|---|---|

| SHA-256 | ASIC | BTC (Bitcoin), BCH (Bitcoin Cash) |

| Scrypt | ASIC | LTC (Litecoin) |

| Ethash | GPU, FPGA, ASIC | ETH (Ethereum), ETC (Ethereum Classic) |

| KawPoW/ProgPoW | GPU | RVN (Ravencoin), Clore |

| Cuckoo | GPU, ASIC | Grin, MWC, AE (Aeternity), Cortex |

| RandomX | CPU | XMR (Monero), RTM (Raptoreum) |

| KHeavyHash | ASIC | KAS (Kadena) |

| PoST | HDD | XCH (Chia) |

Notes:

- SHA-256: One of the earliest and most well-known algorithms, primarily associated with Bitcoin. It’s highly secure but also energy-intensive, leading to the development of specialized ASIC miners for optimized mining.

- Scrypt: While it started as an algorithm suitable for GPU mining, ASICs have since been developed that can mine Scrypt-based coins more efficiently.

- Ethash: Initially designed to be ASIC-resistant and favor GPU mining, but over time, ASICs have been developed for Ethash as well.

- KawPoW/ProgPoW: A newer algorithm designed to be ASIC-resistant and optimize GPU mining.

- Cuckoo: Known for its unique cycle-finding process, it’s suitable for both GPU and ASIC mining.

- RandomX: Optimized for general-purpose CPUs, making it more decentralized and accessible for average users.

- KHeavyHash: Specific to the Kaspa coin, it’s optimized for ASIC mining.

- PoST (Proof of Space and Time): A unique algorithm used by Chia, where miners “farm” rather than “mine” by allocating disk space. It’s a more energy-efficient approach compared to traditional mining algorithms.

Mining Hardware

Cryptocurrency mining requires specialized hardware to solve the complex mathematical problems that underpin the blockchain. Over the years, as the difficulty of these problems has increased, so too has the sophistication and power of the hardware used to solve them. Here’s a detailed look at the most common types of mining hardware:

| Hardware Type | Speed | Energy Efficiency | Versatility | Cost | Commonly Used For |

|---|---|---|---|---|---|

| CPU Farms | Low | Low | High | Low | New cryptocurrencies, hobbyist mining |

| GPU Rigs | Medium | Medium | High | Medium | Altcoins, ASIC-resistant coins |

| FPGA Rigs | High | High | Medium | High | Intermediate mining, niche coins |

| ASIC Farms | Very High | Very High | Low | Very High | Bitcoin, major cryptocurrencies |

Mining Software

Mining software plays a pivotal role in the cryptocurrency mining process. It acts as an intermediary, facilitating the interaction between the mining hardware and the blockchain. While ASICs often come with their proprietary software, CPU, GPU, and FPGA mining heavily rely on third-party mining software to function effectively.

Role of Mining Software

Mining software performs several crucial functions:

- Work Retrieval: It fetches the next piece of work from the mining pool or blockchain.

- Work Processing: It processes this work using the mining hardware (CPU, GPU, FPGA).

- Solution Submission: Once a solution is found, the software submits it back to the blockchain or mining pool.

2. Best Mining Software Programs

Here’s a list of some of the best mining software programs:

| Software Name | Description |

|---|---|

| teamredminer | A highly efficient miner designed for AMD GPUs. |

| trex | Optimized for Nvidia GPUs, it offers high performance and stability. |

| lolminer | A versatile miner that supports multiple algorithms and both AMD and Nvidia GPUs. |

| bzminer | Known for its efficiency and compatibility with various algorithms. |

| miniz | A fast and efficient miner optimized for Equihash algorithms. |

| phoenix | A high-performance Ethereum miner with support for both AMD and Nvidia GPUs. |

| gminer | A versatile miner supporting a wide range of algorithms and both GPU types. |

| nanominer | Known for its user-friendly interface and support for multiple coins. |

| nbminer | Offers high performance for a range of algorithms and is compatible with both AMD and Nvidia GPUs. |

| claymore | One of the oldest miners, especially for Ethash. |

| srbminer | A powerful miner designed for a range of algorithms and primarily for AMD GPUs. |

| xmrig | A high-performance miner for Monero (XMR) and other Cryptonight-based coins. |

3. Choosing the Right Mining Software

The choice of mining software depends on several factors:

- Hardware Compatibility: Ensure the software is compatible with your mining hardware (CPU, GPU, FPGA).

- Supported Algorithms: Different cryptocurrencies use different algorithms. Choose software that supports the algorithm of your chosen cryptocurrency.

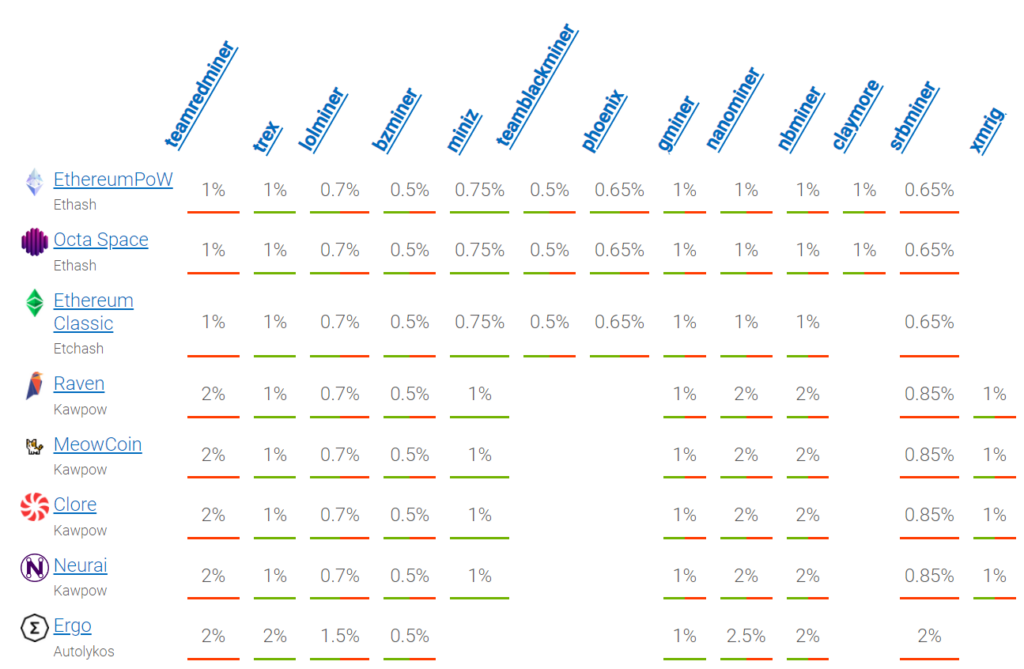

- Fees: Some mining software programs charge a fee, usually a percentage of your mining earnings.

- User Interface: For beginners, a user-friendly interface can be beneficial.

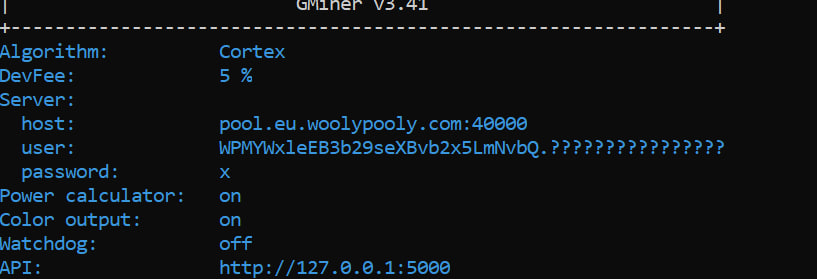

4. Setting Up and Using Mining Software

Setting up mining software typically involves:

- Downloading the software.

- Extracting the files.

- Editing a batch file (.bat) or configuration file to include details like the mining pool’s address, your wallet address, and other settings.

- Running the software to start mining.

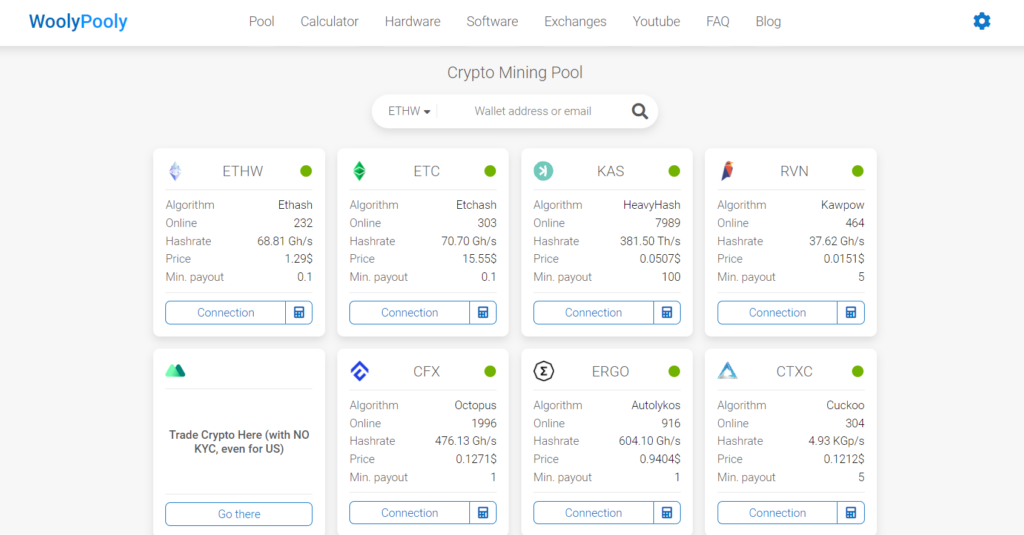

Mining Pools

A mining pool is a collaboration where miners combine their computational resources to increase their chances of validating blocks in a blockchain. By pooling resources, miners aim to share rewards based on their contribution, making earnings more predictable and regular. This concept emerged as individual mining became increasingly challenging due to rising mining difficulties.

How Mining Pools Operate:

- Collective Effort: Miners work collectively, and when a block is solved, rewards are distributed based on each miner’s contribution.

- Joining a Pool: Miners can either register with the pool or mine anonymously using their cryptocurrency wallet address. Some pools, like Woolypooly, offer both options.

- Reward Distribution: Rewards are distributed using various mining pool payout schemes like Pay Per Share (PPS), Pay Per Last N Shares (PPLNS), and Proportional (PROP).

- Pool Fees: To cover operational costs, pools charge fees, either as a fixed amount or a percentage of miners’ earnings.

Benefits of Mining Pools:

- Increased Chances of Earning: Pools increase the likelihood of earning rewards compared to solo mining.

- Regular Payouts: Miners in a pool receive more consistent payouts.

- Access to Advanced Tools: Many pools offer sophisticated mining tools and resources.

The Economics of Crypto Mining

While the technical aspects of mining are often discussed, the economics behind it play a crucial role in determining its viability and profitability. Here’s a deep dive into the economic factors that influence crypto mining:

1. Cost of Hardware and Infrastructure

- Initial Investment: High-quality mining equipment, whether ASIC miners, crypto mining rigs, or CPUs, can be expensive. The initial capital required to set up a mining rig or farm is a significant factor in determining profitability.

- Maintenance and Upgrades: Over time, hardware can become outdated or require maintenance. Regular upgrades and repairs can add to the overall cost.

2. Electricity Costs

- Power Consumption: Mining consumes a lot of electricity. The efficiency of a mining rig is often measured in terms of its power consumption relative to its output.

- Regional Electricity Prices: Electricity costs vary by region. Miners in areas with cheaper electricity have a competitive advantage.

3. Mining Difficulty

- Network Competition: The more miners there are on a network, the higher the mining difficulty. This means that miners have to expend more computational power to earn rewards.

- Block Rewards: Over time, certain cryptocurrencies reduce the reward per block mined, a process known as “halving.” This can impact the potential earnings from mining.

4. Market Value of Cryptocurrencies

- Price Fluctuations: The value of cryptocurrencies can be highly volatile. A high market price can make mining profitable, while a drop in price can render it unviable.

- Liquidity: Being able to quickly and easily convert mined coins into fiat currency or other assets is crucial. The liquidity of a cryptocurrency can influence its attractiveness to miners.

5. Operational Costs

- Cooling Systems: Mining equipment generates heat. Effective cooling systems, which can be costly, are essential to keep the hardware running optimally.

- Security: Protecting mining operations from theft, hacks, or other malicious activities is vital. Security measures, both digital and physical, can add to operational costs.

6. Regulatory and Tax Implications

- Legal Status: In some regions, cryptocurrency mining is heavily regulated or even banned. Compliance with local regulations can influence the cost and feasibility of mining operations.

- Taxation: Earnings from mining can be subject to taxation. Understanding and complying with tax obligations is essential to avoid legal complications and ensure profitability.

7. Mining Pools and Fees

- Shared Resources: Joining a mining pool can increase the chances of earning rewards, but it also means sharing those rewards with other participants.

- Pool Fees: Mining pools usually charge fees, which can eat into a miner’s profits.

8. Mining Software and Fees

Many mining software programs charge fees, which can be structured in various ways:

- Dev Fee: This is a fee embedded in the software, where the software mines for the developers for a short period (e.g., 1 hour for every 24 hours of mining). It’s a way for developers to get compensated for their work.

- Subscription Fee: Some advanced mining software like HiveOS or RaveOS might charge a monthly or yearly subscription fee, offering features like advanced analytics, automation, or improved efficiency.

9. Economic Risks

- Hardware Resale Value: If a miner decides to exit the mining business, the resale value of their equipment can be a concern, especially if the hardware is specialized.

- Market Uncertainty: The future of cryptocurrencies is still uncertain. Regulatory changes, technological advancements, or market dynamics can significantly impact the mining landscape.

Environmental Impact of Crypto Mining

Cryptocurrency mining, particularly Bitcoin mining, has garnered significant attention due to its environmental implications. The energy-intensive nature of mining operations, combined with the source of that energy, can have a substantial environmental footprint. Here’s an in-depth look at the environmental impact of crypto mining:

1. High Energy Consumption

- Computational Power: Mining involves solving complex mathematical problems, which requires significant computational power. This, in turn, demands a lot of electricity.

- Continuous Operation: Mining operations, especially large-scale ones, run 24/7 to maximize profits. This constant operation further amplifies energy consumption.

2. Carbon Footprint

- Energy Source: The carbon footprint of mining largely depends on the source of its electricity. Mining operations powered by coal or other non-renewable sources have a much higher carbon footprint compared to those using renewable energy.

- Geographical Distribution: Regions where electricity is primarily coal-based see a higher environmental impact from mining. For instance, certain areas in China, which account for a significant portion of global Bitcoin mining, rely heavily on coal power.

3. E-Waste

- Hardware Lifecycle: Mining equipment, especially ASIC miners, can have a limited life span. As newer, more efficient models are developed, older ones become obsolete and are discarded, contributing to electronic waste.

- Recycling Challenges: Not all components of mining rigs are recyclable. Some parts can end up in landfills, posing environmental hazards.

4. Heat Production

- Cooling Needs: Mining equipment, especially when operating continuously, generates a lot of heat. Cooling these machines requires additional energy, often in the form of air conditioning or specialized cooling systems.

- Potential for Reuse: Some innovative setups capture and reuse the heat generated from mining operations, turning a potential environmental challenge into a solution. For instance, using the heat to warm buildings during colder months.

5. Water Usage

- Cooling Systems: Large-scale mining farms, especially those in warmer climates, might use water-cooling systems. This can strain local water resources, especially if they are in areas where water is scarce.

6. Mitigation Efforts

- Transition to Renewable Energy: Some mining operations are transitioning to renewable energy sources, such as solar or wind, to power their operations and reduce their carbon footprint.

- Proof of Stake (PoS): As an alternative to the energy-intensive Proof of Work (PoW) consensus mechanism, PoS offers a more energy-efficient method to validate transactions and achieve consensus. Cryptocurrencies like Ethereum are moving towards PoS models to reduce their environmental impact.

- Energy-Efficient Algorithms: There’s ongoing research into creating more energy-efficient cryptographic algorithms that would reduce the energy requirements of mining.

Future of Crypto Mining

The world of cryptocurrency mining has evolved rapidly since the inception of Bitcoin in 2009. As with any burgeoning industry, the trajectory of crypto mining is influenced by technological advancements, market dynamics, regulatory changes, and broader societal trends. Here’s a look into the potential future of crypto mining:

1. Technological Advancements

- Next-Gen Hardware: As the demand for more efficient mining increases, we can expect further advancements in ASICs, GPUs, and other mining hardware. This will likely lead to faster, more energy-efficient, and cost-effective mining rigs.

- Quantum Computing: The advent of quantum computers poses both opportunities and challenges. While they might significantly increase mining speeds, they could also threaten the cryptographic security of existing blockchain networks.

2. Shift to Sustainable Energy

- Green Mining: With increasing awareness of the environmental impact of mining, there’s a growing emphasis on using renewable energy sources. Solar-powered and hydroelectric mining farms could become more prevalent.

- Heat Reutilization: Innovative solutions to harness the heat generated from mining operations, such as using it for space heating, could become standard practice.

3. Consensus Mechanisms

- Proof of Stake (PoS) and Beyond: As environmental concerns mount, more cryptocurrencies might shift from energy-intensive Proof of Work (PoW) mechanisms to alternatives like PoS, which offer security without the significant energy consumption.

- Hybrid Models: Some networks might adopt hybrid models, combining elements of PoW and PoS, to leverage the strengths of both systems.

4. Decentralization vs. Centralization

- Home Mining Revival: Efforts to make mining more energy-efficient and accessible might lead to a resurgence of home mining or small-scale operations.

- Mining Pools & Centralization: On the flip side, the continued growth of large mining pools could lead to further centralization, posing risks to the decentralized ethos of cryptocurrencies.

5. Regulatory Landscape

- Stricter Regulations: As crypto becomes more mainstream, governments might implement stricter regulations around mining, especially concerning energy consumption and environmental impact.

- Tax Implications: Clearer tax guidelines and structures for mining rewards could emerge, impacting the profitability of mining operations.

6. Economic Factors

- Market Volatility: The profitability of mining will continue to be influenced by the volatile nature of cryptocurrency prices. Miners will need to adapt to market fluctuations and potentially diversify their operations.

- Global Economic Trends: Economic downturns, energy prices, and geopolitical events can influence the cost-efficiency and attractiveness of mining operations in various regions.

7. Enhanced Security

- Advanced Protocols: As cyber threats evolve, we can expect the development of more advanced security protocols to protect mining operations from hacks, thefts, and other malicious activities.

Conclusion

The realm of cryptocurrency mining is a fascinating blend of technology, economics, and environmental considerations. At its core, understanding “how crypto mining works” is pivotal not just for those directly involved in mining, but for anyone invested in the broader cryptocurrency ecosystem. As we’ve explored, the choice of mining algorithm, the hardware employed, and the associated environmental implications are all interconnected. These elements collectively shape the future trajectory of crypto mining.

As the digital currency landscape continues to evolve, so will the methods and technologies behind mining. It’s essential for enthusiasts, investors, and everyday users to stay informed about these developments. By grasping the intricacies of “how crypto mining works,” one can better navigate the dynamic world of cryptocurrencies, making informed decisions and contributing to a more sustainable and decentralized digital future.

FAQs

What is the primary purpose of crypto mining?

Mining validates and records transactions on the blockchain.

Is crypto mining still profitable in 2023?

Profitability depends on various factors, including hardware, electricity costs, and the value of the cryptocurrency being mined.

How does crypto mining impact the environment?

Mining consumes significant electricity, leading to concerns about its carbon footprint. However, many miners are now turning to renewable energy sources.