Embarking on the journey of crypto trading can be both exciting and daunting. Understanding how to trade crypto is a crucial step in navigating this dynamic and often volatile digital landscape. This comprehensive guide will equip you with the knowledge and strategies needed to confidently trade cryptocurrencies.

Table of Contents

What is Cryptocurrency?

Cryptocurrency, often simply referred to as ‘crypto’, is a form of digital or virtual currency that uses cryptography for security. It operates independently of a central bank, making it a decentralized form of digital cash. The inception of cryptocurrency dates back to 2009 with the creation of Bitcoin, the first and most well-known cryptocurrency. Since then, the crypto universe has expanded, offering a myriad of digital currencies to trade and invest in.

Why Trade Cryptocurrency?

The world of cryptocurrency offers a unique and dynamic landscape for traders. Here are some reasons why trading cryptocurrency has become increasingly popular:

1. Market Accessibility

Cryptocurrency markets operate 24/7, unlike traditional stock markets that have specific trading hours. This round-the-clock operation provides traders with the flexibility to trade at any time, making it particularly appealing to those who want to trade part-time or those in different time zones.

2. High Volatility

Cryptocurrencies are known for their high volatility. While this can mean increased risk, it also presents opportunities for high returns. The price of cryptocurrencies can change rapidly in a very short time, making it possible for traders to experience significant gains from these price fluctuations.

3. Diversification

Trading cryptocurrencies can be an excellent way to diversify a trading portfolio. With thousands of cryptocurrencies available, traders have a wide range of options to choose from, each offering different benefits and risks.

4. Lower Entry Barrier

Unlike traditional markets where traders often require substantial capital to start, in the crypto market, traders can begin with a relatively small amount of money. This lower entry barrier makes cryptocurrency trading more accessible to individuals around the world.

5. Technological Advancements

The use of blockchain technology in the crypto market offers a level of transparency that is not typically seen in traditional markets. All transactions are recorded on a public ledger, providing transparency for each transaction.

6. Potential for High Returns

While trading cryptocurrencies can be risky, they also offer the potential for significant returns. For instance, those who bought Bitcoin early and held onto it have seen substantial returns on their investment.

Understanding Crypto Markets

Crypto markets operate on the principle of supply and demand, much like traditional financial markets. However, they differ in several key aspects. Crypto markets are decentralized, operate round the clock, and can be influenced by a variety of factors, including technological advancements, regulatory news, and market sentiment.

Types of Cryptocurrency

There are over 5,000 cryptocurrencies available for trading today. These can be broadly categorized into coins and tokens. Coins, like Bitcoin and Ethereum, have their own independent blockchains. Tokens, on the other hand, depend on another cryptocurrency’s blockchain. Each cryptocurrency has its unique features and uses, making it important to research and understand each one before trading.

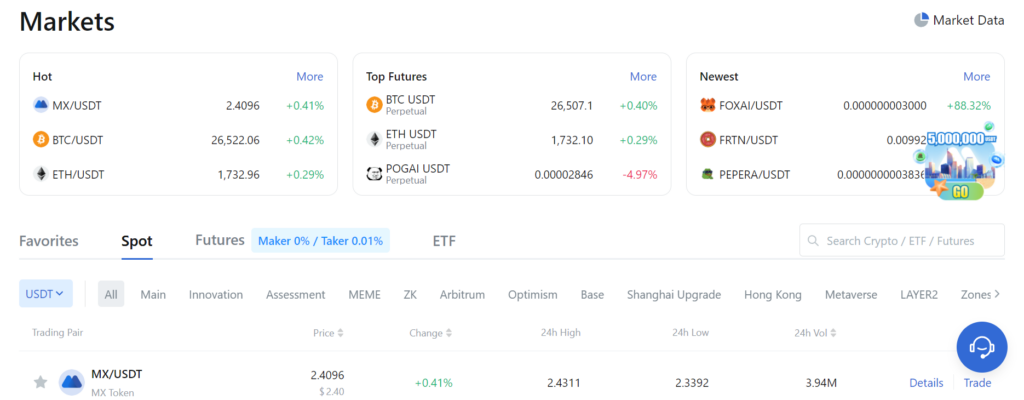

How to Choose a Cryptocurrency Exchange

Choosing the right cryptocurrency exchange is a critical step in your trading journey. Here are some factors to consider when selecting an exchange, with a focus on three popular platforms: MEXC, CoinEx, and Gate.io.

1. Security Measures

The security of your funds should be your top priority when choosing a cryptocurrency exchange. Look for exchanges that employ robust security measures such as two-factor authentication (2FA), cold storage, and encryption.

- MEXC: MEXC Exchange uses a multi-signature cold wallet to store users’ digital assets and employs a distributed architecture and DDOS attack defense system to ensure security.

- CoinEx: CoinEx uses a combination of cold storage and multi-signature wallets. It also offers two-factor authentication for added security.

- Gate.io: Gate.io uses a combination of cold storage and hot wallets for asset management. It also provides two-factor authentication and a host of other security features.

2. Trading Fees

Trading fees can significantly impact your trading profits, especially if you’re a high-volume trader. It’s essential to understand the fee structure of the exchange you choose.

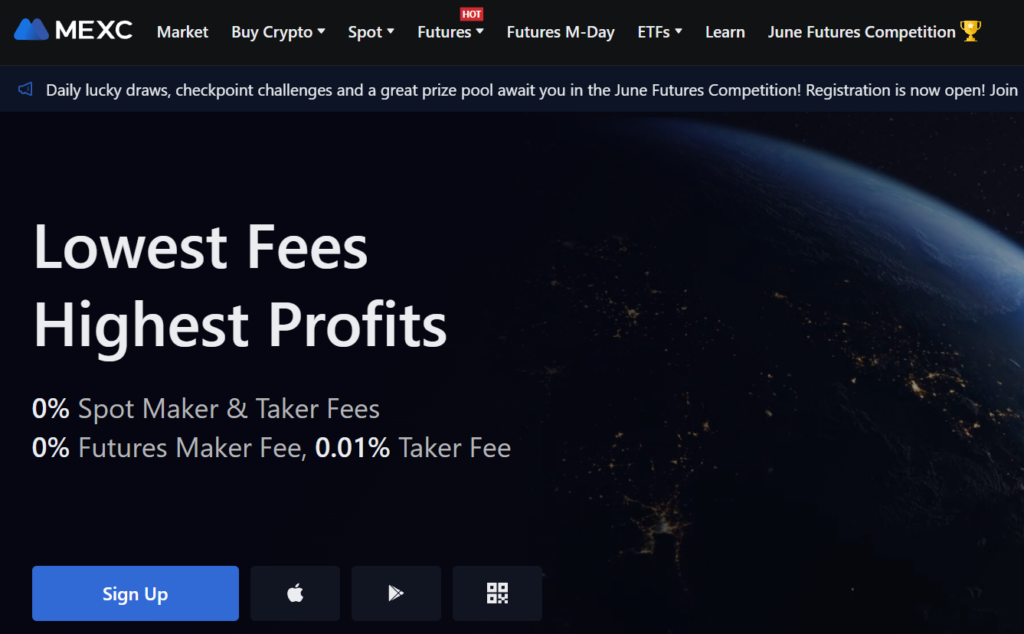

- MEXC: MEXC provides the lowest fees and has a maker-taker fee schedule that starts from 0% (promo action) and can go as low as 0.01% for high-volume traders.

- CoinEx: CoinEx also operates on a maker-taker model, with fees starting at 0.2%. However, fees can be reduced by using the platform’s native token, CET.

- Gate.io: Gate.io charges a flat fee of 0.2% for both makers and takers, which is slightly below the industry average.

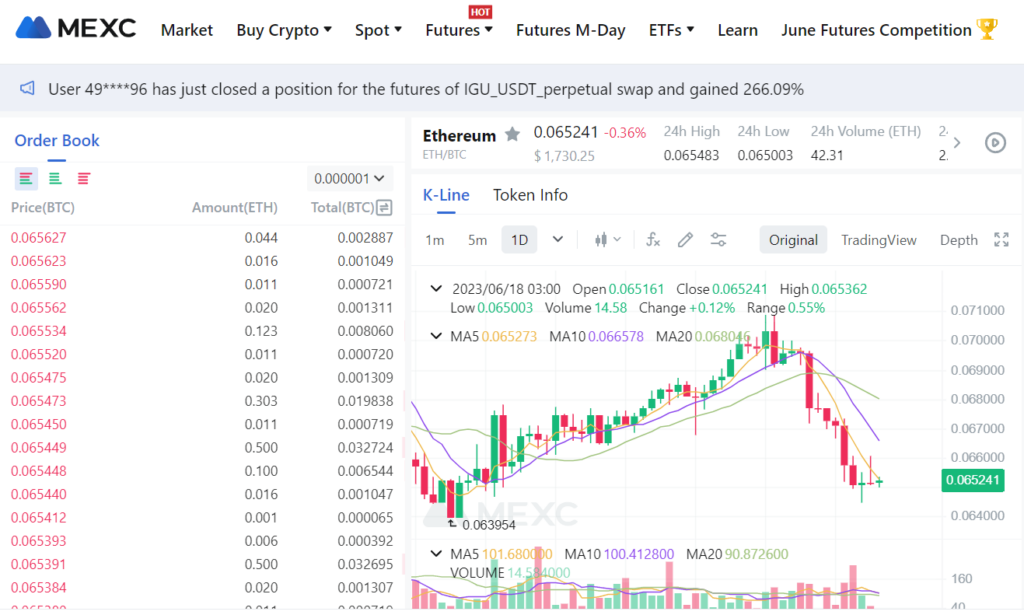

3. User Interface

A user-friendly interface can make your trading experience much smoother. Look for an exchange that offers a clean, intuitive interface with easy-to-use trading tools.

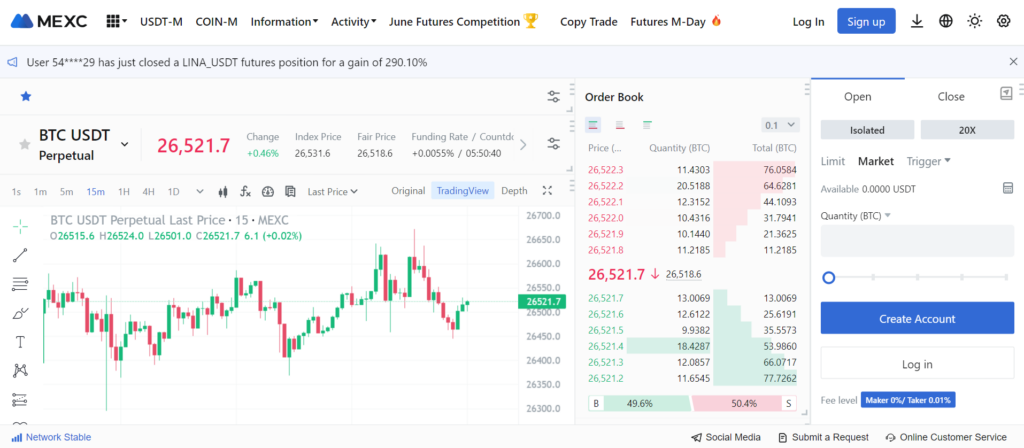

- MEXC: MEXC offers a sleek and user-friendly interface, with a variety of trading tools and charts to help users make informed decisions.

- CoinEx: CoinEx provides a simple and intuitive interface, suitable for both beginners and experienced traders.

- Gate.io: Gate.io offers a comprehensive and user-friendly interface, complete with advanced trading features for experienced traders.

4. Customer Support

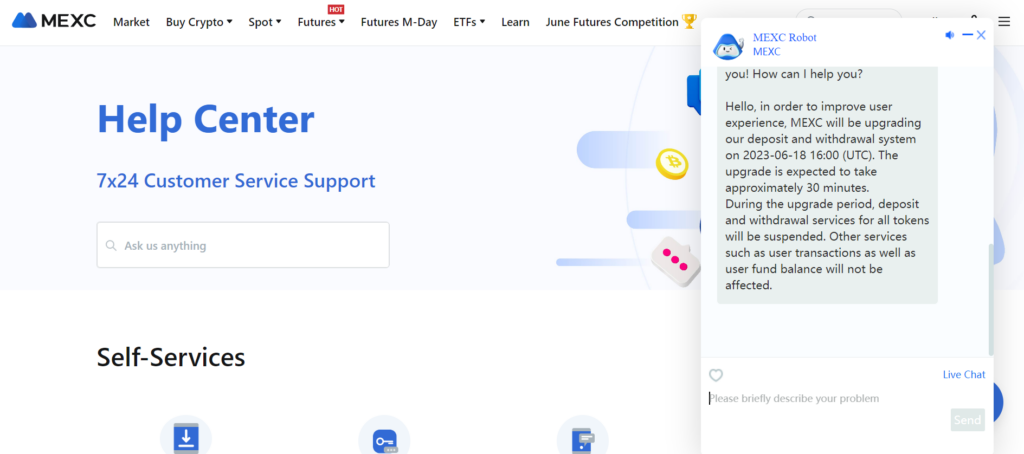

Reliable customer support can be invaluable, especially in a market as volatile as cryptocurrency. Look for exchanges that offer 24/7 customer support and have a reputation for quick and helpful responses.

- MEXC: MEXC provides 24/7 customer service and has a comprehensive FAQ section on their website.

- CoinEx: CoinEx offers round-the-clock customer support via email and live chat.

- Gate.io: Gate.io provides 24/7 customer support and has an extensive help center on their website.

5. Variety of Cryptocurrencies

The variety of cryptocurrencies offered by an exchange can impact your trading strategy. More options mean more opportunities for trading.

- MEXC: MEXC offers a wide range of cryptocurrencies for trading, including popular ones like Bitcoin and Ethereum, as well as lesser-known altcoins.

- CoinEx: CoinEx offers a broad selection of cryptocurrencies and also supports fiat-to-crypto transactions.

- Gate.io: Gate.io offers a vast array of cryptocurrencies and also provides various other financial products like margin trading and futures contracts.

In conclusion, choosing a cryptocurrency exchange is a personal decision that should be based on your specific needs and trading goals. MEXC, CoinEx, and Gate.io each offer unique features and benefits, so consider your options carefully before making a decision.

Setting Up a Crypto Trading Account

Setting up a crypto trading account is a straightforward process that involves several steps. Here’s a step-by-step guide:

Choose a Cryptocurrency Exchange

└───> Sign Up for an Account

└───> Verify Your Account (KYC)

└───> Set Up Two-Factor Authentication

└───> Deposit Funds into Your Account

└───> Start Trading

1. Choose a Cryptocurrency Exchange

The first step is to choose a cryptocurrency exchange that suits your trading needs and preferences. Consider factors such as security measures, transaction fees, user interface, customer support, and the variety of cryptocurrencies offered.

2. Sign Up for an Account

Once you’ve chosen an exchange, you’ll need to sign up for an account. This typically involves providing your email address and creating a password. Some exchanges may also require additional information such as your full name, contact information, and date of birth.

3. Verify Your Account

To comply with regulations, most exchanges require users to verify their identity before they can start trading. This process, known as Know Your Customer (KYC), typically involves submitting a copy of your ID and proof of address.

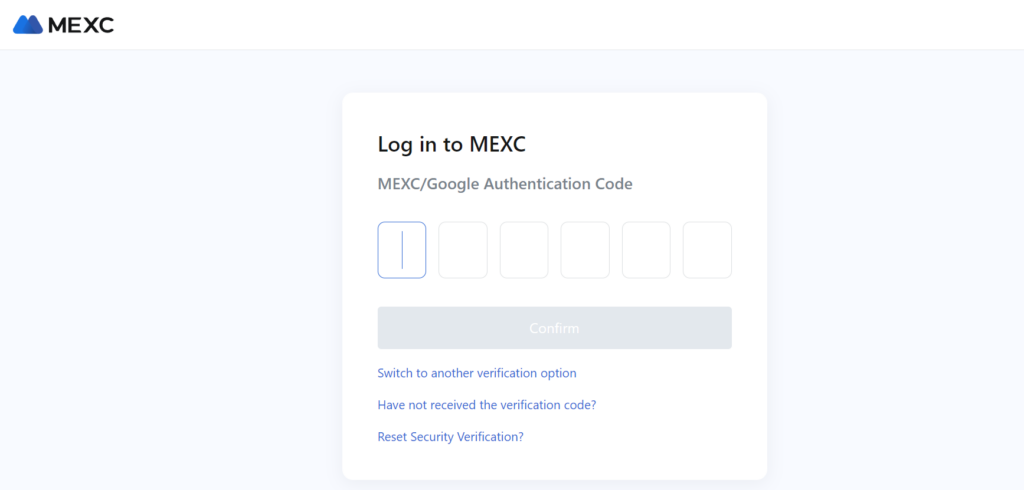

4. Set Up Two-Factor Authentication

For added security, it’s recommended to set up two-factor authentication (2FA). This typically involves linking your account to a mobile device and generating a unique code each time you log in.

5. Deposit Funds into Your Account

Once your account is set up and secure, you can deposit funds into your account. Most exchanges allow you to deposit funds in the form of cryptocurrency or fiat currency, depending on the exchange.

6. Start Trading

With funds in your account, you can start trading. Make sure to do your research and understand the market before making any trades.

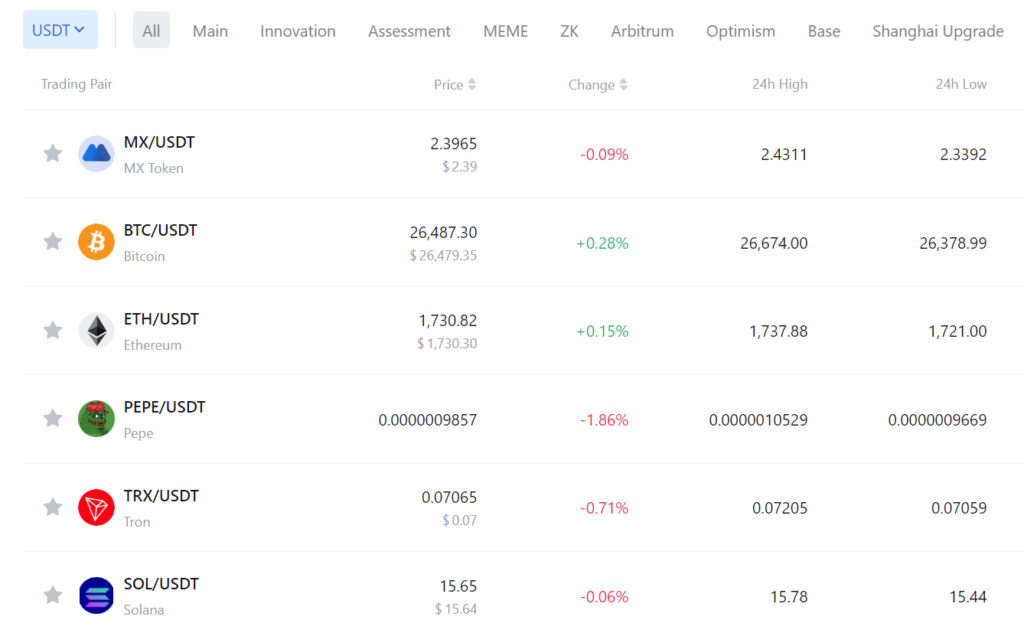

Understanding Crypto Trading Pairs

In the world of cryptocurrency trading, understanding trading pairs is crucial. A trading pair consists of two different types of cryptocurrency, which are traded against each other. The concept is similar to forex trading, where you might trade the US dollar against the euro.

1. What are Crypto Trading Pairs?

A crypto trading pair consists of two currencies that can be traded against each other. The first currency in the pair is called the base currency, and the second one is called the quote currency. For example, in the trading pair BTC/ETH, BTC is the base currency, and ETH is the quote currency. This means you are trading Bitcoin in exchange for Ethereum.

2. Why are Trading Pairs Important?

Trading pairs are important because they give you the information you need to make a trade. For instance, in the BTC/ETH pair, the price listed is the amount of ETH you would need to spend to buy one BTC. Understanding this is crucial for making informed trading decisions.

3. Common Types of Trading Pairs

There are two common types of trading pairs in the crypto world:

- Crypto-to-Crypto: These are trading pairs where both the base and quote currencies are cryptocurrencies. Examples include BTC/ETH, BTC/LTC, and ETH/LTC.

- Crypto-to-Fiat: These are trading pairs where the base currency is a cryptocurrency and the quote currency is a fiat currency like USD, EUR, or GBP. Examples include BTC/USD, ETH/USD, and LTC/USD.

4. How to Choose a Trading Pair

Choosing a trading pair depends on your trading strategy, the currencies you hold, and the currencies you wish to acquire. It’s important to research and understand both currencies in a trading pair before making a trade.

Understanding crypto trading pairs is a fundamental aspect of cryptocurrency trading. It allows traders to understand the value of one cryptocurrency in relation to another, enabling them to make informed trading decisions.

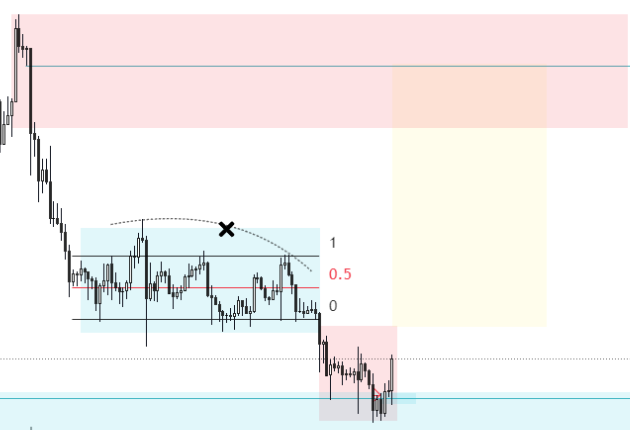

Crypto Trading Strategies

Crypto trading strategies are plans that traders implement to achieve their investment goals. These strategies can vary widely depending on a trader’s risk tolerance, time commitment, and financial goals. Here are some common crypto trading strategies:

1. Day Trading

Day trading involves making multiple trades within a single day, taking advantage of short-term price movements. Day traders spend a lot of time monitoring the markets and must be able to make quick decisions. This strategy requires a significant time commitment and a deep understanding of the crypto market.

2. Swing Trading

Swing trading is a strategy that attempts to capture gains over a period of a few days to several weeks. Swing traders aim to take advantage of the natural “swing” of the price cycles. This strategy requires patience and a good understanding of technical analysis.

3. Scalping

Scalping is a strategy that involves making large numbers of trades in the hopes of making small profits on each one. These profits can add up over time. Scalping is often done using bots or trading algorithms and requires a significant amount of time and attention.

4. Holding

Holding, or “Hodling,” is a long-term investment strategy where a trader buys a cryptocurrency and holds onto it for a long period, regardless of market volatility. This strategy is based on the belief that the price of the cryptocurrency will be higher in the future than it is at the time of purchase.

5. Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a strategy where a trader invests a fixed amount of money in a particular cryptocurrency at regular intervals, regardless of its price. This strategy can help mitigate the impact of volatility and reduce the risk of making a large investment at an inopportune time.

6. Trend Trading

Trend trading is a strategy that involves taking a position in a coin when it’s trending in a particular direction and exiting the position when the trend starts to reverse. This strategy can be used over any time frame – short, medium, or long term.

There’s no one-size-fits-all strategy for trading crypto. The best strategy depends on your individual goals, risk tolerance, and time commitment. It’s important to research and understand each strategy before deciding which one is right for you. Always remember to trade responsibly and only invest what you can afford to lose.

Risk Management in Crypto Trading

Risk management is a crucial aspect of any form of trading, including crypto trading. It involves identifying, assessing, and taking steps to reduce risks. Here are some key risk management strategies for crypto trading:

1. Only Invest What You Can Afford to Lose

This is the golden rule of any form of trading or investing. The volatile nature of the crypto market means prices can fluctuate wildly in a short period. Therefore, it’s crucial to only invest money that you can afford to lose.

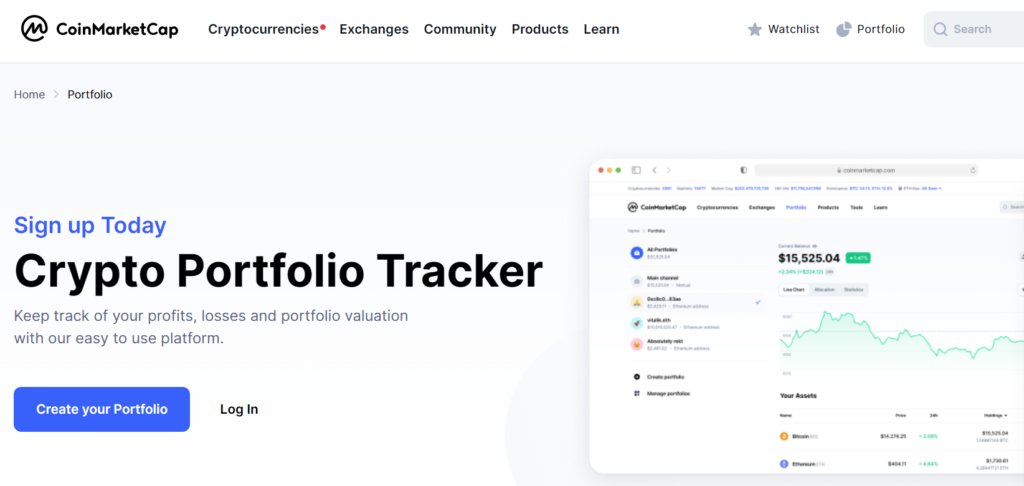

2. Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversifying your portfolio by investing in a variety of cryptocurrencies can help spread the risk. If one cryptocurrency performs poorly, others may perform well and offset the loss. You can create and track your portfolio here.

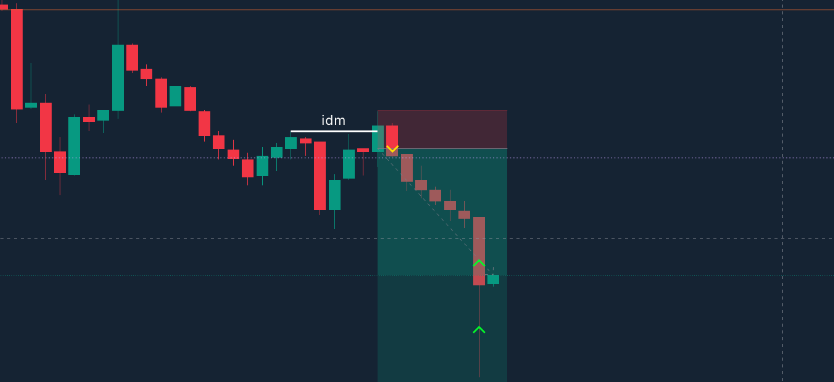

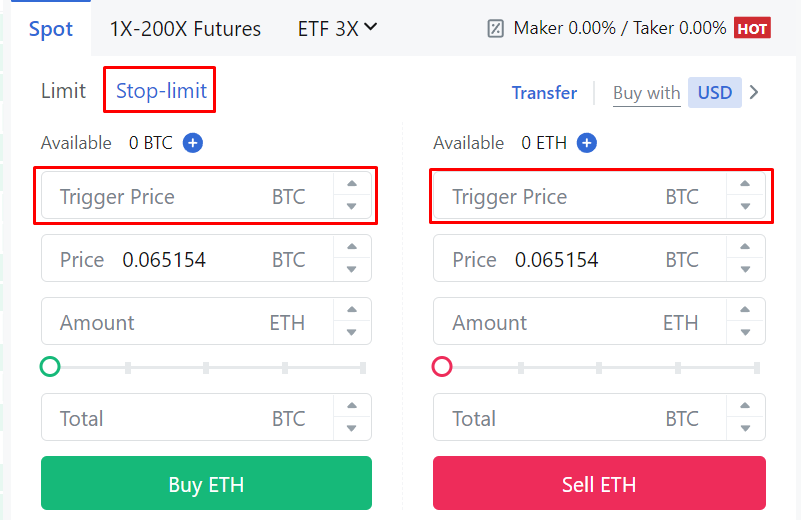

3. Use Stop Losses and Take Profits

A stop loss is an order to sell a cryptocurrency when it reaches a certain price, preventing further losses. On the other hand, a take profit order is set to sell a cryptocurrency once it reaches a certain price, securing profits. These tools can be particularly useful in the volatile crypto market.

4. Regularly Review and Adjust Your Strategy

The crypto market is highly dynamic, and what worked yesterday might not work today. Regularly review your trading strategy and make adjustments as necessary. Stay informed about market trends and news that could impact your investments.

5. Don’t Let Emotions Drive Your Decisions

Trading can be an emotional roller coaster. However, it’s important not to let emotions drive your trading decisions. Fear and greed can lead to poor decisions such as panic selling or holding onto a losing position for too long. Stick to your trading plan and don’t let emotions cloud your judgment.

6. Don’t Drink Before Trading

Alcohol can impair your judgment and decision-making abilities, which are crucial for successful trading. Trading under the influence can lead to rash decisions, such as taking on more risk than you can handle or making trades based on emotions rather than analysis. To maintain a clear mind and make the most informed decisions, it’s best to avoid drinking alcohol before and during trading.

7. Understand the Market

Knowledge is power in crypto trading. The more you understand about the crypto market, the better equipped you’ll be to manage risks. This includes understanding how different factors can impact the price of cryptocurrencies, such as regulatory news, technological advancements, and market sentiment.

While crypto trading can offer significant returns, it also comes with substantial risks. Implementing effective risk management strategies is crucial to protect your investments and increase your chances of successful trading. Always remember that the value of investments can go down as well as up, and you may lose your initial investment.

Conclusion

Navigating the world of cryptocurrency trading can be a thrilling journey. It offers opportunities for significant returns and the excitement of engaging with a new and rapidly evolving form of finance. However, like any investment, it comes with its own set of risks.

Understanding how to trade crypto involves more than just knowing the mechanics of buying and selling. It requires a deep understanding of the market, the ability to analyze trends, and the discipline to stick to a well-thought-out trading strategy. It also involves understanding the risks involved and implementing effective risk management strategies to protect your investments.

Choosing the right cryptocurrency exchange, understanding trading pairs, and developing a sound trading strategy are all crucial steps in becoming a successful crypto trader. Equally important is the ability to manage risks effectively, which includes only investing what you can afford to lose, diversifying your portfolio, using stop losses and take profits, regularly reviewing your strategy, and maintaining a clear mind by avoiding things like alcohol before trading.

In the volatile world of crypto trading, knowledge is your most valuable asset. Stay informed, stay disciplined, and remember that successful trading is a marathon, not a sprint. Happy trading!

What is the best strategy for trading crypto?

There is no one-size-fits-all strategy for trading crypto. The best strategy depends on your individual goals, risk tolerance, and time commitment. Some traders may prefer day trading, while others may opt for swing trading or holding.

Is it safe to trade crypto?

While trading crypto can be profitable, it also comes with risks. The crypto market is known for its volatility, which can lead to significant price swings. It’s important to implement effective risk management strategies to protect your investments.

How can I start trading crypto?

To start trading crypto, you’ll first need to choose a cryptocurrency exchange and set up a trading account. Once your account is set up, you can deposit funds and start trading.

What are the most popular cryptocurrencies to trade?

Bitcoin and Ethereum are among the most popular cryptocurrencies to trade due to their market capitalization and liquidity. However, there are many other cryptocurrencies that traders can consider, depending on their trading strategy and risk tolerance.