Cryptocurrency day trading has emerged as a lucrative yet challenging venture. The key to mastering this art lies in the platform you choose. So, which is the best crypto exchange for day trading? Let’s embark on this journey to unveil the top contenders of 2025.

Table of Contents

What to Look for in a Crypto Exchange for Day Trading

Trading Volume and Liquidity

Significance

Trading volume represents the number of assets traded on an exchange within a specific timeframe, usually 24 hours. High trading volume is often synonymous with high liquidity, which means assets can be quickly bought or sold without causing significant price fluctuations.

Benefits for Day Traders

Price Stability

High liquidity prevents drastic price changes during large trades, ensuring more predictable price movements.

Quick Order Execution

Orders get filled faster in liquid markets, which is crucial for crypto traders who often operate on tight margins.

Better Spread

The difference between the buying and selling price (known as the spread) is generally lower in high-volume exchanges, reducing the cost of trades.

Trading Fees

Understanding Fee Structures

Most exchanges have a tiered fee structure based on trading volume. There are typically two types of fees: maker fees (for creating orders) and taker fees (for fulfilling orders). For better day trading experience choose the crypto exchange with lowest fees.

Benefits for Day Traders

- Cost Efficiency: Day traders execute multiple trades daily. Even a slight reduction in fees can lead to significant savings.

- Promotions and Discounts: Some exchanges offer reduced fees for high-volume traders or loyalty promotions, further enhancing profitability.

Security Measures

The Threat Landscape

The crypto world, while lucrative, is rife with threats like hacking, phishing, and fraud.

Essential Security Protocols

- Two-Factor Authentication (2FA): An additional layer of security where users verify their identity using a second method, usually a mobile code.

User Interface and Experience

The Need for Intuitive Design

Day trading requires quick decisions. A cluttered or confusing interface can lead to costly mistakes.

Key Features

Real-time Price Charts

Visual representation of price movements.

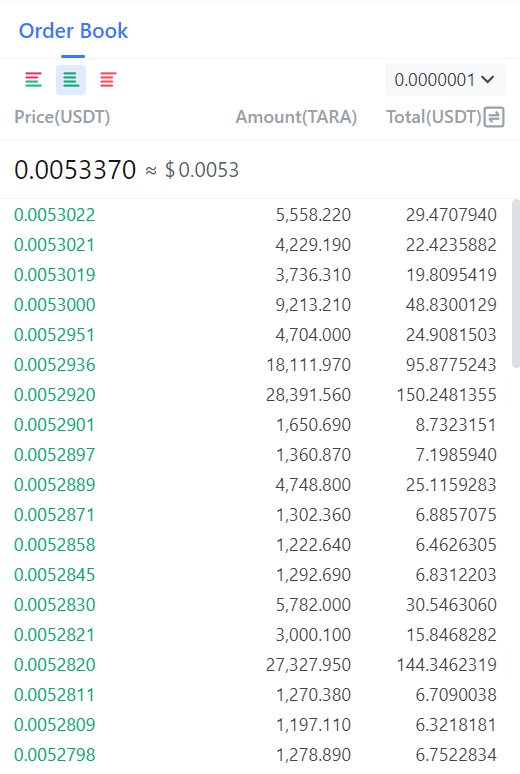

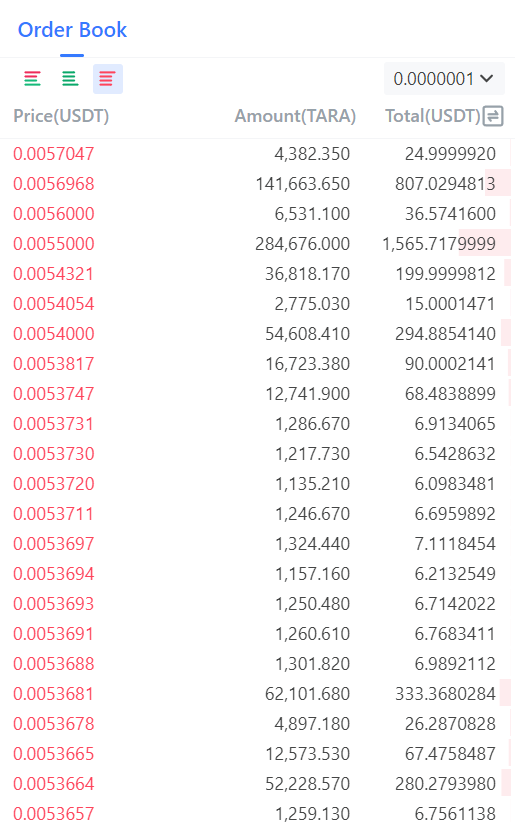

Order Book Visibility

Displays pending orders, providing insights into potential price movements.

Quick Trade Execution

Features like one-click trading can be invaluable for day traders.

Mobile Trading Capabilities

The Rise of On-the-Go Trading

With the increasing reliance on smartphones, many traders prefer executing trades from their mobile devices.

Essential Mobile Features

- Push Notifications: Real-time alerts on price movements, order completions, or news events.

- Biometric Security: Enhanced security using fingerprint or facial recognition.

- Full Functionality: The mobile app should mirror the desktop experience, ensuring no feature is missed out.

Customer Support

The Backbone of Any Platform

When things go awry, responsive customer support can be a trader’s best ally.

Support Channels

- Live Chat: Instant support for urgent queries.

- Email and Ticketing: For detailed issues or documentation.

- Knowledge Base: A self-help repository with articles, guides, and FAQs.

Comprehensive Reviews of Top 6 Crypto Exchanges for Day Trading

Chart: Overview of Selected Crypto Exchanges

| Exchange | Trading Volume | Leverage Level | Maker Fees | Taker Fees | KYC |

|---|---|---|---|---|---|

| MEXC | 474 mln | 200x | 0% | 0.03% | No (30 BTC per day) |

| OKX | 550 mln | 125x | 0.02% | 0.05% | No (10 BTC per day) |

| BingX | 285 mln | 150x | 0.02% | 0.04% | No (50K USDT per day) |

| Bitget | 362 mln | 125x | 0.02% | 0.06% | Yes |

| Gate | 445 mln | 125x | 0.015% | 0.05% | Yes |

| Bybit | 736 mln | 100x | 0.02% | 0.04% | Yes |

Note: All of the above exchanges have a great multiplatform support and robust mobile applications optimized for day trading.

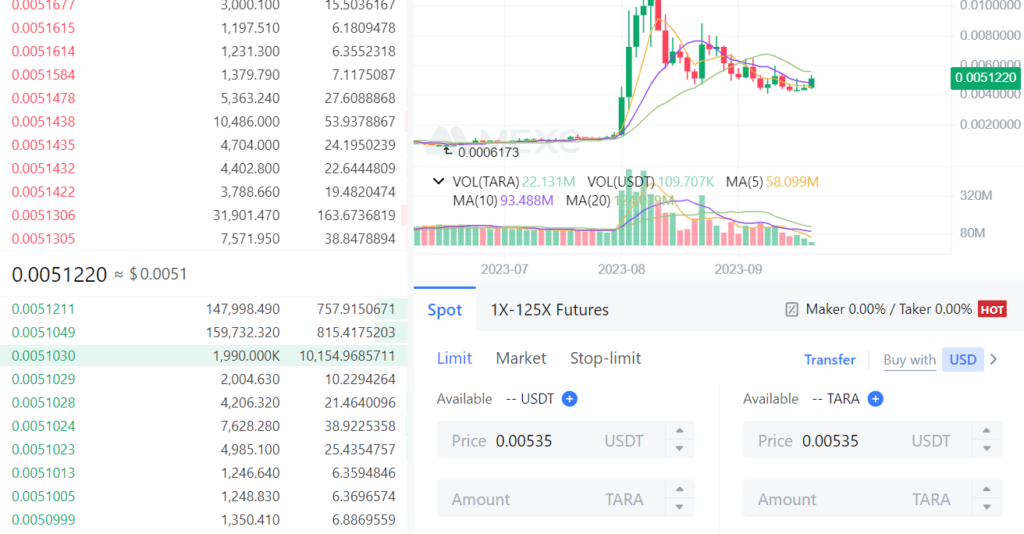

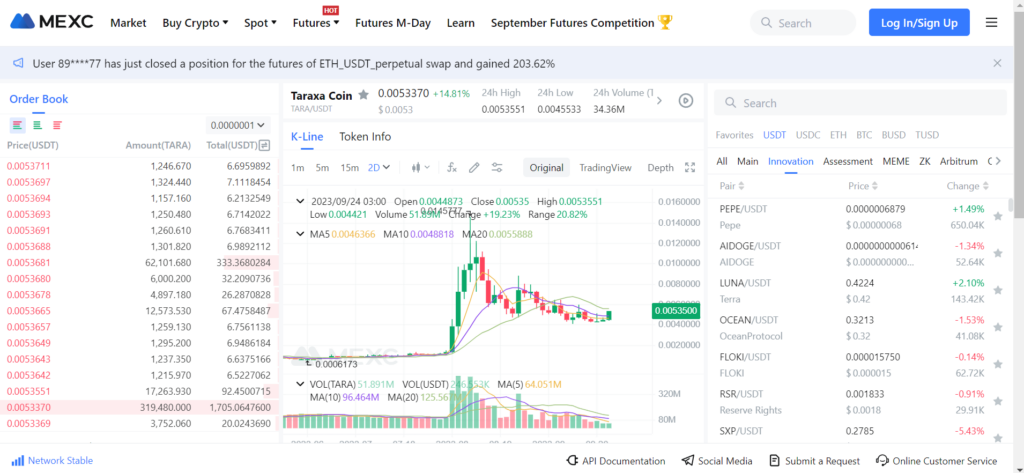

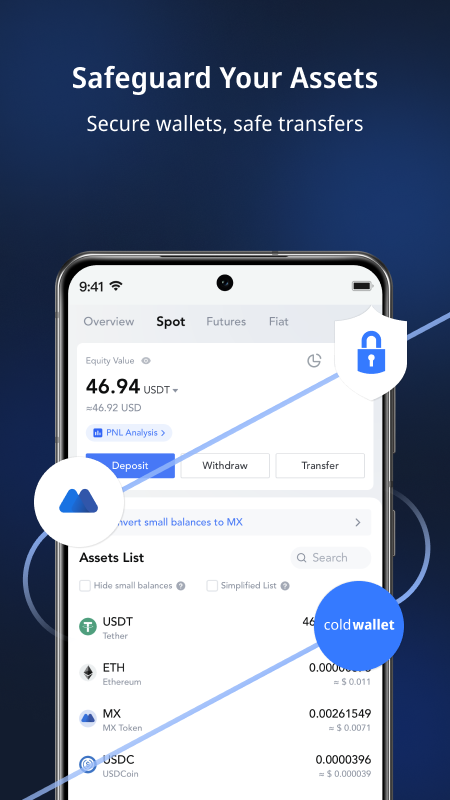

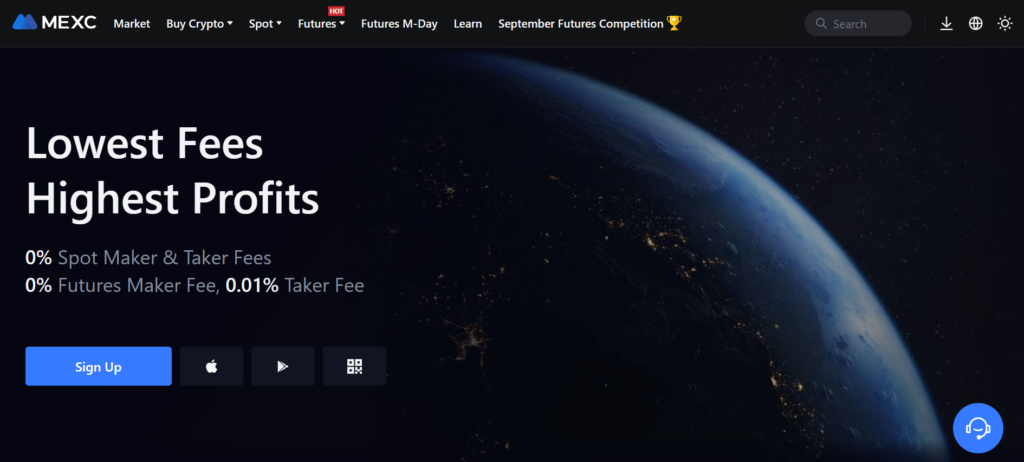

1. MEXC: The Powerhouse of Low Fees

MEXC is a great no KYC crypto exchange which stands out with its impressive trading volume and offers the highest leverage among the exchanges listed. It boasts a 0% maker and taker fee for spot trading, making it an attractive option for day traders. The platform is known for its user-friendly interface and a plethora of trading pairs. MEXC also frequently hosts competitions and events, such as the “15-200x Futures Leverage Challenge,” where traders can win bonuses. Their mobile application is intuitive, ensuring traders can execute trades on the go.

Features for Crypto Day Traders:

- Futures Trading: MEXC offers futures trading with top-tier liquidity and boasts a 0% maker fee, making it an attractive option for traders looking to leverage their positions.

- Spot Trading: MEXC ranks high in terms of the number of cryptocurrencies listed, providing traders with a wide array of options for spot trading.

- MEXC Mobile App: The platform offers a comprehensive mobile app experience, available on iOS, Android, and Windows. This ensures traders can execute trades, monitor their portfolio, and stay updated on the go.

- High-Quality Crypto Projects: MEXC emphasizes launching new and high-quality crypto projects efficiently, ensuring good liquidity for traders.

- World-Class Security System: MEXC prioritizes the security of its users’ funds and data, implementing top-notch security measures.

Pros:

- Competitive Rates: MEXC claims to offer the lowest rates in the market, making it a cost-effective choice for traders.

- Best Liquidity: With its focus on providing the best liquidity in the market, traders can expect smooth and quick trade executions.

- Fast Crypto Listing: MEXC’s ability to quickly list a wide range of cryptocurrencies ensures traders have access to emerging and trending assets.

- User-Friendly Interface: Whether on the web platform or the mobile app, MEXC offers an intuitive and user-friendly trading experience.

Cons:

- None.

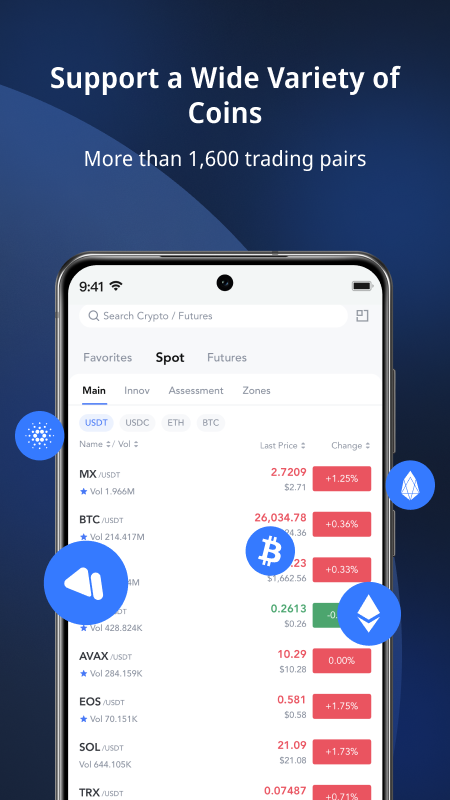

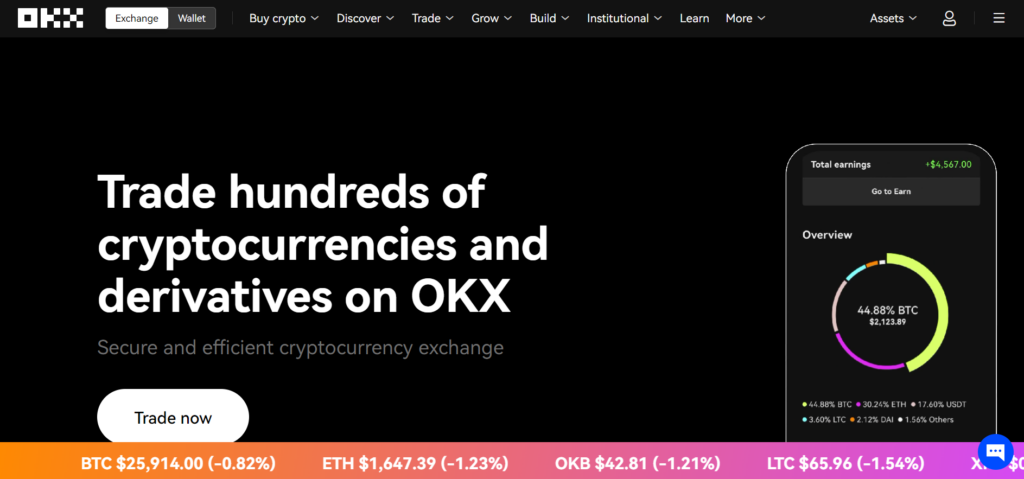

2. OKX: A Blend of Volume and Flexibility

With a trading volume of 550 million, OKX is another major player in the crypto exchange arena. It offers a decent leverage level of 125x and has competitive fees. OKX is known for its security features and a wide range of supported cryptocurrencies. The platform also emphasizes user education, providing resources for both beginners and seasoned traders. Its mobile application is designed for seamless trading, with real-time price tracking and advanced charting tools.

Features for Crypto Day Traders:

- Trade like a pro: OKX offers features such as low fees, a world-class matching engine, and powerful APIs.

- One app. Unlimited possibilities: OKX provides a comprehensive app experience where users can jump from trading to DeFi to NFTs all in one place.

- A mode for everyone: Whether you’re new to crypto or an experienced trader, OKX has a mode tailored for you.

Pros:

- Low fees: OKX boasts some of the lowest fees in the industry.

- Powerful APIs: For those looking to automate their trading or integrate with other platforms, OKX offers robust APIs.

- Diverse trading options: From traditional crypto trading to DeFi and NFTs, OKX provides a wide range of options for traders.

Cons:

- Regional restrictions: OKX Exchange products aren’t available in certain regions, including the United States, due to local laws and regulations.

3. BingX: High Leverage with Generous Withdrawal Limits

BingX may have a lower trading volume compared to others, but it offers a high leverage level of 150x. The exchange is also notable for its generous withdrawal limit of 50K USDT per day without KYC. BingX focuses on providing a smooth trading experience, with a user-friendly interface and a range of tools to assist traders in making informed decisions. The mobile app is optimized for day trading, with features like price alerts and quick trade execution.

4. Bitget: Safety First with KYC

Bitget emphasizes security, making it mandatory for users to complete the KYC process. With a trading volume of 362 million and a leverage level of 125x, it offers a balanced trading environment. Bitget is known for its advanced trading tools and detailed analytics, helping traders strategize effectively. The mobile application is feature-rich, allowing traders to manage their portfolio, set alerts, and execute trades with ease.

Features for Crypto Day Traders:

- Copy Trading: Bitget boasts itself as the world’s largest crypto copy trading platform. This feature allows users to replicate the trades of elite traders, potentially benefiting from their expertise.

- Spot and Futures Trading: Bitget offers both spot and futures trading options for its users.

- Trading Bots: Automated trading strategies can be employed using Bitget’s trading bots.

- Mobile App: Bitget offers a mobile app that allows users to trade anytime and anywhere, ensuring they never miss a trading opportunity.

- Security: Bitget emphasizes its security measures, including Proof of Reserves, cold storage for digital assets, and a Protection Fund of 300M USDT to guard against security threats.

Pros:

- High Liquidity: With a 24h trading volume of 362 mln USDT, Bitget ensures high liquidity for its traders.

- Diverse Cryptocurrency Options: Bitget lists over 550 cryptocurrencies, offering a wide range of trading options.

- Low Transaction Fees: Bitget prides itself on having some of the lowest transaction fees in the industry, with rates below 0.10%.

- Brand Ambassador: International football superstar Lionel Messi serves as Bitget’s brand ambassador, adding to the platform’s credibility and global appeal.

Cons:

- Complexity for Beginners: With a plethora of features and trading options, beginners might find the platform a bit overwhelming initially.

- Risk Associated with Copy Trading: While copy trading can be beneficial, it also comes with risks, especially if the trader being copied makes poor decisions.

5. Gate: A Blend of Security and Efficiency

Gate has carved a niche for itself with a trading volume of 445 million. It offers a leverage level of 125x and has a competitive fee structure. Gate prioritizes user security, making KYC mandatory. The platform is designed for both beginners and professionals, with a range of tools and resources to enhance the trading experience. The mobile app is intuitive, with features like real-time tracking, advanced charting, and quick trade options.

Features for Crypto Day Traders:

- Extensive Cryptocurrency Selection: With over 1,700 cryptocurrencies available, traders have a vast array of options to choose from.

- Perpetual Futures: Gate.io offers perpetual futures with a Hedge Mode, allowing up to 100X leverage. This feature enables traders to amplify their income by going long or short.

- Instant Deposit/Withdrawal: The platform boasts an efficient and convenient trading system, ensuring that traders can deposit and withdraw their funds instantly.

- Quantitative Strategies: Gate.io provides various quantitative strategies, and traders can also copy the strategy of top earners on the platform’s Leaderboard.

- NFT Marketplace: Users can create their NFT assets for free, earn lasting royalty income, and explore high-quality projects.

Pros:

- Security: Gate.io protects users’ funds with both centralized and decentralized methods. It has also invested millions in security and law funds to ensure additional protection.

- Reliability: Operating stably since 2013, Gate.io has a track record of being a reliable exchange for a decade.

- Transparency: As one of the earliest and largest cryptocurrency exchanges, Gate.io has always complied strictly with regulations and has never allowed market manipulation.

- User-Friendly Mobile App: The Gate.io mobile app allows traders to execute trades from anywhere, anytime.

Cons:

- US Restrictions: Gate.io does not offer services to US users. US-based traders need to access Gate.us instead.

- KYC Requirements: While some traders appreciate the added security of KYC, others might find it cumbersome, especially if they’re looking for quick and anonymous trades.

6. Bybit: The Volume Leader

Bybit leads the pack with a whopping trading volume of 736 million. It offers a leverage level of 100x and has a transparent fee structure. Known for its robust security measures, Bybit has become a preferred choice for many day traders. The platform offers advanced trading tools, detailed analytics, and a range of educational resources. The mobile application is designed for on-the-go trading, with a user-friendly interface and a range of features to enhance the trading experience.

Features for Crypto Day Traders:

- Unified Trading Account: Bybit allows users to trade Spot, Derivatives, and Options all from a single account, providing flexibility and convenience.

- Trading Bot: Bybit offers a trading bot feature that lets users navigate the crypto world on autopilot, optimizing trading strategies.

- Spot Grid: This feature allows users to buy low and sell high automatically, making it ideal for sideways markets.

- Bybit Card: A unique feature that lets users seamlessly convert and pay with crypto worldwide.

- Bybit Web3: Bybit is diving into the Web3 space, offering next-level reliability, innovation, and opportunities.

Pros:

- High Liquidity: With a 24H trading volume exceeding 736 mln USD, Bybit ensures high liquidity for its traders.

- Security: Triple-layer asset protection is in place, with user funds securely stored offline in cold wallets. The platform also emphasizes real-time monitoring and advanced data protection.

- User-Friendly Mobile App: Whether on iOS or Android, the Bybit app ensures traders can execute trades and monitor their portfolios on the go.

- 24/7 Customer Support: Bybit offers round-the-clock customer support, ensuring users get assistance whenever they need it.

Cons:

- Complex Interface: Some users might find Bybit’s interface a bit overwhelming, especially if they’re new to crypto trading.

- Lack of Detailed Information: While the platform offers a plethora of features, there’s a lack of in-depth information on some of them, which might require users to do additional research.

How to Day Trade Crypto on Any of These Exchanges: A Comprehensive Guide

Here’s a step-by-step guide on how to day trade crypto on any of the aforementioned exchanges.

1. Setting Up Your Account

- Registration: Begin by visiting the official website of your chosen exchange. Sign up by providing your email address, setting a strong password, and verifying your email.

- KYC Process: Some exchanges like Bitget and Gate require a Know Your Customer (KYC) verification. This involves uploading identification documents and sometimes a selfie for verification. It’s a security measure to prevent fraud.

- Two-Factor Authentication (2FA): For added security, enable 2FA. This typically involves linking your account to a mobile app like Google Authenticator, which generates time-sensitive codes.

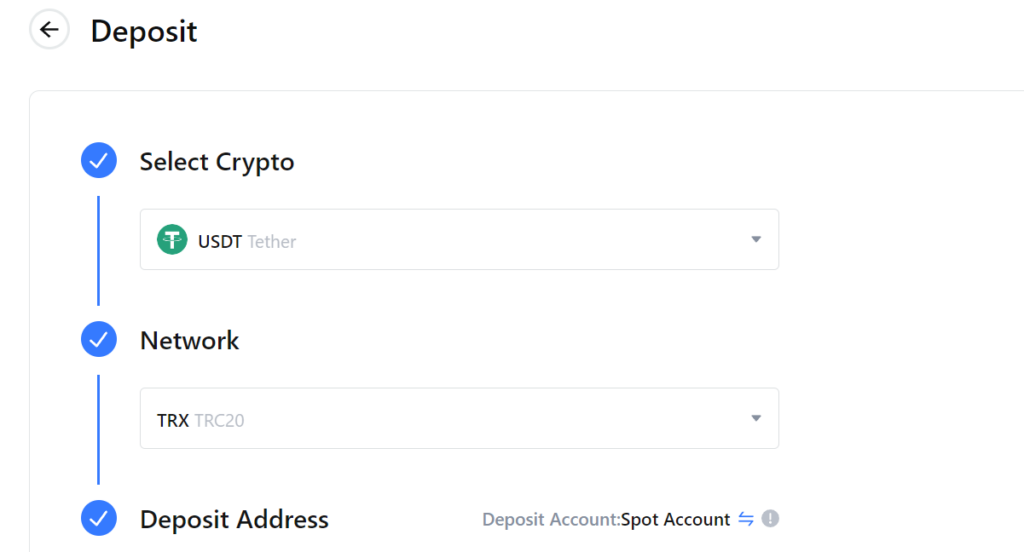

2. Depositing Funds

- Wallet Address: Once registered, navigate to the ‘Wallet’ or ‘Deposits’ section. Here, you’ll find your unique crypto wallet address for the exchange.

- Transfer Funds: From your external wallet or another exchange, send the cryptocurrency to this address. Ensure you’re sending the right crypto to the correct address (e.g., BTC to a BTC address).

- Wait for Confirmations: Crypto transfers require network confirmations. Depending on the cryptocurrency, this can take anywhere from a few minutes to an hour.

3. Understanding the Trading Interface

- Dashboard: Familiarize yourself with the dashboard. This is where you’ll see real-time price charts, order books, and your open trades.

- Order Types: Understand the difference between market orders (buy/sell immediately at market price) and limit orders (buy/sell at a specific price).

- Leverage: Some exchanges offer leveraged trading. This allows you to borrow funds to increase your trading position. For instance, with 100x leverage, a $100 position becomes $10,000. But be cautious, as leverage also amplifies losses.

4. Developing a Trading Strategy

- Technical Analysis: Use tools like Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI) to predict price movements.

- Set Stop-Losses: Always set a stop-loss order to limit potential losses. Decide on an exit point before entering a trade.

- Stay Updated: Follow crypto news, as real-world events can impact prices. Use platforms like Twitter, Reddit, and crypto-specific news websites.

5. Executing Trades

- Start Small: Especially if you’re new, begin with smaller amounts until you’re confident in your strategy.

- Monitor Trades: Keep an eye on your open positions. Use the exchange’s mobile app to track trades on the go.

- Take Profits: Don’t get greedy. If a trade hits your target profit, consider cashing out, even if you believe it might go higher.

6. Withdrawing Profits

- Navigate to Withdrawals: Once you’ve made a profit and want to cash out, go to the ‘Withdraw’ section.

- Enter External Wallet Address: Provide the address of your external wallet or another exchange where you want to send the funds.

- Confirm and Wait: After confirming the withdrawal, wait for it to process. Always double-check withdrawal addresses.

Tips for Successful Day Trading on Crypto Exchanges

Educate Yourself

- Understand the Basics: Before diving into day trading, ensure you have a solid understanding of the cryptocurrency market, blockchain technology, and the specific coins you’re interested in.

- Stay Updated: The crypto world evolves rapidly. Regularly read news, follow reputable crypto influencers, and participate in forums or discussion groups.

Start Small

- Test the Waters: Begin with a small amount that you’re willing to lose. This approach allows you to get a feel for the market without risking significant capital.

- Diversify: Don’t put all your eggs in one basket. Spread your investments across multiple cryptocurrencies to mitigate risks.

Set Clear Goals and Limits

- Profit and Loss Thresholds: Determine in advance the profit you aim to achieve and the loss you’re willing to tolerate. Stick to these limits to avoid emotional decision-making.

- Regularly Review: Periodically reassess your goals based on market conditions and your trading performance.

Use Technical Analysis

- Chart Patterns: Familiarize yourself with common chart patterns like head and shoulders, flags, and triangles. These can give insights into potential price movements.

- Indicators: Tools like Moving Averages, Bollinger Bands, and the Relative Strength Index can help predict future price actions.

Stay Calm and Disciplined

- Avoid Emotional Trading: The crypto market is known for its volatility. It’s crucial to remain calm during market swings and avoid making impulsive decisions.

- Stick to Your Strategy: Once you’ve developed a trading strategy, be disciplined enough to stick to it, even when tempted to stray.

Use Stop-Losses

- Protect Your Capital: A stop-loss is an order placed with a broker to buy or sell once the stock reaches a certain price. It’s a tool to prevent large losses in volatile markets.

- Reassess Regularly: Adjust your stop-loss orders based on market conditions and your risk tolerance.

Stay Informed About Regulatory Changes

- Global Landscape: Cryptocurrency regulations vary from country to country. Ensure you’re aware of the regulations in your country and any changes that might affect your trading.

Security First

- Use Reputable Exchanges: Always trade on well-known and reputable exchanges. Check reviews, security measures, and the platform’s history.

- Enable Two-Factor Authentication: This adds an extra layer of security to your accounts, making it harder for unauthorized users to gain access.

Continuous Learning

- Never Stop Educating Yourself: The crypto space is continuously evolving. Dedicate time to learn about new coins, technologies, and trading strategies.

- Learn from Mistakes: Every trader makes mistakes. Instead of getting discouraged, analyze what went wrong and use it as a learning opportunity.

Network with Other Traders

- Share Insights: Joining trading communities can provide valuable insights, tips, and strategies that you might not have come across on your own.

- Stay Grounded: Interacting with fellow traders can also help in keeping emotions in check, as they can offer a more objective perspective during turbulent market times.

Conclusion

The realm of cryptocurrency day trading is as exhilarating as it is challenging. With the potential for significant returns, it’s no wonder that many are drawn to this digital gold rush. However, as we’ve explored throughout this article, success in this arena isn’t merely about seizing opportunities but also about meticulous preparation, continuous learning, and unwavering discipline.

Choosing the right exchange is a pivotal step. Platforms like MEXC, OKX, BingX, Bitget, Gate, and Bybit each offer unique features tailored to different trading needs. From high leverage options to diverse cryptocurrency listings, from robust security measures to innovative trading tools, each exchange presents its strengths and considerations.

But beyond the technicalities and features of exchanges, successful crypto day trading hinges on the trader’s mindset and approach. The tips and strategies we’ve discussed serve as a compass, guiding both novices and seasoned traders through the volatile crypto seas. Embracing continuous education, setting clear boundaries, leveraging technical analysis, and networking with fellow traders are all integral to crafting a successful trading journey.

In the ever-evolving landscape of cryptocurrency, one thing remains constant: change. Prices will fluctuate, new coins will emerge, regulations will adapt, and technologies will advance. As traders, staying agile, informed, and grounded will be our most valuable assets.

In closing, crypto day trading is not just a pursuit of profit but a journey of self-discovery, resilience, and growth. As you embark or continue on this journey, may you navigate with clarity, trade with confidence, and achieve the success you seek.

FAQs

Why is exchange liquidity important in day trading?

Liquidity ensures smooth transactions and better price stability.

How do I choose the best crypto exchange for day trading?

Consider factors like trading volume, security measures, fees, user interface, customer support, and available trading tools. Researching and comparing exchanges, reading reviews, and testing platforms can help you make an informed decision.

How can I reduce fees in day trading?

Opt for exchanges with lower fee structures and consider fee discounts offered for high-volume traders.