Cryptocurrency, the digital gold of the 21st century, has been making headlines for its meteoric rise and potential for significant returns. But how can one navigate this volatile landscape and truly understand how to make money with cryptocurrency? This comprehensive guide will illuminate the path for you.

Key Takeaways

- Understanding Cryptocurrency: Before diving into the world of cryptocurrency, it’s crucial to understand what it is, why it’s valuable, and the risks involved. Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank.

- Investment Strategies: There are several strategies for making money with cryptocurrency, including long-term holding (HODLing), day trading, mining, staking, yield farming, and participating in DeFi platforms. Each strategy has its own risk and reward profile, and it’s important to choose the one that aligns with your financial goals and risk tolerance.

- Tools and Resources: To effectively navigate the cryptocurrency market, you’ll need the right tools and resources. This includes cryptocurrency exchanges, digital wallets, portfolio tracking apps, news and analysis websites, and educational resources.

- Legal and Tax Implications: Making money with cryptocurrency has legal and tax implications. It’s important to understand the legal status of cryptocurrency in your country, comply with any regulatory requirements, fulfill your tax obligations, and keep detailed records of your transactions.

- Benefits of Different Strategies: Each strategy for making money with cryptocurrency has its own benefits. HODLing, for example, offers potential for high returns and simplicity, while day trading allows for profit from short-term price fluctuations. Mining contributes to network security, staking and yield farming provide passive income, and DeFi offers open and accessible financial services.

Table of Contents

Understanding Cryptocurrency

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central bank and is based on blockchain technology, which ensures transparency and decentralization.

A Brief History of Cryptocurrency

The journey of cryptocurrency began in 2009 with the introduction of Bitcoin by an anonymous entity known as Satoshi Nakamoto. Since then, thousands of cryptocurrencies, often referred to as ‘altcoins’, have emerged, each with its unique features and uses.

Different Types of Cryptocurrencies

| Cryptocurrency | Launch Year | Notable Feature |

|---|---|---|

| Bitcoin (BTC) | 2009 | First Cryptocurrency |

| Ethereum (ETH) | 2015 | Smart Contracts |

| Ripple (XRP) | 2012 | Real-time International Transactions |

| Litecoin (LTC) | 2011 | Faster Transaction Times |

| Kaspa (KAS) | 2022 | Fastest POW, Blockdag |

Why Consider Cryptocurrency for Wealth Generation?

Cryptocurrency, often hailed as the ‘money of the future’, offers unique opportunities for wealth generation that are reshaping the financial landscape. Here’s why you might want to consider this digital frontier as a means to increase your earnings.

Potential for High Returns

Cryptocurrencies have shown a remarkable potential for high returns. For instance, those who recognized the potential of Bitcoin or Ethereum in their early days have seen their initial stakes multiply many times over. While past performance is not a guarantee of future results, the potential for significant returns remains a compelling reason for many to explore how to make money with cryptocurrency.

Diversification of Earnings Portfolio

Diversification is a key principle in wealth generation. By adding cryptocurrency to your earnings portfolio, you can spread risk and potentially increase overall returns. Cryptocurrencies often show price movements that are not correlated with traditional asset classes, such as stocks and bonds, providing a new avenue for wealth generation.

Increasing Acceptance and Use

More and more businesses, both online and offline, are beginning to accept cryptocurrencies as a form of payment. This increasing acceptance and use are creating more opportunities for individuals to make money with cryptocurrency. From earning cryptocurrencies through freelance work to receiving tokens as part of a blockchain-based loyalty program, the ways to earn are expanding.

Innovation and Growth

The cryptocurrency sector is at the forefront of technological innovation. From the development of decentralized finance (DeFi) to the rise of non-fungible tokens (NFTs), new opportunities for making money with cryptocurrency are emerging regularly. By staying informed about these trends, individuals can position themselves to take advantage of these innovative ways to generate wealth.

Understanding the Risks in the Cryptocurrency Landscape

While the potential for wealth generation in the cryptocurrency sector is undeniable, it’s equally important to understand the risks involved. Here are some key considerations when exploring how to make money with cryptocurrency.

Market Volatility

Cryptocurrencies are known for their extreme volatility. Prices can skyrocket or plummet in a matter of hours, driven by factors such as market sentiment, regulatory news, technological advancements, or macroeconomic trends. This volatility can lead to significant gains, but it can also result in substantial losses.

Regulatory Risks

The regulatory environment for cryptocurrencies is still evolving and varies significantly across different countries. Changes in regulations can have a substantial impact on the value of a cryptocurrency or even its legality. For instance, a decision by a government to ban or restrict cryptocurrencies can lead to a sharp drop in their prices.

Technological Risks

Cryptocurrencies rely on complex technologies like blockchain and cryptography. While these technologies offer many advantages, they also come with risks. For example, if a vulnerability in a cryptocurrency’s underlying technology is discovered and exploited, it could lead to a loss of funds. Additionally, if a better or more advanced technology emerges, it could render existing cryptocurrencies obsolete.

Security Risks

Security is a significant concern in the cryptocurrency sector. Cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking. If a hacker gains access to your wallet, they could steal your cryptocurrencies. Additionally, transactions made with cryptocurrencies are irreversible, so if your cryptocurrencies are sent to the wrong address, they cannot be recovered.

Risk of Fraud and Scams

The cryptocurrency sector has been associated with various fraudulent activities and scams, including Ponzi schemes, pump-and-dump schemes, and fraudulent initial coin offerings (ICOs). It’s crucial to thoroughly research any cryptocurrency investment or earning opportunity to avoid falling victim to such scams.

How to Make Money from Cryptocurrency

The world of cryptocurrency offers a myriad of opportunities for wealth generation. However, knowing where to start can be daunting. Here’s a step-by-step guide to help you embark on your journey to making money with cryptocurrency.

1. Research and Choose the Right Cryptocurrency

Not all cryptocurrencies are created equal. Some have established track records and wide acceptance, like Bitcoin and Ethereum. Others may offer innovative features but come with higher risk due to their lesser-known status. Thoroughly research different cryptocurrencies, understand their use cases, and consider their long-term potential. This will help you choose the right cryptocurrency for your wealth generation goals.

2. Set Up a Digital Wallet

A digital wallet is where you store your cryptocurrencies. There are various types of wallets available, including online wallets, mobile wallets, desktop wallets, and hardware wallets. Each comes with its own set of advantages and security features. Choose a wallet that best suits your needs and ensure it’s from a reputable provider to keep your cryptocurrencies safe.

3. Select a Reputable Cryptocurrency Exchange

| Platform | Pros | Cons |

|---|---|---|

| MEXC | User-friendly interface, wide range of cryptocurrencies, lowest crypto exchange fees, advanced trading features | Platform may be complex for beginners, slow customer service response times |

| Binance | Large number of cryptocurrencies, advanced trading features, high liquidity, user-friendly interface | Reports of delayed customer service responses, potential target for hackers |

| Gate.io | Wide range of cryptocurrencies, advanced trading features, user-friendly interface, educational resources for beginners | Higher trading fees, does not support fiat currency deposits or withdrawals |

| OKX | Large number of cryptocurrencies, advanced trading features, competitive fees, user-friendly interface, educational resources for beginners | Reports of account freezes without prior notice, slow customer service response times |

| BingX | Advanced trading features, high leverage, ability to copy trades from successful traders, user-friendly interface | Smaller selection of cryptocurrencies, less liquidity due to smaller user base |

Cryptocurrency exchanges are platforms where you can buy, sell, and trade cryptocurrencies. When choosing an exchange, consider factors like security, user interface, available cryptocurrencies, trading fees, and customer support.

4. Make Your First Purchase

Once you’ve set up your wallet and chosen an exchange, you’re ready to make your first cryptocurrency purchase. Start with a small amount that you can afford to lose until you become more comfortable with the process. Remember, the value of cryptocurrencies can fluctuate rapidly, so it’s essential to invest responsibly.

5. Stay Informed and Continue Learning

The cryptocurrency landscape is constantly evolving, with new developments and trends emerging regularly. Stay informed about these changes and continue learning about different strategies for making money with cryptocurrency. This will help you adapt your approach and maximize your potential for wealth generation.

Strategies for Making Money with Cryptocurrency

The world of cryptocurrency offers a variety of strategies for wealth generation. Here are some of the most popular methods people use to make money with cryptocurrency.

Long-Term Holding (HODLing)

One of the most common strategies for making money with cryptocurrency is long-term holding, often referred to as “HODLing” in the crypto community. This strategy involves buying cryptocurrencies and holding onto them for a long period, regardless of short-term market fluctuations. The idea is that over time, the value of these cryptocurrencies will increase, leading to substantial returns.

The idea behind HODLing is to buy a cryptocurrency and hold onto it for a long period (1-7 years), regardless of market volatility and potential price drops. HODLers believe in the large-scale acceptance and growth of cryptocurrencies, and thus, they expect their investments to increase over time.

Consider this Gold vs Bitcoin comparison chart:

| Asset | 3 year CAGR | 4 year CAGR | 5 year CAGR |

|---|---|---|---|

| Gold | 2.4% | 2.5% | 2.2% |

| Bitcoin | 152% | 187% | 272% |

As you can see from the table, over a 5-year period, Bitcoin had a compound annual growth rate (CAGR) of 272%. This means that if you had bought Bitcoin worth $10,000 in 2017 and held onto it until 2022, your investment would have grown to $37,200.

Benefits of HODLing

- Potential for High Returns: Cryptocurrencies have shown a remarkable potential for high returns over the long term. For instance, early investors in Bitcoin or Ethereum who held onto their investments have seen substantial growth in their value. While past performance is not a guarantee of future results, the potential for significant returns remains a compelling reason for HODLing.

- Simplicity: HODLing is a straightforward strategy that doesn’t require advanced investment knowledge or constant monitoring of the market. Once you’ve bought your chosen cryptocurrency, you simply hold onto it for the long term.

- Mitigates Short-Term Volatility: The cryptocurrency market is known for its volatility, with prices often experiencing significant fluctuations in short periods. By HODLing, you’re less affected by these short-term market movements and can focus on the potential long-term growth of your investment.

- Benefit from Cryptocurrency Adoption: As cryptocurrencies become more widely accepted and used, their value could increase. By HODLing, you position yourself to benefit from this potential growth and adoption.

- Lower Transaction Costs: Frequent buying and selling of cryptocurrencies can lead to substantial transaction fees. By holding onto your cryptocurrencies for the long term, you can minimize these costs.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a popular investment strategy that can be particularly effective in the volatile world of cryptocurrency. This strategy involves investing a fixed amount of money in a particular asset (like Bitcoin or Ethereum) at regular intervals, regardless of the asset’s price at that time.

The primary goal of DCA is to reduce the impact of volatility on the overall purchase. By spreading out purchases over time, you avoid investing all your money at a peak price. Instead, you buy more coins when prices are low and fewer coins when prices are high, which can result in a lower average cost per coin over time.

DCA in Bitcoin and Ethereum

Let’s consider an example where you decide to invest $200 in Bitcoin and Ethereum every month. Regardless of whether the price of Bitcoin or Ethereum goes up or down, you stick to your plan and invest your set amount.

In some months, when the price of Bitcoin or Ethereum is high, your $200 might buy you less than a whole coin. But in other months, when the price is low, the same $200 could buy you more than one coin. Over time, this strategy can result in a lower average cost per coin, potentially leading to better returns compared to a one-time investment.

Benefits of DCA

- Mitigates Risk: DCA helps mitigate the risk of investing a large amount in a single go, potentially at a high price. It spreads the risk over time, reducing the impact of short-term price volatility.

- Promotes Discipline: DCA encourages a disciplined, systematic investment approach, rather than trying to time the market.

- Accessible: DCA is a simple strategy that doesn’t require advanced investment knowledge, making it accessible to new investors.

Day Trading

Day trading involves buying and selling cryptocurrencies within short timeframes to profit from price fluctuations. This strategy requires a deep understanding of the market and technical analysis. While it can be profitable, it’s also risky and time-consuming, making it more suitable for experienced traders.

Benefits of Day Trading

- Profit from Short-Term Price Fluctuations: Cryptocurrencies are known for their volatility. Day trading allows traders to take advantage of these short-term price fluctuations, potentially earning profits from both rising and falling markets.

- Leverage: Many cryptocurrency exchanges offer leverage, which allows traders to borrow money to trade larger positions than their account balance. This can amplify profits, but it also increases risk.

- No Overnight Risk: Since day traders close all positions before the end of the trading day, they don’t carry risk overnight when prices can change drastically.

- High Liquidity: Day trading typically involves trading highly liquid cryptocurrencies, which allows for easy entry and exit from positions.

- Diversification: Day trading allows traders to diversify their portfolio by trading different cryptocurrencies based on market trends and signals.

- Learning Opportunity: Day trading requires a deep understanding of the market and technical analysis. This continuous learning process can enhance a trader’s knowledge and skills.

Mining

Mining involves using computer hardware to solve complex mathematical problems, a process that helps secure the network and validate transactions. Miners are rewarded with new coins for their efforts. However, mining requires significant computational resources and electricity, making it less viable for individuals in regions with high energy costs.

Benefits of Mining

- Earning Potential: Miners are rewarded with new coins and transaction fees for their efforts, providing a potential source of income.

- Contribution to Network Security: Mining contributes to the security and decentralization of the cryptocurrency network. By participating in mining, you’re helping to maintain the integrity of the blockchain.

- Access to New Coins: Mining can provide access to new coins before they’re available on exchanges, especially in the case of new cryptocurrencies. This can potentially lead to high returns if the coin increases in value.

- No Need for Trading: Mining allows you to earn cryptocurrencies without the need for buying and selling on exchanges, which can be complex and risky.

- Potential for Increased Value: If the cryptocurrency you’re mining increases in value over time, the rewards you earn could also increase in value, leading to higher returns.

Staking and Yield Farming

Staking involves participating in a proof-of-stake (PoS) blockchain network by holding and “staking” a cryptocurrency in a digital wallet to support network operations like block validation. In return, participants earn staking rewards. Yield farming, a concept in decentralized finance (DeFi), involves lending your cryptocurrency assets to others through smart contracts, earning interest in return.

Benefits of Staking and Yield Farming

- Passive Income: Both staking and yield farming provide opportunities to earn passive income. By simply holding and staking your cryptocurrencies, or by providing liquidity to a decentralized finance (DeFi) platform, you can earn rewards or interest.

- Lower Risk than Trading: Compared to day trading, both staking and yield farming can be less risky as they don’t require frequent buying and selling of assets, which can be affected by short-term market volatility.

- Contribution to Network Security and Functionality: In proof-of-stake (PoS) networks, staking helps maintain the network’s security and functionality. By staking, you’re contributing to the network’s health and operation.

- Access to New Projects: Yield farming can provide early access to new projects in the DeFi space. Early participants in successful projects can potentially earn substantial returns.

- Liquidity Provision: Yield farming often involves providing liquidity to a liquidity pool. This can earn you fees and rewards, providing another income stream.

Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs)

ICOs and IEOs are fundraising methods used by new cryptocurrency projects. By participating in an ICO or IEO, you can purchase tokens at an early stage, often at a lower price. If the project succeeds, these tokens could increase in value. However, this strategy is risky as many projects fail or turn out to be scams.

DeFi (Decentralized Finance) Opportunities

DeFi refers to financial services built on blockchain technology, such as lending platforms, decentralized exchanges, and prediction markets. DeFi platforms often offer lucrative opportunities to earn interest on your cryptocurrency holdings or to make money through yield farming or liquidity mining.

Benefits of DeFi

- Open and Accessible: DeFi platforms are open to anyone with an internet connection. This makes financial services accessible to a global audience, including those in unbanked or underbanked regions.

- Earning Opportunities: DeFi platforms often offer lucrative opportunities to earn interest on your cryptocurrency holdings through lending and yield farming.

- Ownership and Control: With DeFi, you have full control over your assets. Unlike traditional banks, there’s no need for a middleman or intermediary.

- Transparency: DeFi applications are built on public blockchains, providing transparency for all transactions. This can increase trust and security for users.

- Innovation and Financial Services: DeFi is at the forefront of financial innovation, offering new and exciting services like flash loans, automated market makers, and decentralized exchanges.

- Interoperability: DeFi applications are often built on the same blockchain, allowing them to interact with each other. This interoperability can lead to innovative use cases and increased efficiency.

Tools and Resources for Cryptocurrency Investors

Navigating the world of cryptocurrency and implementing strategies for wealth generation requires the right tools and resources. Here are some essentials that can help you on your journey to making money with cryptocurrency.

Digital Wallets

Digital wallets are where you store your cryptocurrencies. Wallets come in various forms, including online (web) wallets, mobile wallets, desktop wallets, and hardware wallets. Some well-known wallet providers include Ledger (hardware wallet), MyEtherWallet (web wallet), and Trust Wallet (mobile wallet).

| Digital Wallet | Key Features | Link |

|---|---|---|

| Trezor Model T | High security, supports 14 cryptocurrencies, open-source software | Trezor Model T |

| Ledger Nano X | Secure cold storage, connects via Bluetooth or USB, supports over 5,500 cryptocurrencies | Ledger Nano X |

| Electrum | Customizable transaction fees, high security, only works for Bitcoin | Electrum |

| Exodus | Built-in exchange, good for beginners, supports cold storage | Exodus |

| MetaMask | A crypto wallet & gateway to blockchain apps, supports token exchange | MetaMask |

| Trust Wallet | Supports a wide range of tokens, built-in exchange, secure and private | Trust Wallet |

| Coinbase Wallet | Supports a wide range of tokens, secure and private, integrates with Coinbase | Coinbase Wallet |

| Tangem Wallet | Card-shaped self-custodial cold wallet, supports 6000+ coins and tokens | Tangem Wallet |

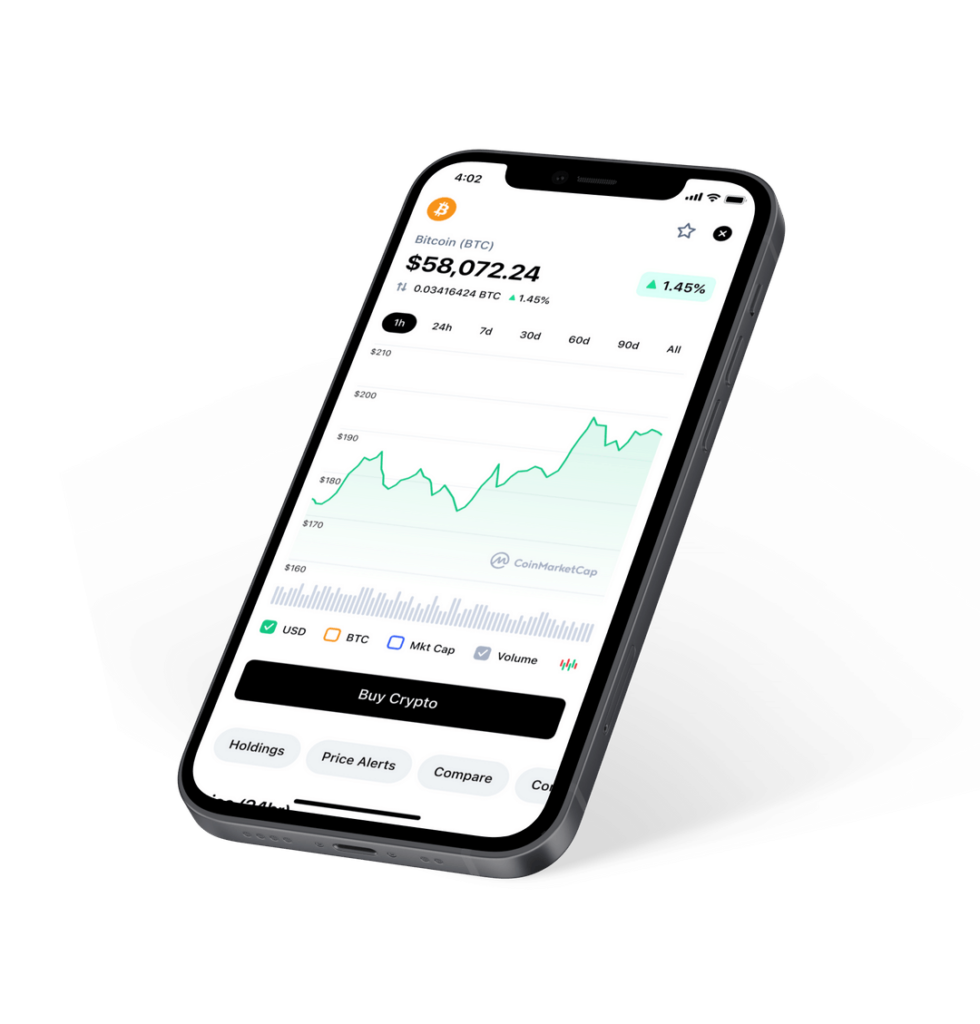

Portfolio Tracking Apps

Portfolio tracking apps allow you to monitor the value of your cryptocurrency holdings in real-time. These apps can track multiple cryptocurrencies across various exchanges, providing a comprehensive view of your portfolio. Examples include Coinmarketcap APP and Delta.

Cryptocurrency News and Analysis Websites

Staying informed about the latest news and market trends is crucial when making money with cryptocurrency. Websites like our blog, CoinDesk, and Cointelegraph offer up-to-date news, while platforms like CoinMarketCap and CryptoCompare provide detailed market analysis and coin data.

Cryptocurrency Forums and Social Media

Communities like Reddit’s r/cryptocurrency, Bitcointalk forums, and social media platforms are valuable resources for discussions, advice, and sentiment analysis. They can provide insights into market trends and potential investment opportunities.

Educational Resources

Websites like Coursera and Udemy offer courses on cryptocurrency and blockchain technology. Books like “Mastering Bitcoin” by Andreas Antonopoulos and “The Age of Cryptocurrency” by Paul Vigna and Michael J. Casey can also provide valuable insights.

In conclusion, the right tools and resources can significantly enhance your ability to make money with cryptocurrency. By leveraging these tools, you can stay informed, make informed decisions, and effectively manage your cryptocurrency investments.

Legal and Tax Implications

As you embark on your journey to make money with cryptocurrency, it’s crucial to understand the legal and tax implications. These can vary significantly depending on your location and the nature of your cryptocurrency activities.

Legal Status of Cryptocurrency

The legal status of cryptocurrencies varies widely from country to country. In some jurisdictions, cryptocurrencies are fully legal and regulated, while in others, their use is restricted or outright banned. It’s essential to understand the legal status of cryptocurrency in your country before engaging in any activities. This includes buying, selling, mining, and even using cryptocurrency for payments.

Regulatory Compliance

Depending on your country and the nature of your cryptocurrency activities, you may need to comply with certain regulatory requirements. For example, if you’re trading cryptocurrencies on a large scale, you may need to register as a money services business or comply with anti-money laundering (AML) and know your customer (KYC) regulations.

Tax Obligations

In many countries, cryptocurrencies are treated as taxable assets. This means that you may need to pay taxes on any profits you make from buying and selling cryptocurrencies. The specific tax rules can vary widely. For example, some countries treat cryptocurrency profits as capital gains, while others treat them as income.

In some cases, even if you don’t sell your cryptocurrencies, you may still have tax obligations. For example, if you earn cryptocurrencies through mining or staking, these earnings may be considered income and be subject to tax.

Record Keeping

Given the tax implications of cryptocurrency activities, it’s crucial to keep detailed records of all your transactions. This includes the dates of your transactions, the amounts in question, the prices at the time of the transactions, and the purpose of each transaction. These records will be essential for calculating your tax obligations and for proving your income and expenses if you’re audited.

Conclusion

Making money with cryptocurrency is a journey that requires understanding, strategy, and awareness of the risks and legal implications. With the right approach, the potential for profit in the cryptocurrency market is substantial.

FAQs

What is the best strategy for making money with cryptocurrency?

The best strategy depends on your risk tolerance, investment capital, and understanding of the market.

Is it legal to make money with cryptocurrency?

The legality of cryptocurrency varies by country. It’s essential to understand the laws in your region before investing.

Can I lose money making them from cryptocurrency?

Yes, the cryptocurrency market is volatile, and there is a risk of losing your money.